What Do Recent eToro Swings Mean for Investors After the Social Trading App Launch?

If you are watching eToro Group right now, you are likely asking yourself whether the recent price swings spell opportunity or signal renewed risk. The stock has staged a modest comeback in the past week, climbing 3.5%, but that barely dents a rougher month with shares down 20.7% over the last 30 days. Year to date, eToro Group has slipped a hefty 31.4%. Clearly, volatility is the name of the game at the moment and is stirring both nerves and interest among potential investors.

Some of these fluctuations may be tied to broader market shifts and shifting sentiment toward the fintech sector as investors weigh both growth prospects and changing risk dynamics. While news flow remains relatively quiet, it is clear that the market is adjusting its stance on eToro Group's long-term outlook. So, is there real value here or is the current price simply reflecting increased caution?

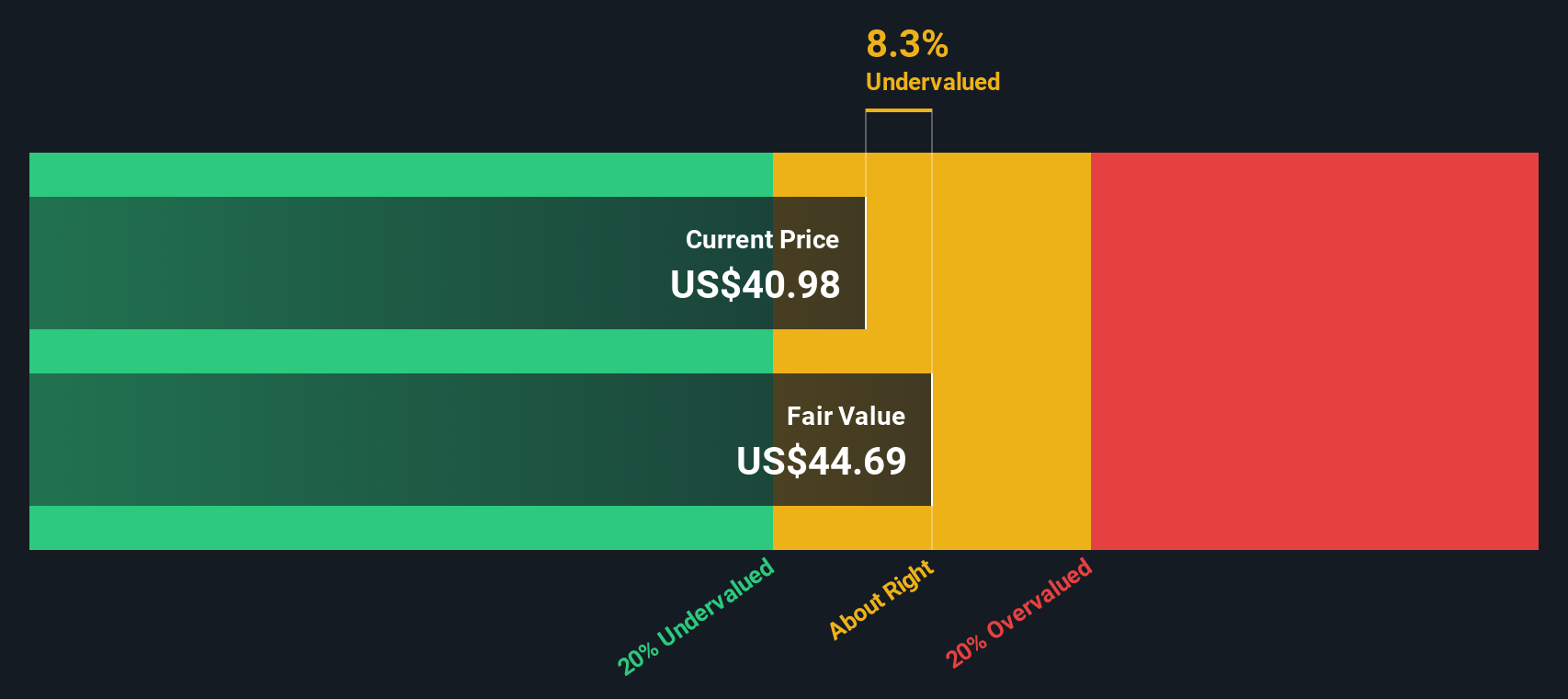

To help answer that, we will dig into multiple valuation methods and see how eToro Group stacks up according to each. The company currently scores 1 out of 6 on our undervaluation checks, which means there is room for improvement if you are seeking a strong value play. But before we make any big conclusions, let’s walk through the numbers and approaches and ultimately explore whether there is a smarter way to get a sense of true value in eToro Group stock.

eToro Group scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: eToro Group Excess Returns Analysis

The Excess Returns valuation model focuses on how efficiently eToro Group deploys its capital, weighing its returns against the cost of equity to gauge whether the company is meaningfully creating value for shareholders. This method is all about financial productivity. If returns on equity consistently outpace the cost of equity, value is being added, and that should reflect in the stock price.

For eToro Group, the numbers break down as follows:

- Book Value: $16.43 per share

- Stable EPS: $3.71 per share (Source: Median Return on Equity from the past 5 years.)

- Cost of Equity: $1.66 per share

- Excess Return: $2.05 per share

- Average Return on Equity: 22.56%

- Stable Book Value: $16.43 per share (Source: Median Book Value from the past 5 years.)

Based on these metrics, the model suggests an intrinsic value for eToro Group that is roughly 0.9% higher than the current share price. This implies the stock is just slightly overvalued. The gap, however, is so minor that the shares are essentially trading at fair value given their recent financial performance and return profile.

Result: ABOUT RIGHT

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for eToro Group.

Approach 2: eToro Group Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies, as it relates a company's share price to its per-share earnings. This makes it especially relevant for eToro Group, which has posted positive earnings and is part of an industry where profitability sets critical benchmarks.

Growth prospects and risk play a big role in what constitutes a "fair" PE ratio. Higher expected earnings growth or lower perceived risk often justify a higher multiple. Conversely, lower growth or higher risk can push the fair valuation down. Comparing against peers and the broader Capital Markets industry can offer useful context.

eToro Group currently trades at a PE of 20.5x, which puts it below the Capital Markets industry average of 26.7x but above the peer average of 12.6x. This positioning indicates that the market sees eToro as less expensive than the average industry player, but pricier than some of its direct competitors.

Simply Wall St's "Fair Ratio" offers a tailored benchmark for eToro Group by factoring in not just industry context and growth expectations, but also the company’s profit margins, market capitalization, and risk profile. This approach often gives a clearer view of intrinsic valuation than relying on broad industry or peer averages, making it particularly useful for more nuanced investment decisions.

With eToro Group's current PE so closely aligned to what the Fair Ratio suggests for a business with its specific attributes, the evidence points to shares being approximately fairly valued at present.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your eToro Group Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply your personal story or perspective on a company, connected directly to your financial assumptions, such as your expected fair value and estimates for future revenue, earnings, and profit margins.

Narratives link the story you believe in about eToro Group to real financial forecasts and ultimately to an up-to-date fair value, all in one simple tool. This means you do not need to rely solely on traditional ratios or broad models. Instead, you can easily create and compare Narratives within Simply Wall St's Community, where millions of investors share and refine their point of view.

By mapping your Narrative, you can clearly see whether your fair value suggests it is time to buy, hold, or sell the stock based on where the current market price sits. Best of all, Narratives are automatically updated as new facts, earnings releases, or news hit the market, so your investment story always reflects the latest information.

For example, one investor might use a Narrative that projects rapid fintech growth and value eToro Group at a premium, while another sees regulatory pressure limiting upside and sets their fair value much lower. Both perspectives are visible and actionable on the platform.

Do you think there's more to the story for eToro Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal