The G7 countries' high government debt corporate bond market has sounded the alarm

The Zhitong Finance App notes that some of the world's largest economies are at the center of the bond market turmoil. Investors are increasingly worried that governments have not taken sufficient measures to reduce uncomfortably high debt levels.

Guy Miller, chief market strategist at Zurich Insurance Group, said: “The level of government debt is too high, and not enough measures have been taken to solve this problem.”

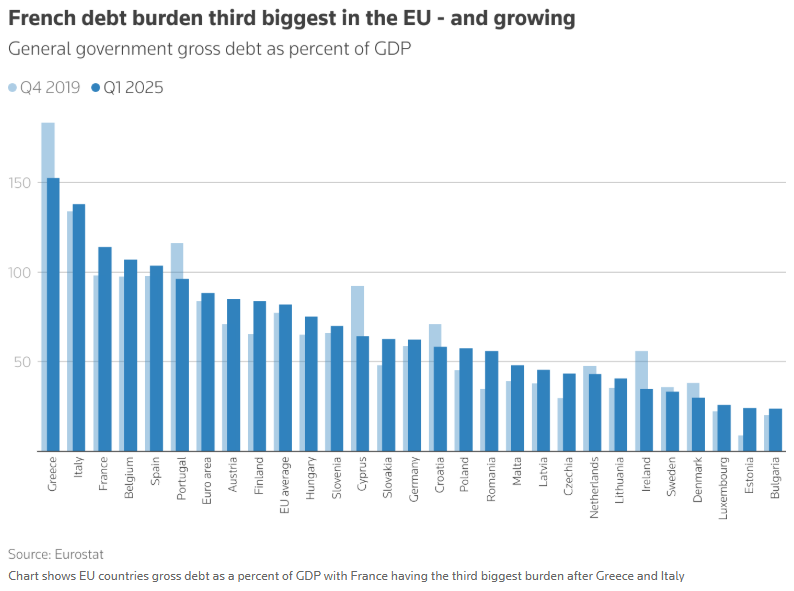

France

France has soared to the top of the list of concerns. This week, opposition parties overturned center-right Prime Minister François Belou's budget austerity plan because it was unpopular. Political uncertainty means it will be difficult to tame a debt pile of more than 100% of gross domestic product (GDP) and a budget deficit close to twice the EU limit.

The French Court of Audit warned that if economic growth slows down or the deficit is reduced, debt payments may exceed 100 billion euros (117 billion US dollars) by 2029, compared to 59 billion euros last year.

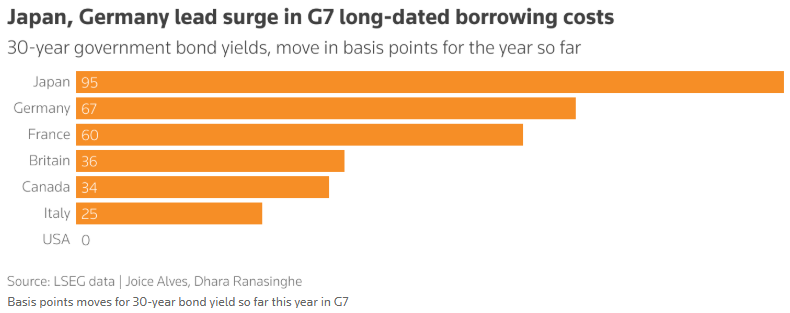

Commonwealth Bank of Australia monetary strategist Carol Kong said, “It may take a bond market turmoil to force the coalition government to pass the budget.” The yield on 30-year treasury bonds has reached its highest level since 2009. The cost of long-term borrowing is higher than that of Spain, almost the same as Italy, and the risk of a downgrade in the sovereign rating has also increased.

United Kingdom

British Prime Minister Stammer's restructuring of the senior advisory team and the annual budget scheduled to be released in November have drawn attention to Britain's ability to control finances. Long-term borrowing costs soared to their highest level since 1998 this month, while the pound plummeted.

Economists say Chancellor of the Exchequer Rachel Reeves will have to raise taxes by at least £20 billion ($27 billion) to make up for revenue shortages caused by weak growth, high borrowing costs, and a reversal of spending reduction plans. The UK has the highest borrowing costs and inflation among the Group of Seven (G7) developed economies, making it a target of market anxiety.

For Nordea's chief analyst Jan von Gersch, the UK isn't as worrying as the US or France. “It's easier to find the political will to make changes in the UK,” the statement said.

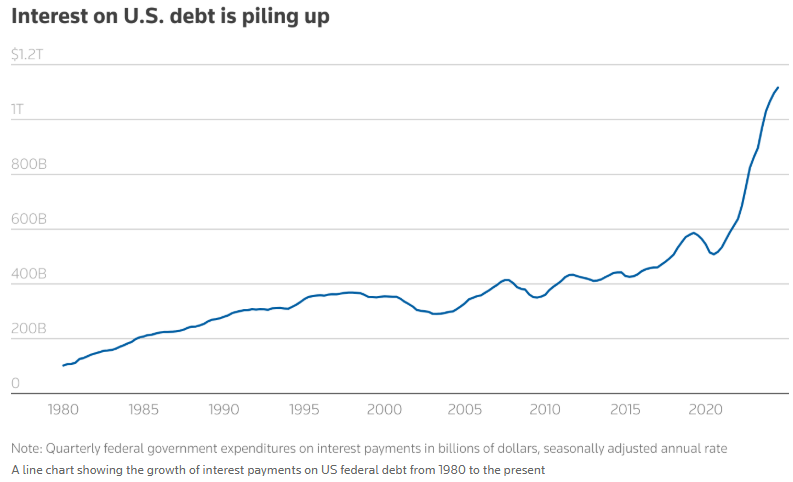

America

The world's largest economies have not escaped market attention. Its total debt is nearly 37 trillion US dollars. The nonpartisan Congressional Budget Office estimates that President Donald Trump's tax cuts and spending bill signed into law on July 4 could add another $3.3 trillion over the next decade.

Admittedly, the deepest and most liquid capital market in the world is a buffer, but rising debt means investors are demanding more compensation to hold treasury bonds. The recent signs of weak demand for auctions are worrying.

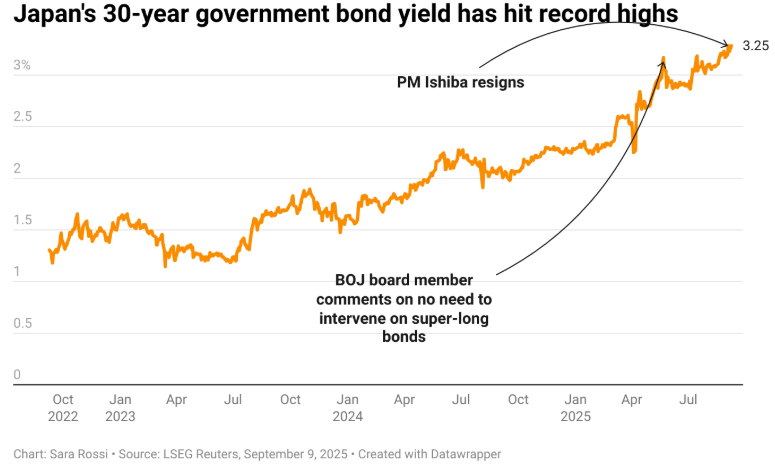

Japan

It's no secret that Japan's high debt is among the highest in the world. What has changed is that as inflation returns, the prospect of rising interest rates is driving up borrowing costs, and as the Bank of Japan reduces bond purchases, high debt is the focus of attention. Demand for auctions has been weak recently, exacerbating market pain.

Political uncertainty after Prime Minister Ishiwari Shigeru's resignation also helped push 30-year Treasury yields to record highs, as people speculated that his successor would increase spending.

Germany

Debt sustainability is not an immediate concern for Germany. It has the lowest debt-to-GDP ratio in the G7, and can increase spending to boost economic growth. The market is watching, however, as large-scale stimulus means Germany is borrowing more money through bond sales. Its 30-year Treasury yield is at its highest level since 2011.

The high infrastructure and defense investments just confirmed in the 2025 budget brought the spending plan to 591 billion euros, including investments from infrastructure funds and 100 billion euros of special defense funds.

“It's almost a good reason to increase supply,” said Lynn Graham Taylor, senior interest rate strategist at Rabobank.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal