How Investors May Respond To Expand Energy (EXE) Operational Synergy Gains and Free Cash Flow Outlook

- Expand Energy Corporation recently presented at the Gastech Exhibition & Conference 2025, sharing updates on capital expenditure reductions, increased synergy targets, and anticipated free cash flow improvements.

- The company’s outlook for higher annual synergies and incremental free cash flow reflects ongoing operational efficiency and capital discipline efforts, drawing renewed analyst attention.

- We’ll now explore how this improved synergy outlook may influence the current investment narrative for Expand Energy.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Expand Energy Investment Narrative Recap

For shareholders, the investment case for Expand Energy hinges on the company’s ability to drive operational efficiencies and capture growth from surging natural gas demand, especially in core U.S. basins. The recent update on capital expenditure reductions and higher synergy targets may not materially impact the most important short-term catalyst, maintaining strong free cash flow generation to support shareholder returns, but does little to address the ongoing risk posed by sector-wide energy transition pressures and potentially tightening emissions regulations.

Of the recent announcements, Expand Energy’s raised annual synergy outlook to US$600 million by the end of 2026 stands out, as it underlines expectations for improved cost structure and incremental free cash flow, even as commodity prices fluctuate. This improvement in operating leverage and discipline is central to the near-term investment narrative, especially as the company seeks to balance buybacks, dividends, and debt reduction amid continued market uncertainty.

In contrast, investors should also be aware of the risk that growing regulatory and environmental pressures could sharply raise costs and challenge margins if...

Read the full narrative on Expand Energy (it's free!)

Expand Energy's narrative projects $13.2 billion revenue and $4.0 billion earnings by 2028. This requires 14.3% yearly revenue growth and a $3.8 billion increase in earnings from the current $206.0 million.

Uncover how Expand Energy's forecasts yield a $132.15 fair value, a 37% upside to its current price.

Exploring Other Perspectives

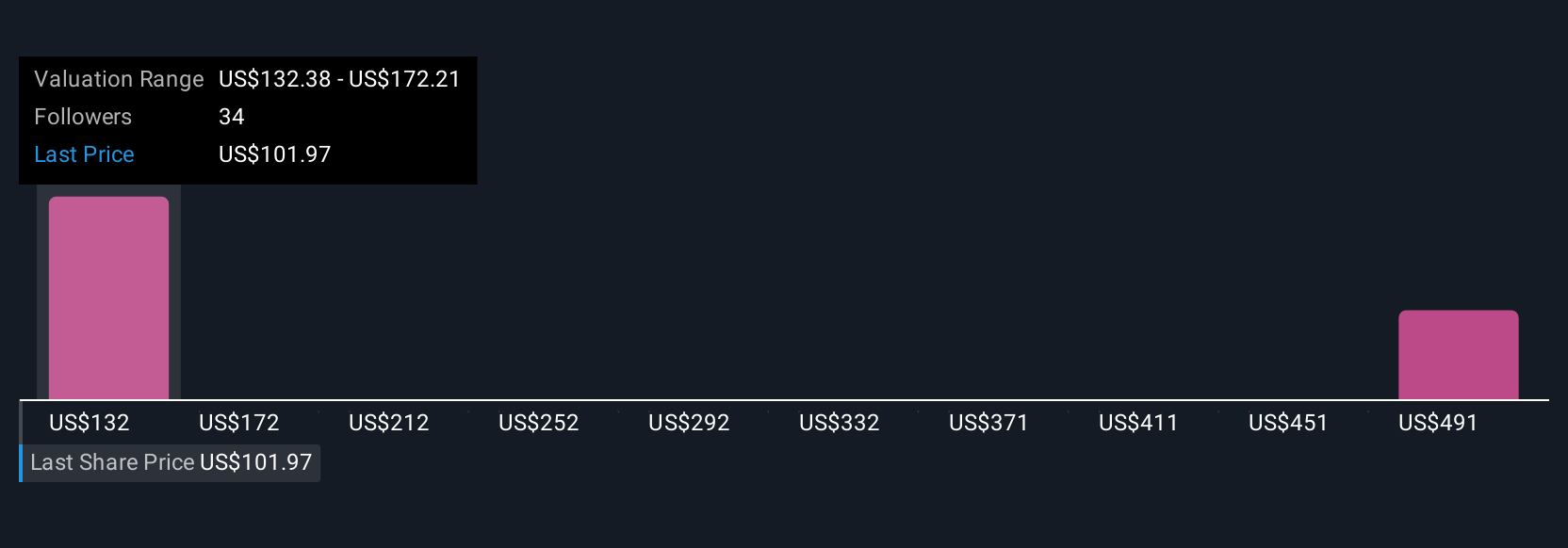

Community fair value estimates for Expand Energy range widely from US$132 to US$488, based on two independent perspectives in the Simply Wall St Community. As many market participants weigh in, the risk of tightening climate policy and decarbonization underscores how the company’s future performance is viewed through very different lenses.

Explore 2 other fair value estimates on Expand Energy - why the stock might be worth over 5x more than the current price!

Build Your Own Expand Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Expand Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Expand Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Expand Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal