Exploring Nexans (ENXTPA:NEX) Valuation After Recent Share Movement Pauses

Most Popular Narrative: 2% Undervalued

The most followed narrative currently sees Nexans trading just below fair value, indicating a modest opportunity for value-seeking investors. This view balances optimism about growth with caution regarding sector challenges.

A strengthened balance sheet with near-zero net debt, strong free cash flow, and substantial liquidity creates flexibility for M&A, investments in green/recyclable cable production, and innovation. These factors support long-term earnings growth and higher return on capital employed.

Want to uncover what puts Nexans in this sweet spot? The backbone of this valuation is built on bold financial assumptions and future margin improvements, shifting expectations for both revenue and earnings. Curious about the analyst numbers that could spark a bigger debate? This narrative bases its fair value on forecasts only the most plugged-in investors are tracking.

Result: Fair Value of €130.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing margin pressure or a sudden shift in industry dynamics could quickly challenge the upbeat view analysts currently hold for Nexans.

Find out about the key risks to this Nexans narrative.Another View: Discounted Cash Flow Perspective

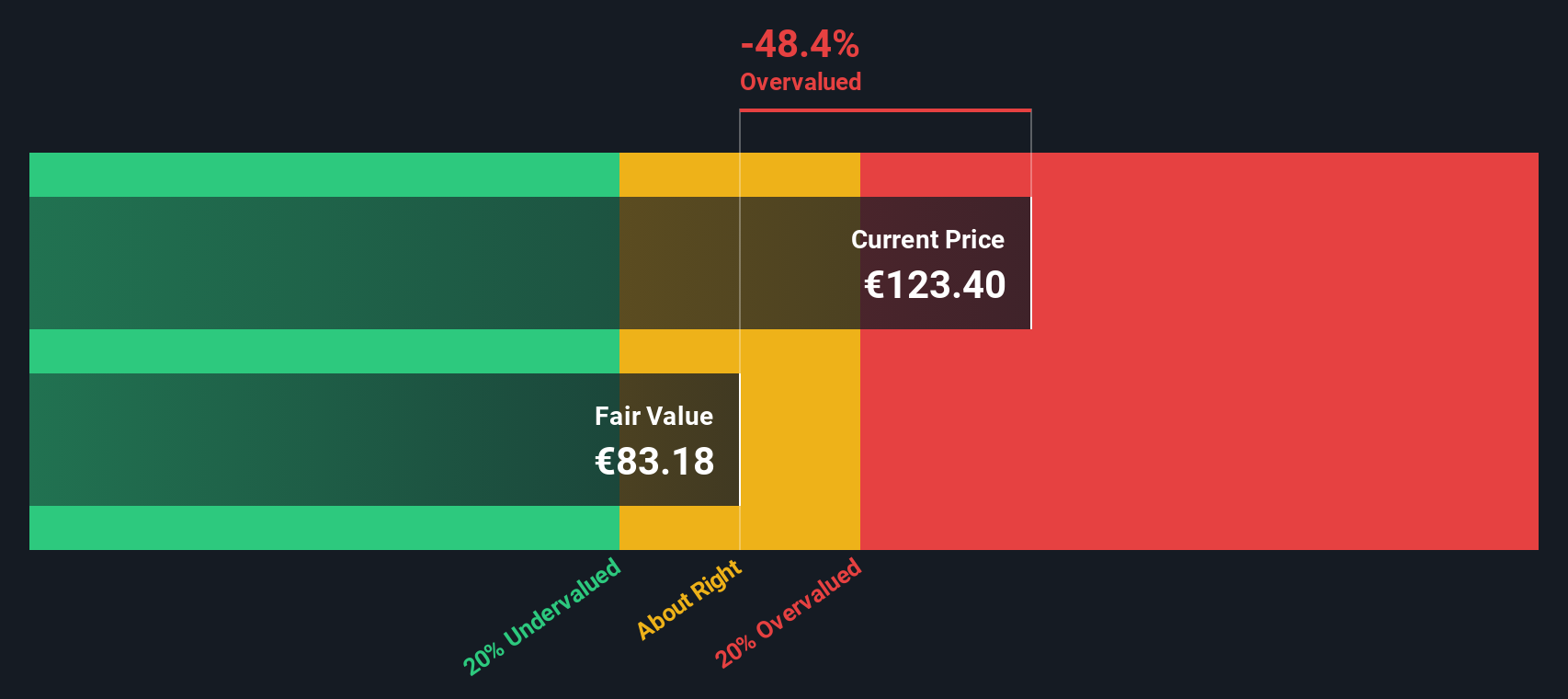

While the current narrative points to Nexans being slightly undervalued, our DCF model presents a more cautious picture and suggests the share price could be running ahead of underlying cash flow value. Which approach will prove more accurate as the market shifts?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Nexans Narrative

Not convinced by these perspectives, or eager to run your own numbers? It takes just a few minutes to craft a narrative that reflects your own outlook. Do it your way.

A great starting point for your Nexans research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Sharpen your portfolio with proven strategies. Using the right tools now can set you up for opportunities many investors overlook. Don’t miss your chance to act on these handpicked ideas powered by Simply Wall Street’s screeners.

- Spot value where others miss it and unlock fresh opportunities chosen for their attractive cash flow potential with our undervalued stocks based on cash flows.

- Fuel your returns with companies revolutionizing healthcare using artificial intelligence. Tap into the latest picks through our healthcare AI stocks.

- Unearth dynamic opportunities in the digital asset space by zeroing in on tomorrow’s growth leaders with our cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal