Assessing Lifco’s Growth Prospects Following Flat Performance in 2025

If you are trying to figure out what to do with Lifco shares, you are not alone. It is a company that often flies a bit under the radar but has shown an impressive ability to grow over time. The past three years have been especially noteworthy, with the stock rising a massive 108.2%. Even looking further back, Lifco’s five-year return stands at nearly 150%, putting it well ahead of most indices and many peers.

So, what is going on right now? In the past year, shares are up just over 2%, and they have barely budged in the past month with a 0.3% gain over seven days and a modest loss of 3% in the past thirty. The market’s attention seems to have shifted toward big-picture sector moves and changing risk sentiment, creating opportunities for stocks like Lifco when investors begin looking for steady compounders again.

But before getting too excited about liftoff, let’s look under the hood. According to our valuation framework, Lifco is currently undervalued in zero out of six standard checks, giving it a valuation score of 0. That is not to say there is no potential here, but it does suggest we should dig deeper.

Coming up, I will break down the main ways investors evaluate a company’s worth, and you will see how Lifco stacks up. Stick around to the end for a perspective on valuation that could be even more insightful than the usual models.

Lifco scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Lifco Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today. This helps investors judge whether the current share price reflects true worth. This approach provides a forward-looking perspective and emphasizes the company's earnings power over time rather than short-term swings.

For Lifco, the starting point is its latest twelve-month Free Cash Flow, which is just under SEK 3.89 billion. Analyst forecasts put 2029 Free Cash Flow at about SEK 5.54 billion, showing a steady but not explosive growth trajectory. It is important to note that while projections for the next five years rely on analyst estimates, the DCF model extends further based on reasonable extrapolation methods from Simply Wall St to create a ten-year outlook.

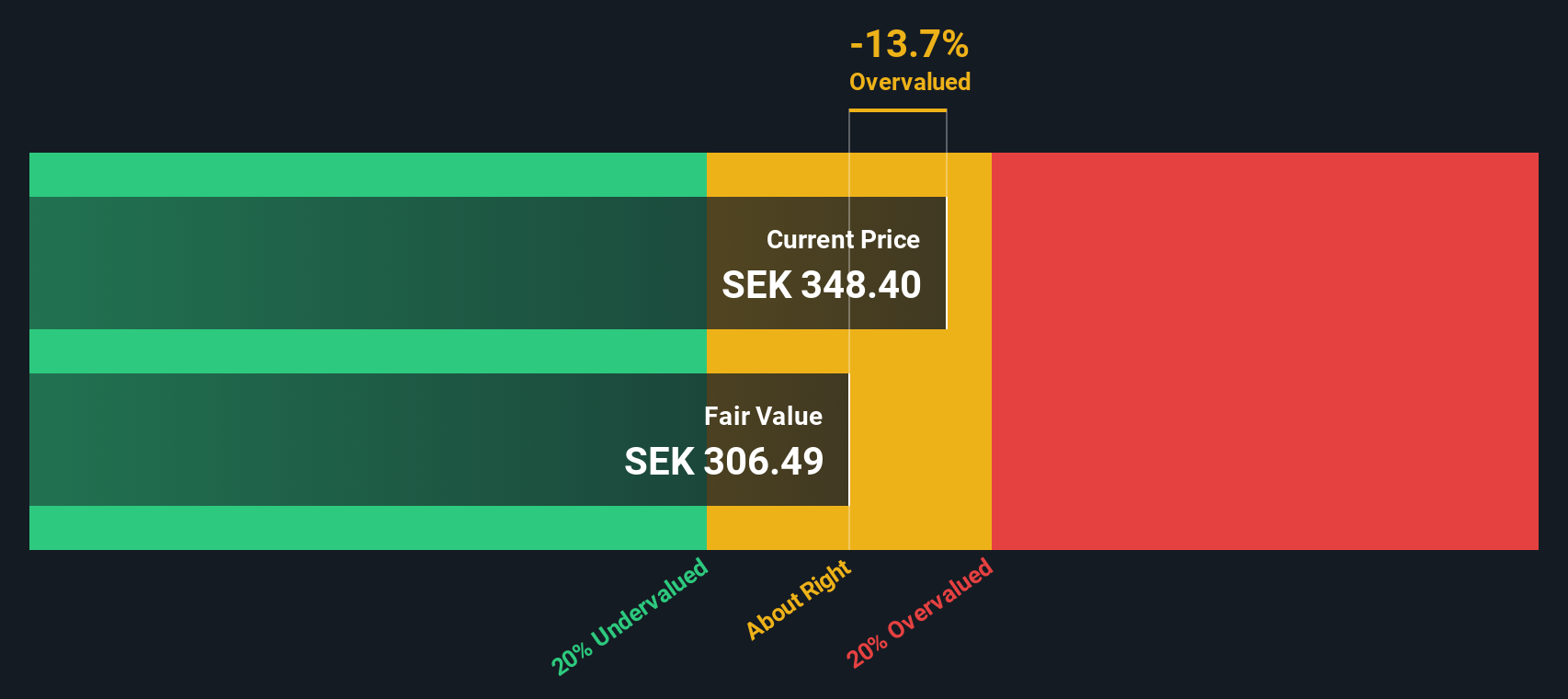

Taking all these assumptions and projections into account, the intrinsic value estimate comes out to SEK 300.73 per share. Compared to today’s trading price, this result suggests the stock is around 11% overvalued according to the DCF method.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Lifco.

Approach 2: Lifco Price vs Earnings

The Price-to-Earnings (PE) ratio is a go-to metric for valuing profitable companies like Lifco, as it directly ties a company’s share price to its earnings. This helps investors understand what the market is willing to pay for each unit of profit, making it an intuitive benchmark for comparing valuation.

However, not all PE ratios are created equal. Companies with higher expected growth rates or lower risk profiles can often justify higher PE multiples, while sluggish or riskier businesses tend to get lower ones. So, it is important to look beyond the headline figure and consider the context.

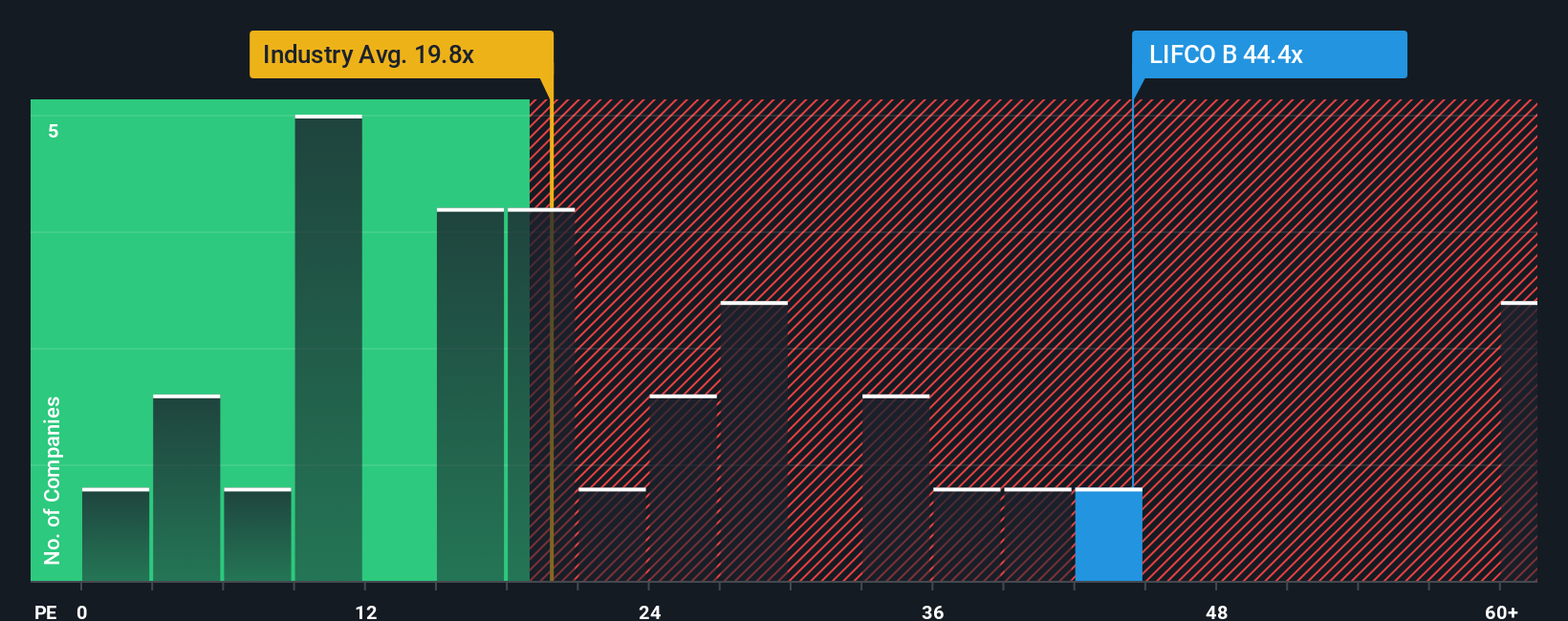

Currently, Lifco trades on a lofty PE of 44.4x, which sits well above the Industrials sector average of 12.8x and the average for similar peers at 27.7x. However, Simply Wall St’s proprietary Fair Ratio, which factors in Lifco’s growth prospects, industry, profit margins, market cap, and risks, is 24.3x. This approach is more precise than simply comparing against sector or peer averages, as it customizes the benchmark to Lifco’s unique qualities.

With Lifco’s actual PE ratio significantly higher than what we see as “fair,” this methodology suggests the stock is overvalued on a relative basis.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Lifco Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is essentially your perspective on Lifco’s story: how you interpret its strengths, risks, and future potential. This personal story links directly to your forecasts for the company’s revenue, earnings, and margins, ultimately resulting in your estimated fair value.

Unlike static models that rely on a single set of numbers, Narratives reflect how you see Lifco’s future unfolding and turn your investment thesis into a financial forecast. Narratives are a central, easy-to-use feature built into the Simply Wall St Community page, used by millions of investors globally. Here, you can quickly build, publish, and debate your perspective with others.

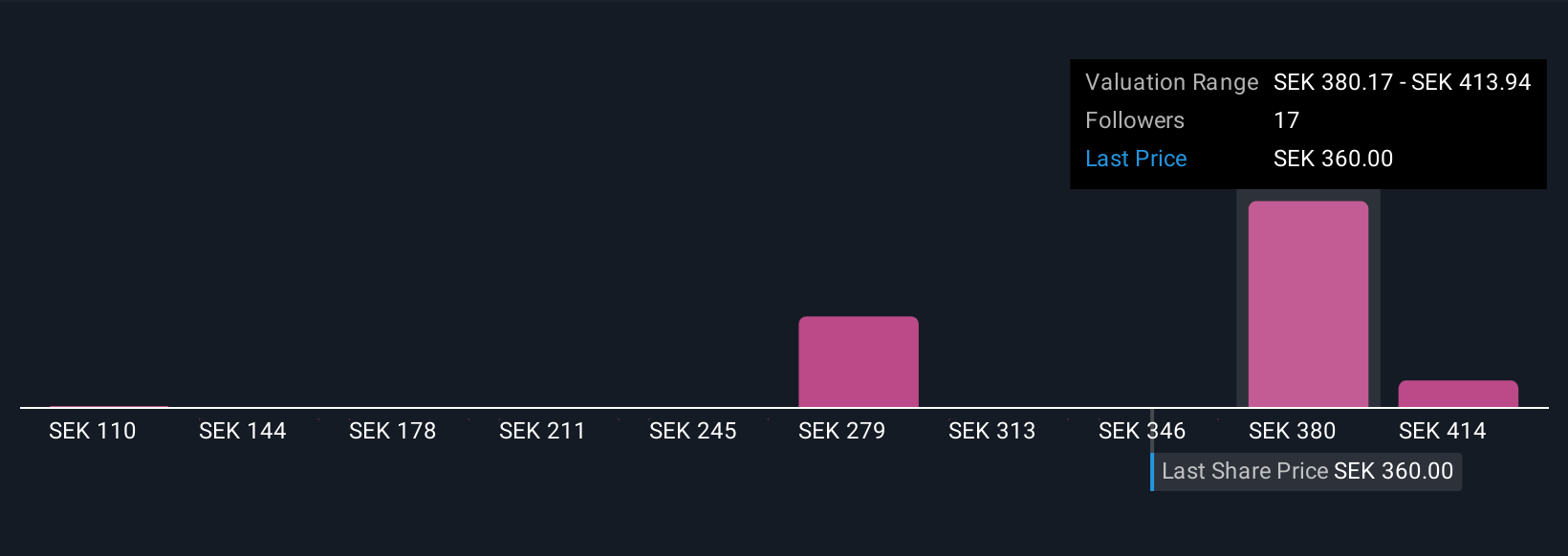

This approach helps you make smarter buy or sell decisions by comparing your Narrative’s fair value to the current market price. Because Narratives update dynamically as company news or results arrive, your outlook always stays up to date. For instance, some investors may take an optimistic view, forecasting stronger earnings and a higher fair value for Lifco (SEK 420.0). Others may spotlight risks and set a more conservative target (SEK 347.0), all based on the same set of latest information but interpreted through their own lens.

Do you think there's more to the story for Lifco? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal