3 European Dividend Stocks To Watch With Up To 7.3% Yield

As the pan-European STOXX Europe 600 Index recently ended slightly lower amid concerns about global growth and a stronger euro, investors are increasingly looking towards dividend stocks as a potential source of stable income. In this environment, identifying stocks with robust dividend yields can be particularly appealing for those seeking steady returns amidst mixed market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.32% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.89% | ★★★★★☆ |

| Telekom Austria (WBAG:TKA) | 4.23% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.40% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.60% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.91% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.24% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.55% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.66% | ★★★★★★ |

| Afry (OM:AFRY) | 3.96% | ★★★★★☆ |

Click here to see the full list of 223 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

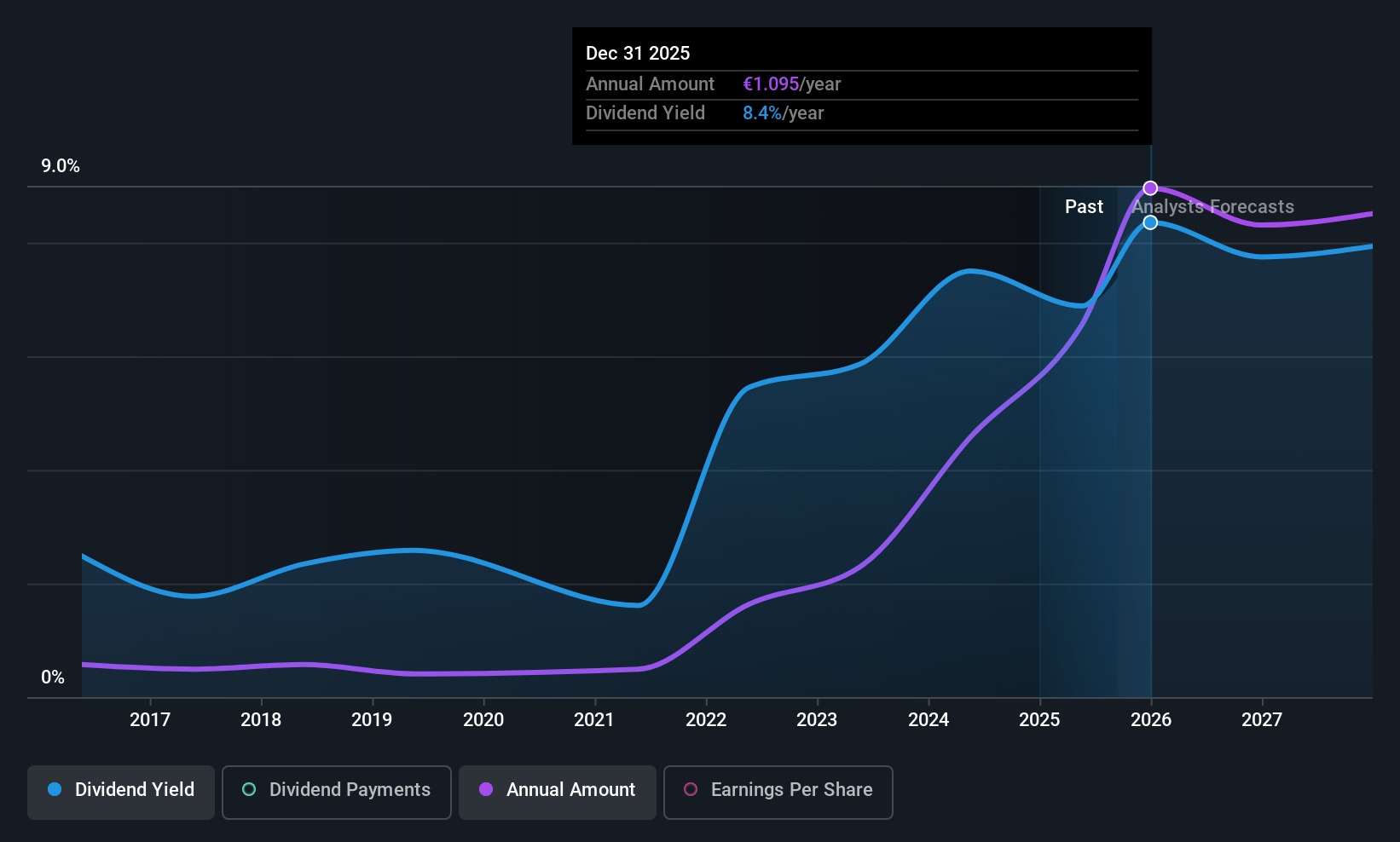

Banca Popolare di Sondrio (BIT:BPSO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banca Popolare di Sondrio S.p.A., along with its subsidiaries, offers a range of banking products and services in Italy, with a market cap of €5.75 billion.

Operations: Banca Popolare di Sondrio generates revenue through several segments, including Companies (€472.14 million), Central Structure (€661.57 million), Securities Sector (€140.30 million), and Individuals and Other Customers (€305.69 million).

Dividend Yield: 6.3%

Banca Popolare di Sondrio's dividend yield of 6.26% ranks in the top quarter of Italian dividend payers, but its history is marked by volatility and unreliability. While current dividends are covered by earnings with a payout ratio of 55.7%, the bank's low allowance for bad loans (92%) and high non-performing loans (2.2%) pose risks. Recent earnings growth and a rejected acquisition offer from BPER Banca highlight ongoing strategic challenges amidst potential market changes.

- Navigate through the intricacies of Banca Popolare di Sondrio with our comprehensive dividend report here.

- Our expertly prepared valuation report Banca Popolare di Sondrio implies its share price may be too high.

Banco de Sabadell (BME:SAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco de Sabadell, S.A. offers a range of banking products and services to personal, business, and private customers both in Spain and internationally, with a market cap of €16.90 billion.

Operations: Banco de Sabadell's revenue segments include €185 million from its Banking Business in Mexico, €1.32 billion from the United Kingdom, and €4.37 billion from Spain, which includes its Real Estate Asset Transformation Business.

Dividend Yield: 7.4%

Banco de Sabadell offers a competitive dividend yield of 7.4%, placing it among the top 25% in Spain, but its dividend history is volatile and less reliable. The bank's payout ratio of 54.2% suggests dividends are currently well-covered by earnings, though future coverage may tighten to 72.3%. Recent earnings growth contrasts with a high level of bad loans at 2.4% and a low allowance for bad loans at 64%, which could impact financial stability amidst ongoing strategic maneuvers including share buybacks and potential asset sales like TSB Banking Group plc.

- Click to explore a detailed breakdown of our findings in Banco de Sabadell's dividend report.

- The valuation report we've compiled suggests that Banco de Sabadell's current price could be quite moderate.

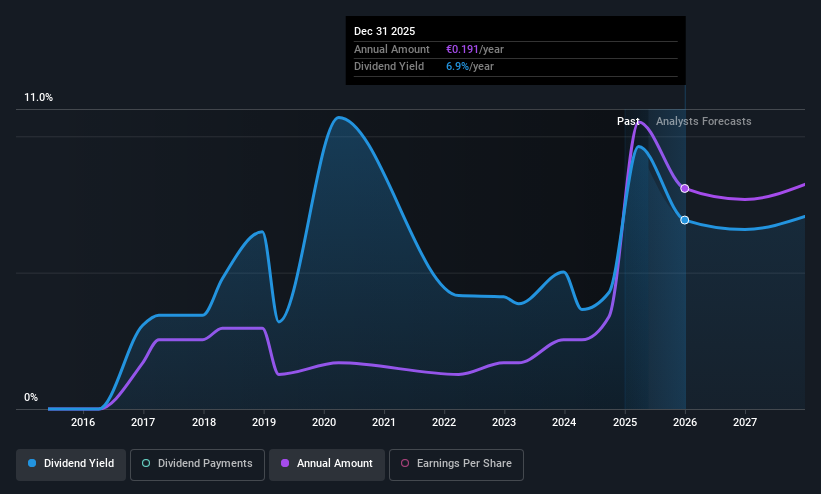

Manitou BF (ENXTPA:MTU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Manitou BF SA, with a market cap of €714.07 million, develops, manufactures, and distributes equipment and services across regions including France, Southern Europe, Northern Europe, the Americas, Asia, the Pacific, Africa, and the Middle East.

Operations: Manitou BF SA generates revenue primarily through its Products Division, which accounts for €2.11 billion, and its Services & Solutions Division, contributing €416.52 million.

Dividend Yield: 6.7%

Manitou BF's dividend yield of 6.7% ranks in the top 25% of French market payers, yet its dividend history is marked by volatility and unreliability over the past decade. Despite a recent decrease to €1.25 per share, dividends remain covered by earnings (65.9%) and cash flows (37.2%). The company's net profit margin has declined from last year, with recent half-year earnings showing a significant drop in both sales (€1.27 billion) and net income (€32.67 million).

- Get an in-depth perspective on Manitou BF's performance by reading our dividend report here.

- Our valuation report unveils the possibility Manitou BF's shares may be trading at a discount.

Turning Ideas Into Actions

- Get an in-depth perspective on all 223 Top European Dividend Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal