Alaska Air Group (ALK): Assessing Valuation After Major Iceland Route and European Expansion with Icelandair

Most Popular Narrative: 6% Undervalued

The prevailing narrative suggests that Alaska Air Group is undervalued by approximately 6%, reflecting confidence in the company’s strategic shifts and future earnings growth.

The successful integration of Hawaiian Airlines and realization of synergy initiatives, particularly in network connectivity and premium offerings, are unlocking incremental profit, enhancing operational efficiency, and supporting margin expansion for the next several years.

Want to know what’s fueling this undervalued call? The narrative is built on bold growth forecasts, significant profit assumptions, and a notably low future multiple. Curious what margin improvement and buybacks underpin the fair value? The quantitative details behind this target might surprise you.

Result: Fair Value of $66.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising operating costs and ongoing integration risks with Hawaiian Airlines could present challenges to Alaska Air Group’s growth outlook and may affect future profitability.

Find out about the key risks to this Alaska Air Group narrative.Another View: Price Ratios Tell a Different Story

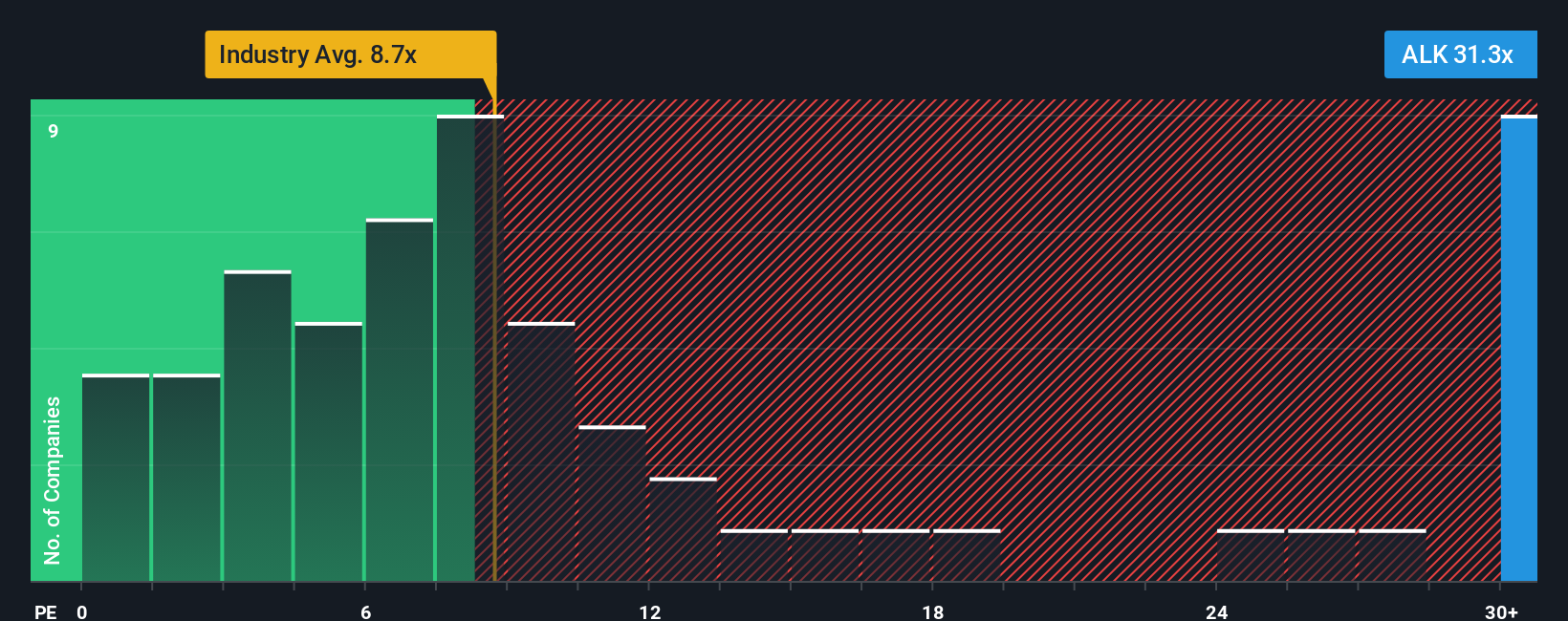

While many see Alaska Air Group as undervalued, another lens suggests a higher valuation than industry averages based on current price ratios. Could the market already be factoring in all of that future growth potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alaska Air Group Narrative

If you see things differently or want to dive into the numbers yourself, you can craft your own Alaska Air Group narrative in just a few minutes. Do it your way.

A great starting point for your Alaska Air Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for Your Next Investment Move?

Smart investors never stand still. Don’t let exciting opportunities pass by. See what’s out there for your portfolio with Simply Wall Street’s expert screeners.

- Uncover high-potential companies reshaping patient care and medical technology by taking a closer look at healthcare AI stocks.

- Target steady income streams by seeking out dividend stocks with yields > 3% offering reliable returns and strong financial health.

- Jump into the future of high-speed computing with access to quantum computing stocks at the forefront of next-generation breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal