A Look at Trimble’s (TRMB) Valuation Following Its Technology Outlet Expansion with Martin Equipment

If you’re wondering whether now is the time to make a move on Trimble (TRMB), the latest headlines might have you leaning closer to the buy button. Trimble’s recent partnership with Martin Equipment to launch a new Trimble Technology Outlet isn’t just another distribution deal; it’s a practical example of the company’s broader strategy to deepen its presence in civil construction. The arrangement expands access to Trimble’s site positioning and grade control technologies for John Deere and Wacker Neuson equipment users, and it strengthens the distribution channel right where construction tech is in high demand.

This business expansion comes on the heels of other growth initiatives, like the launch of Trimble Freight Marketplace and collaborative product rollouts with partners such as Hyundai. Over the past year, shares of Trimble have climbed 43%, with particularly strong momentum since spring. Even after this remarkable run, management is signaling confidence and making moves to extend their reach. The market continues to monitor future prospects and ongoing performance volatility.

Given Trimble’s recent momentum and expanded footprint, is this a buying opportunity for long-term growth, or is the market already pricing in the next chapter?

Most Popular Narrative: 14.6% Undervalued

According to the most widely referenced narrative, Trimble appears undervalued with a potential upside, backed by robust assumptions about future growth and margin expansion.

"Accelerating adoption of AI-enabled, cloud-based solutions (such as ProjectSight, autonomous procurement, and analytics in project management and transportation) is increasing customer value and workflow integration. This supports higher recurring software revenues and improved net margins."

Think the numbers behind this valuation are bold? The real story lies in aggressive growth forecasts and a profit margin leap that could reshape Trimble’s earnings profile. The outcome depends on a set of forward-looking assumptions that, if realized, could give the current share price a major boost. Curious what these projections look like in practice? Take a look at the quantitative levers powering this valuation case.

Result: Fair Value of $94.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent government spending weakness and rapid tech advances by competitors could easily derail these bullish assumptions and challenge Trimble’s future growth outlook.

Find out about the key risks to this Trimble narrative.Another View: A High Price Tag?

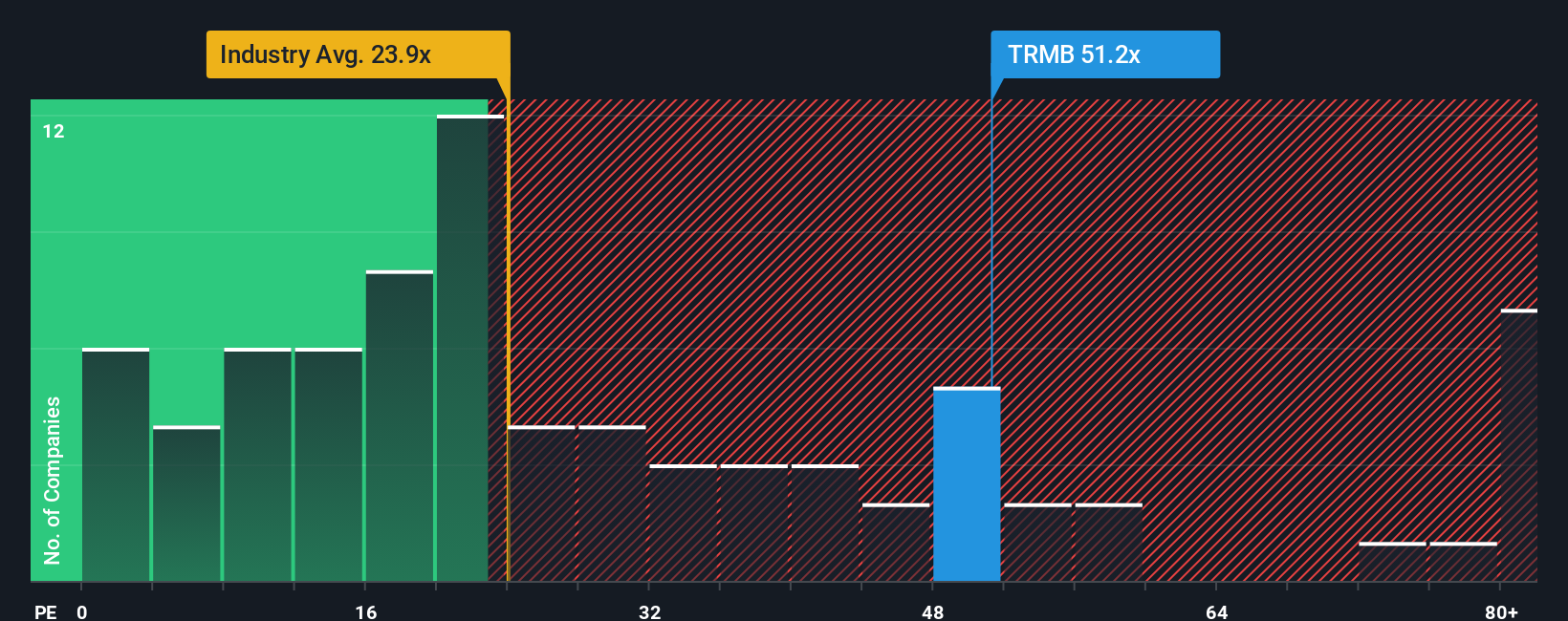

While the earlier case highlights Trimble's upside, another lens tells a different story. Based on its earnings multiple, the company actually looks pricey compared to industry norms. Could this premium limit future returns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trimble Narrative

If you want to dig deeper or think the story deserves a different take, you can build your own narrative in just a few minutes. Do it your way.

A great starting point for your Trimble research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t miss your chance to uncover stocks with standout potential. Use the Simply Wall Street Screener to target unique growth themes and unlock new market winners now.

- Accelerate your hunt for tomorrow’s tech leaders by analyzing emerging opportunities with AI penny stocks featured in every sector.

- Pinpoint strong cash flow performers early in their trend by reviewing a selection of undervalued stocks based on cash flows that others might overlook.

- Amplify your yield strategy and uncover reliable income streams as rates rise with top picks among dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal