CEMEX, S.A.B. de C.V. (BMV:CEMEXCPO) Not Flying Under The Radar

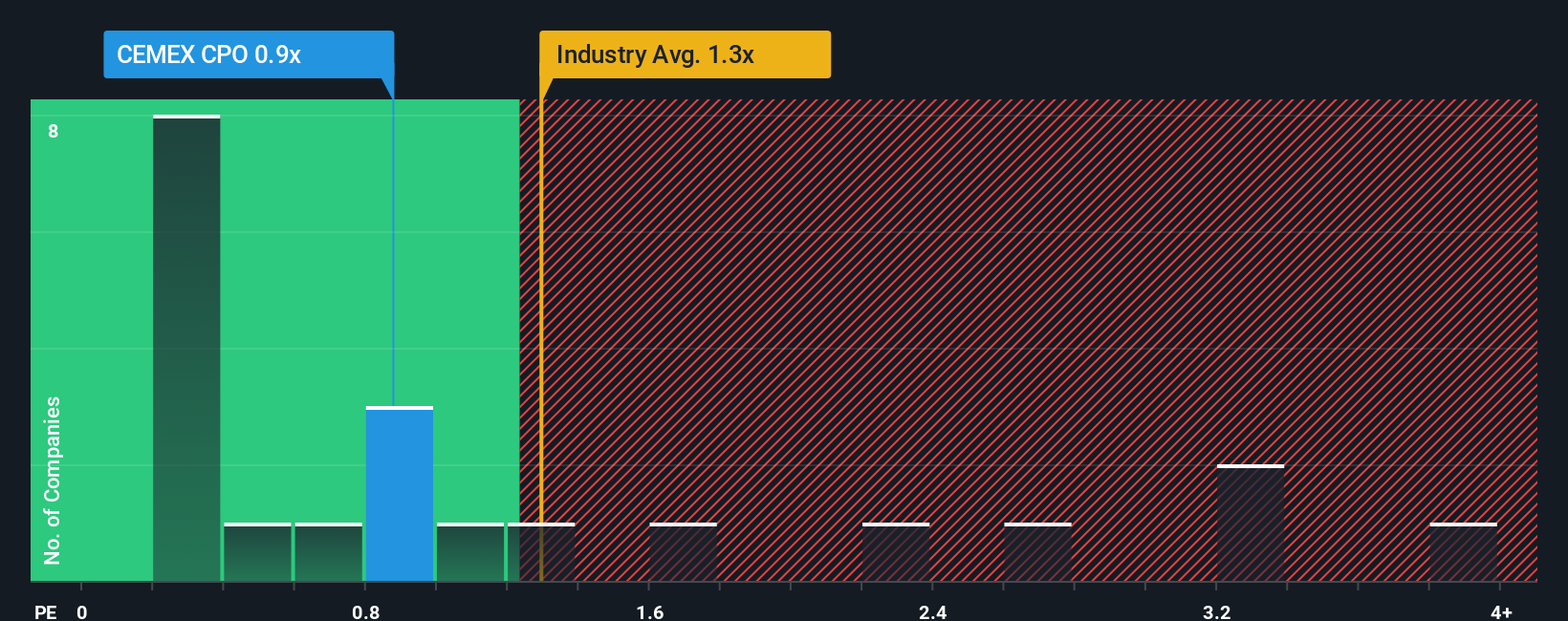

With a median price-to-sales (or "P/S") ratio of close to 0.9x in the Basic Materials industry in Mexico, you could be forgiven for feeling indifferent about CEMEX, S.A.B. de C.V.'s (BMV:CEMEXCPO) P/S ratio, which comes in at about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for CEMEX. de

What Does CEMEX. de's Recent Performance Look Like?

Recent times haven't been great for CEMEX. de as its revenue has been falling quicker than most other companies. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think CEMEX. de's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like CEMEX. de's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 6.1% decrease to the company's top line. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 4.0% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 5.5% each year, which is not materially different.

In light of this, it's understandable that CEMEX. de's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On CEMEX. de's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A CEMEX. de's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Basic Materials industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for CEMEX. de with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal