Evaluating Sumitomo Bakelite (TSE:4203): Is the Market Pricing in Too Much Optimism?

If you have been watching Sumitomo Bakelite (TSE:4203) lately, chances are the recent movement in its stock price has made you pause and wonder if there is something larger at play. With no headline-grabbing event driving the current momentum, investors are left to interpret what this upward trend might really signal about the company’s outlook. Perhaps the move is just the market catching up with steady fundamentals, or maybe there is a subtle shift in sentiment that is worth unpacking.

The last month has been particularly interesting for Sumitomo Bakelite shareholders, as the stock has climbed over 8%. That momentum is even more pronounced when looking back over the past 3 months, with a jump of 30%. Year to date, shares are up 34%, and over the last year, the stock has delivered a 44% total return. Longer-term investors have seen nearly 2.8 times gains over five years, suggesting a mix of growth potential and recognition from the broader market, even as recent news headlines remain relatively quiet.

With numbers like these, it is only natural to ask, is Sumitomo Bakelite trading at a bargain compared to its true worth, or is the market already factoring in higher growth in the years ahead?

Price-to-Earnings of 22.7x: Is it justified?

Sumitomo Bakelite is currently trading at a Price-to-Earnings (P/E) ratio of 22.7x, which is notably higher than both the industry average and its own estimated fair ratio. This elevated multiple suggests that the market may have high expectations for the company's future earning power.

The P/E ratio reflects how much investors are willing to pay for each yen of the company’s earnings. It is an important benchmark for comparing firms within the same industry. In this sector, a lower P/E might suggest undervaluation or concerns about growth, while a higher P/E could indicate optimism about profitability and future prospects.

For Sumitomo Bakelite, the above-average P/E implies that shares are priced at a premium, possibly in anticipation of stronger performance or unique advantages. However, whether the company can deliver on these high expectations is something investors must weigh closely.

Result: Fair Value of ¥5,113 (OVERVALUED)

See our latest analysis for Sumitomo Bakelite.However, slower-than-expected revenue growth or disappointing earnings could quickly shift sentiment and challenge the current optimism around Sumitomo Bakelite’s valuation.

Find out about the key risks to this Sumitomo Bakelite narrative.Another View: SWS DCF Model Suggests Undervaluation

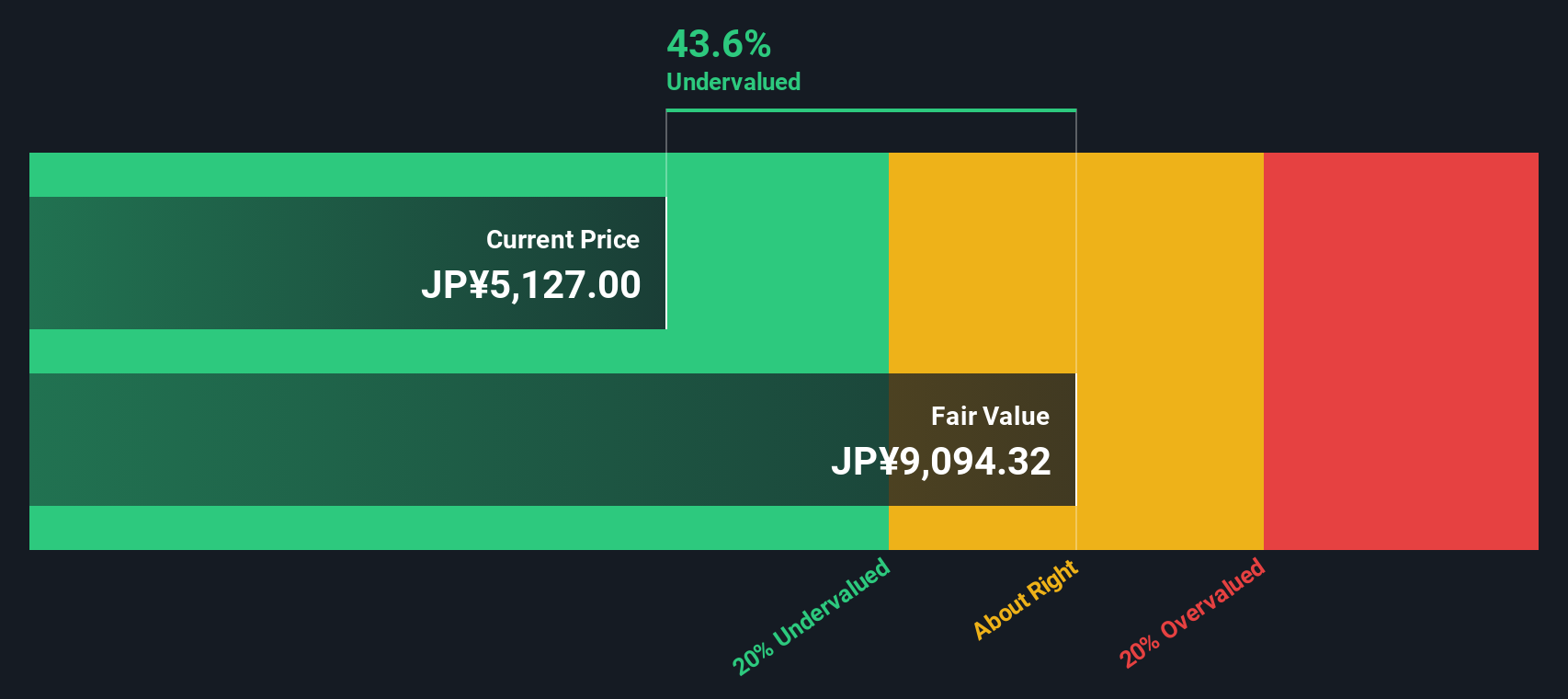

While the current market price seems high based on earnings multiples, our DCF model tells a different story. This indicates that Sumitomo Bakelite may actually be undervalued. Could the market be missing something deeper?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sumitomo Bakelite Narrative

If you think the current analysis does not fully capture your perspective or would rather dig through the numbers yourself, you are free to build your own narrative in just a few minutes. Do it your way

A great starting point for your Sumitomo Bakelite research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Give yourself an edge by using the Simply Wall Street Screener to target unique growth opportunities, untapped sectors, and resilient performers you might otherwise overlook.

- Uncover stable income streams and spot market leaders with attractive yields by targeting dividend stocks with yields > 3%, which offer consistency and long-term reliability.

- Tap into emerging healthcare trends shaping tomorrow’s patient care by analyzing healthcare AI stocks that power advancements in diagnostics and medical technology.

- Challenge the status quo and hunt for overlooked bargains in the market by zeroing in on undervalued stocks based on cash flows with strong fundamentals relative to their price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal