Reinsurance Group of America (RGA): Is the Stock’s Current Valuation Overlooked?

If you have been eyeing Reinsurance Group of America (RGA) lately, the stock’s latest move might have you wondering if this is the moment to make a move or just a subtle blip worth keeping in your watchlist. With no headline-grabbing news or disruptive events in the last few weeks, investors are left to interpret recent activity as a potential signal, albeit a quiet one, about where sentiment is heading for the insurer.

Looking over the last year, shares of Reinsurance Group of America have declined about 8%, underperforming the broader market. This comes despite steady top-line growth, healthy net income, and a decade-plus reputation for disciplined underwriting. Momentum appears mixed, with a modest bounce in the past month offset by a broader slide since January. The three-year and five-year tallies still show strong, positive returns. With no earth-shaking headlines to chase, attention naturally shifts to fundamental valuation and how the market is playing its cards.

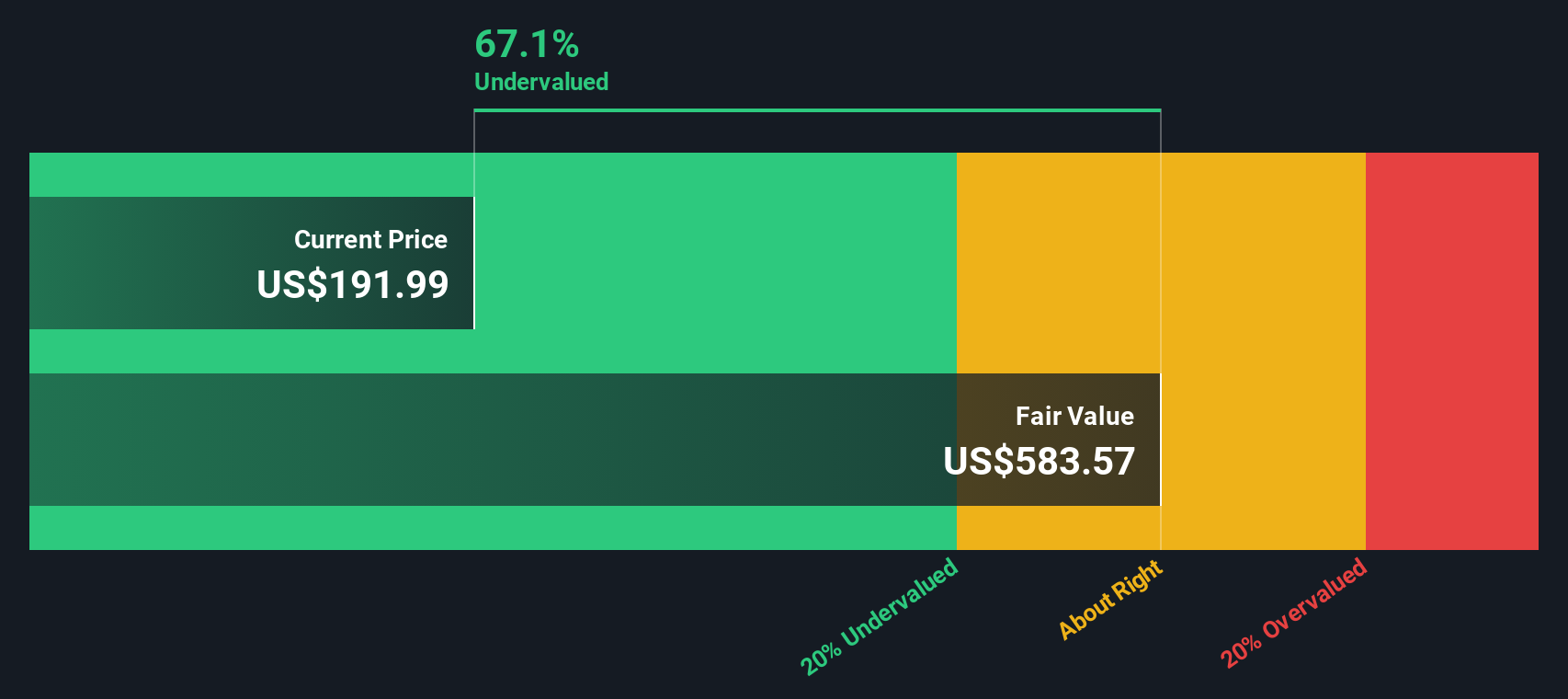

So, are investors overlooking an undervalued opportunity in RGA, or has the market already factored in all the relevant growth prospects?

Most Popular Narrative: 18.9% Undervalued

According to the most widely followed narrative, Reinsurance Group of America is currently undervalued by nearly 19%, pointing to notable upside potential if projections materialize as expected.

"The company's leadership in digital underwriting solutions and customized reinsurance products, bolstered by data analytics and exclusive arrangements, enhances efficiency and pricing power. This is likely to improve net margins and generate higher earnings as these tech-enabled capabilities scale."

How can tech innovation and international expansion reshape this insurer’s financial destiny? One big assumption in this price target hinges on future profit margins and aggressive revenue growth forecasts that not everyone sees coming. Want to know which bold projections could unlock that almost 20% upside? Get the full breakdown by reviewing the most popular narrative’s numbers and reasoning.

Result: Fair Value of $236.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistently high volatility in U.S. life claims or rising medical costs could quickly challenge these optimistic projections and reduce investor confidence.

Find out about the key risks to this Reinsurance Group of America narrative.Another View: How Do Other Valuations Stack Up?

Looking at valuation from a different perspective, our DCF model presents a much more bullish story. It suggests the stock could be trading at a substantial discount to its intrinsic value. Why is there such a significant gap between these numbers?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Reinsurance Group of America Narrative

If you want to take a hands-on approach or reach your own conclusions, you can craft your own narrative using the same data set in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Reinsurance Group of America.

Looking for More High-Potential Stock Ideas?

Smart investors always stay ahead of the curve by seeking out new opportunities. Don’t let the next big winner slip through your fingers. Expand your horizon today.

- Accelerate your portfolio’s yield by checking out dividend stocks with yields > 3% to spot companies with payouts surpassing 3%.

- Capitalize on the AI revolution by exploring AI penny stocks to find innovators at the forefront of artificial intelligence advancements.

- Find overlooked bargains by leveraging undervalued stocks based on cash flows and see which stocks offer compelling value based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal