Counterpoint: As of 2025, the cumulative revenue of Apple Watch exceeded 100 billion US dollars in Q2

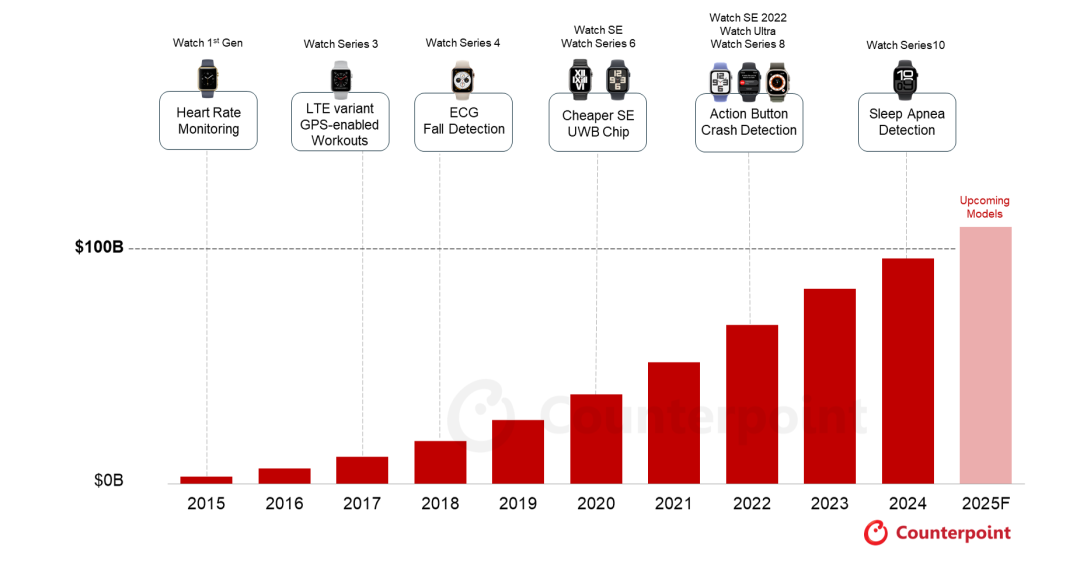

The Zhitong Finance App learned that according to Counterpoint Research data, as of the second quarter of 2025, the cumulative revenue of Apple Watch had exceeded 100 billion US dollars. This growth is due to the continuous evolution of Apple Watch's health features and health monitoring use cases, which continue to expand the actual utility of the product. The company has also expanded its product portfolio to further improve its reach; seamless integration with iPhone has also significantly optimized the user experience. Apple has pioneered a new category in the high-end watch market, challenging traditional high-end mechanical/analog watches.

Over time, Apple has also stratified its product line: the Watch SE is aimed at more price-sensitive consumers, and the Watch Ultra covers high-end users. Watch SE is particularly helpful in attracting new users in emerging, price-sensitive markets. Since it is only compatible with iPhone, Apple Watch has also become a key pivot in strengthening the Apple ecosystem and user retention.

Apple Watch's cumulative revenue and key feature highlights

(2015—2025F)

Source: Counterpoint Research, Apple 360 Service (Revenue Unit: USD)

In the picture, Apple continues to lead the industry in innovation and health features:

Series 4: FDA-approved ECG ECG;

Series 6: UWB ultra-wideband chip;

Series 10: FDA-approved sleep apnea test.

However, as competitors continue to improve in hardware design, health-monitoring sensor accuracy, and compliance certification for new health projects such as the Huawei Watch D2's blood pressure monitoring, competition is becoming more intense. Segmented rivals such as Garmin continue to grow in high-end sports watches such as running, golf, and diving; at the same time, Imoo dominates the expanding global children's watch market; the emerging category of screen-less fitness bracelets may also challenge the health functions of smartwatches. This competitive trend, combined with the intermittent pace of SE and Ultra releases, lengthening switching cycles, and insufficient major hardware upgrades, has led to Apple experiencing seven consecutive quarters of year-on-year decline as of the second quarter of 2025. Furthermore, geographical challenges remain, particularly in China, the world's largest smartwatch market, where Huawei rose to first place in the second quarter of 2025.

Looking ahead to 2025, Apple's watch business is expected to return to growth with the release of the 10th anniversary Watch Series 11, Watch Ultra 3, and the possible Watch SE 3. These new products may be equipped with satellite messaging, blood pressure monitoring, and deeper integration of Apple Intelligence (Apple Intelligence) in watchOS 12.

A richer product portfolio+updated features are expected to help Apple reverse the market decline, attract new users on the one hand, and promote the upgrading of existing users on the other.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal