Will Luckin Coffee’s (LKNC.Y) U.S. Debut and China Lead Shift Its Global Growth Narrative?

- In early September 2025, Macquarie initiated coverage of Luckin Coffee with an ‘Outperform’ rating, noting the company’s strong Q2 financial results, continued rapid store growth in China, and its entry into the U.S. market through new stores in New York City.

- A key insight is that Luckin Coffee has surpassed Starbucks as the largest coffee chain in China, highlighting its significant momentum both domestically and with its first steps into international markets.

- We'll explore how Luckin’s international expansion, particularly its U.S. market entry, may influence the company’s longer-term investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Luckin Coffee Investment Narrative Recap

To be a shareholder in Luckin Coffee, you need to believe in its ability to convert rapid store growth and expanding digital engagement within China into lasting profitability, while managing operational risks linked to accelerated scale. The recent Macquarie coverage, highlighting Luckin’s entry into New York and ongoing strong quarterly results, brings extra attention to its international ambitions, but does not materially alter the most immediate catalyst, continued domestic store expansion, or shift the biggest risk, which remains potential overexpansion and store productivity pressures.

Of all recent announcements, the July 30, 2025, Q2 earnings report stands out: It confirmed a 47% year-on-year increase in net revenue and a 44% increase in net income, driven by Luckin’s rapid new store additions and growing transaction volumes. These results reinforce the company’s narrative of operational scale as a key earnings catalyst, but also amplify the relevance of expansion-related risks highlighted by Macquarie and other observers as Luckin pushes into new territories.

In contrast, investors should be aware that continued rapid store openings may expose Luckin to the real possibility of...

Read the full narrative on Luckin Coffee (it's free!)

Luckin Coffee's narrative projects CN¥73.6 billion revenue and CN¥6.9 billion earnings by 2028. This requires 21.5% yearly revenue growth and a CN¥3.0 billion earnings increase from CN¥3.9 billion today.

Uncover how Luckin Coffee's forecasts yield a $46.89 fair value, a 28% upside to its current price.

Exploring Other Perspectives

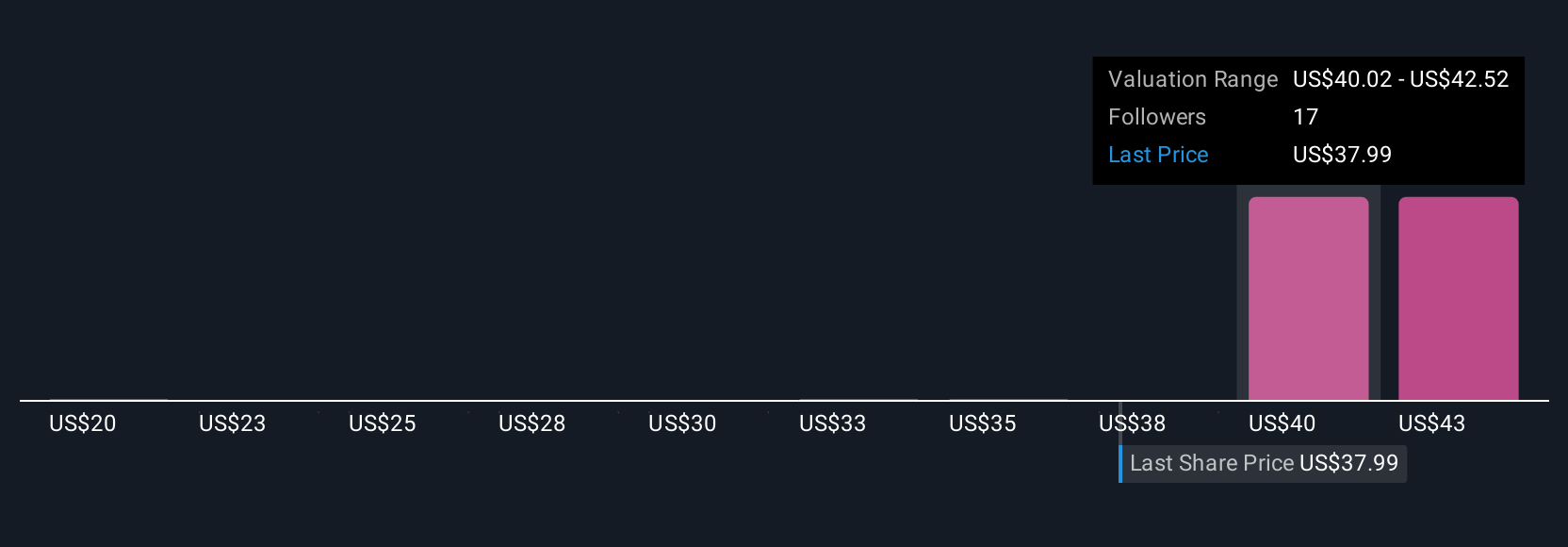

Six recent fair value estimates from the Simply Wall St Community range from US$32.39 to US$46.89 per share. While community opinions vary widely, many are watching closely to see if Luckin’s aggressive growth will outpace the risk of store saturation and margin squeeze.

Explore 6 other fair value estimates on Luckin Coffee - why the stock might be worth as much as 28% more than the current price!

Build Your Own Luckin Coffee Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Luckin Coffee research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Luckin Coffee research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Luckin Coffee's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal