Upstart Holdings (UPST): Assessing Valuation Following New Referral Network Partnership Expansion

If you have been watching Upstart Holdings (UPST) lately, the recent news about its partnership with Cornerstone Community Financial Credit Union probably caught your eye. This collaboration brings smarter and more inclusive personal loan offerings to more people, as Cornerstone Community Financial becomes the latest participant in the Upstart Referral Network. Strategic partnerships like this play directly into Upstart’s strengths, since expanding the network potentially increases both customer reach and loan volume.

With this development, Upstart has maintained solid momentum. The company’s share price has seen a sharp gain of 94% over the last year and is up more than 18% over the past 3 months, even after some short-term fluctuations. Recent moves are building on strong annual revenue growth, but investors will be weighing what this means for future earnings given continued net losses and a competitive lending environment.

The question now, of course, is whether Upstart’s latest deal signals that the stock is undervalued, or if the market is already pricing in all that future growth.

Most Popular Narrative: 15.6% Undervalued

The most widely followed narrative suggests Upstart Holdings could be meaningfully undervalued, driven by anticipated rapid increases in revenue and margin expansion.

Improvements in underwriting, automation, and personalization enhance loan approval rates, lower costs, and reduce default risks. These factors positively impact revenue and net margins. Strategic HELOC growth, supported by strong banking relationships and an expanded borrower base, sets the stage for future revenue growth and earnings support.

Curious how a company with recent net losses justifies a fair value above its current share price? This narrative is powered by optimistic assumptions such as high growth rates, dramatic margin shifts, and a future profit multiple similar to industry leaders. Want to uncover the numerical leap that analysts believe Upstart could make in revenue and profit? Dive in to see which projections hold the key to this bullish outlook.

Result: Fair Value of $80.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, this upbeat outlook could quickly change if borrower defaults spike again or if Upstart’s model accuracy slips under volatile economic conditions.

Find out about the key risks to this Upstart Holdings narrative.Another View: Looking at Market Comparisons

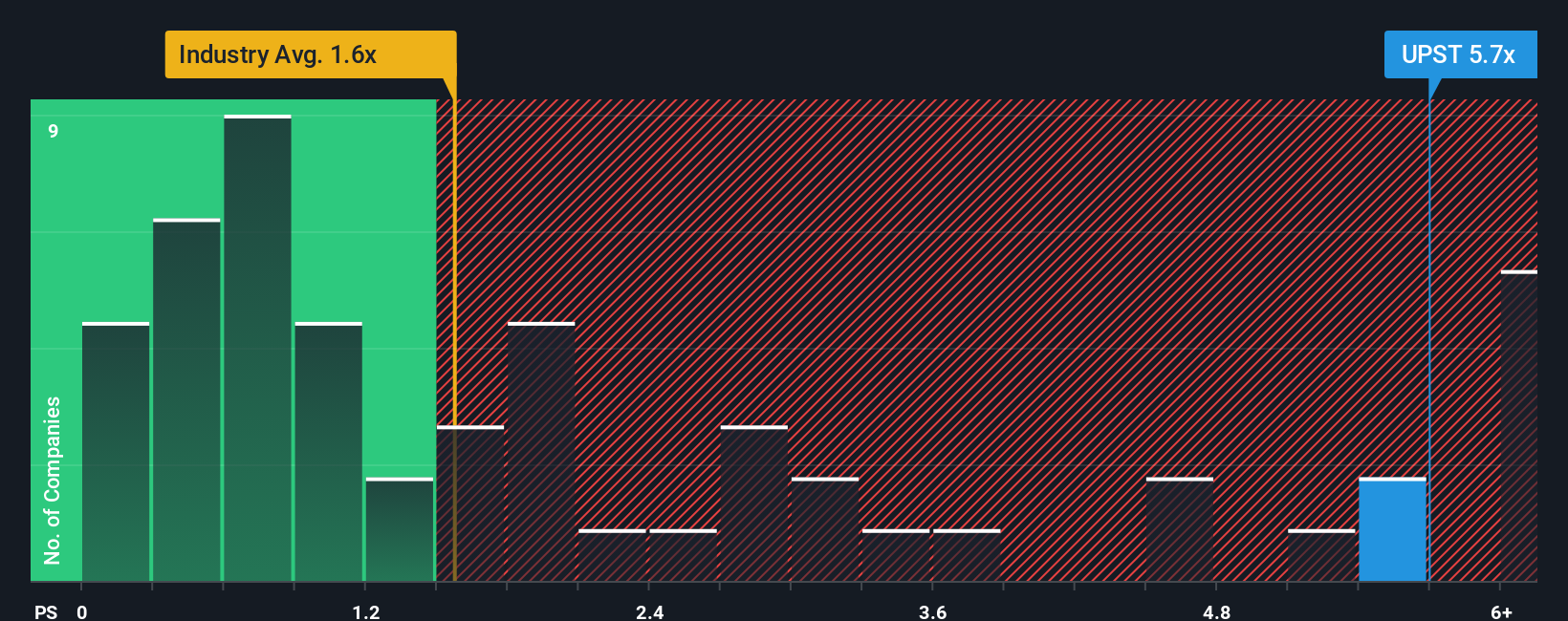

Some investors focus instead on how Upstart is valued compared to others in its industry. In this view, the market currently prices Upstart higher than average for similar financial companies, possibly questioning the upside case. But is the market right, or missing something?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Upstart Holdings Narrative

If you have a different viewpoint or want to analyze the numbers in your own way, you can easily build your personal case for Upstart Holdings in just a few minutes. Do it your way

A great starting point for your Upstart Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Expand your horizon beyond Upstart Holdings, and take action on fresh opportunities you might not have considered. The Simply Wall Street Screener can help you spot these standout choices that others might be missing.

- Seize the chance to find companies redefining artificial intelligence using AI penny stocks and powering breakthroughs in automation, robotics, and next-generation data analytics.

- Uncover value gems flying under the radar by investigating undervalued stocks based on cash flows to see which stocks offer compelling potential based on their future cash flows.

- Maximize your returns with reliable income opportunities by exploring dividend stocks with yields > 3%, known for consistent dividend payouts exceeding 3% yield.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal