From Bullish to Gemini: Retail Power Is Rewriting the Rules of the IPO Game

The Zhitong Finance App learned that retail investors, who have long been regarded as “stupid money” by Wall Street, have changed the investment dynamics of the market from individual stocks to cryptocurrencies to “end-of-date rights”. Today, they are expanding their influence into the global stock market IPO market — and these IPO companies and Wall Street giants have welcomed this with open arms, greatly broadened the stock sales pool for retail investors. With the help of a huge retail investor base, their issue price increased dramatically, and the momentum of the first day was extremely strong.

Taking Bullish as an example, this “hot fried chicken” in the cryptocurrency sector successfully landed on US stocks last month with a massive $1.1 billion IPO. The company directly opens the right to participate in initial public offerings (IPOs) to retail investors through internet brokerage firms such as SoFi and Robinhood — a privilege usually enjoyed by Wall Street's largest commercial banks, early-stage venture investors, or wealthy customer groups. People familiar with the matter said that demand for IPOs from these channels was so strong that Bullish was able to set the issue price at $37 per share, which is nearly 20% higher than the upper limit of its initially proposed range.

Even so, the price was still not high enough. The stock surged 143% from the issue price during the opening transaction, bringing huge profits on paper to this retail group that has traditionally been excluded from initial IPOs.

Retail investors write a new paradigm for IPOs

Bullish's case showed Wall Street giants and private companies preparing to start the IPO process that retail investor groups — which account for more than 20% of total US stock trading volume and have a profound impact on emerging markets such as the crypto industry and artificial intelligence — can in particular bring in sufficient fund-raising scale to change the IPO pricing dynamics. The surge in retail participation on internet brokerage platforms also means that investment banks don't have to specifically and overly rely on existing relationships with institutional investors or high-net-worth clients — they can provide IPO shares to almost any retail investor, thereby broadening the demand pool.

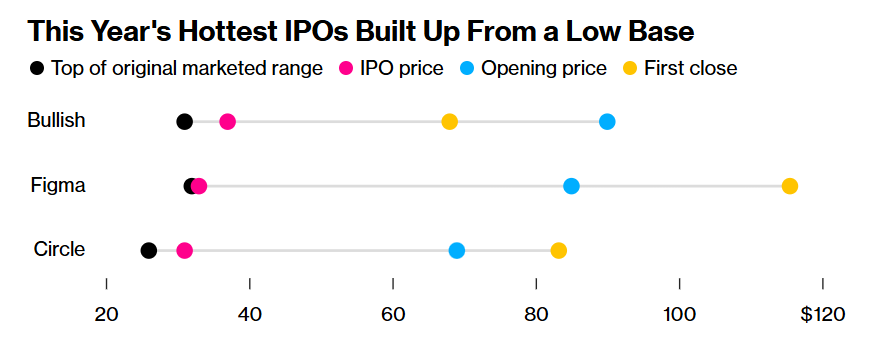

This year's hottest IPOs have accumulated from a low position

“This is definitely a new paradigm,” said Becky Steinthal, head of TMT capital markets at Wall Street financial giant Jefferies Financial Group, which participated in Bullish's IPO. “The cryptocurrency, artificial intelligence, and other buzzword sectors targeting global consumers will definitely see the most extreme demand from retail investors. Issuers are now choosing to make the share of retail investors in the IPO process higher than the historical average,” she stressed. “It's all driven by the tech boom and demand.”

In the process of the US stock IPO project, which will be priced in the next few days, the positioning of retail investors is clearly visible. The IPO of Gemini Space Station Inc., a subsidiary of the Winklevoss Brothers, clearly includes a share of up to 10% distributed to retail investors, which can be subscribed through internet brokerage platforms such as Robinhood, SoFi, Moomoo, and Webull.

Other companies that are about to go public and trade are following suit. Figure Technology Solutions Inc., a company focused on blockchain finance, requires its underwriting banks to provide shares to retail investors through specific online brokerage platforms. The public transportation software company Via Transportation Inc. used SoFi, RobinHood, and the eTrade platform owned by Morgan Stanley to sell shares to retail investors before the IPOs officially open in the stock market.

Investment demand from retail investors for IPO companies has surged

According to Robinhood statistics, this strategy is likely to bring strong returns to global stock market IPO candidates. The platform's investment demand for IPO companies has increased fivefold since this year compared to last year. Steve Quirk, the company's chief brokerage officer, revealed in an interview.

“We were oversubscribed with every order,” Quirk said. “Demand is always stronger than supply. The issuer loves this situation and hopes that more retail fans of their company will get the stock sale.”

According to its CEO Tom Farley, Bullish sold one-fifth of its shares to individual investors, or about $220 million, which is about four times what industry veterans call the “normal level.” Moomoo's US CEO Neil McDonald said that Moomoo customers alone submitted more than $225 million in subscription orders. The brokerage promoted opportunities to participate in this IPO on various platforms, which also attracted the attention of thousands of retail investors on rival platforms including Robinhood and SoFi.

“The share sale ratio of retail investors is distributed between traditional investment banking channels and the new generation of online electronic retail brokerage firms (such as SoFi and RobinHood), rather than being overly concentrated in one category.” Farley from Bullish said in an interview on the day the company went public.

Representatives from Bullish and its underwriters (including J.P. Morgan Chase, Jefferies, and Citi) declined to comment on the role of retail investors in this release.

A reliable partner

For a long time, Wall Street viewed retail buyers as insensitive to prices. Basically, they viewed them as reliable buyers of IPOs, hoping to seize any first-day “jump.” As a result, retail investors often buy at a high level, and large institutional participants in IPOs are left with heavy losses after making a sharp sell-off at a profit.

Today, private companies no longer view retail investors as “bad guys,” but rather as reliable partners worthy of giving back in IPO marketing. The desire to sell shares to retail investors can bring a certain level of loyalty; and given the continued expansion trend of retail stock trading in the market, other types of key transactions may also attract individual investors to participate.

This group's classic tendency to “buy and hold” helps support the stability of stock prices, but it may also affect the trading liquidity of a stock on the first day of listing. Therefore, internet brokerage platforms, including Robinhood, also have strict restrictions on retail investors' “large-scale returns” within 30 days after the IPO, which may result in penalties and restrictions on their opportunities to participate in other stock transactions.

Despite this, a sharp correction in the stock market, entry into a bear market zone, or a series of underperforming IPOs may drive retail investors to flee the IPO market on a large scale.

“There is a very typical saying that retail investors are both your friends and your enemies: when the IPO market is hot, they tend to pour in in large numbers, and when the market is sluggish, they don't choose to approach you.” Steinthal from Jefferies said. “The trend of retail investors participating in stock market IPOs will depend on specific market conditions.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal