How a Surge in Bearish Options Activity at aTyr Pharma (ATYR) Has Changed Its Investment Story

- On September 5, 2025, aTyr Pharma Inc saw unusually high bearish put option volume, with the Put/Call ratio rising to 1.55 and at-the-money implied volatility increasing by nearly six points as the company approaches its anticipated November 6 earnings report.

- This concentration of speculative bearish bets highlights heightened caution among investors, marking a period of intensified scrutiny for aTyr ahead of its key financial update.

- Next, we’ll explore how the surge in bearish options trading shapes the investment narrative for aTyr Pharma moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is aTyr Pharma's Investment Narrative?

For anyone considering aTyr Pharma, the main thesis rests on belief in its pipeline and the possibility of successful late-stage trial outcomes for efzofitimod, as the company pursues treatments for complex lung diseases with few options. The stock’s recent burst of bearish options activity is a signal investors are bracing for volatility or potential disappointments as the crucial EFZO-FIT Phase 3 results and the November earnings report approach. aTyr’s near-term story has pivoted: while its past announcements pointed to clear catalysts from trial milestones and new candidate development, this sudden rise in bearish speculation puts extra focus on risks around trial outcomes, financing, and ongoing losses. However, with no new clinical or financial results yet, the options market move may reflect sentiment rather than hard news, and may not shift the underlying investment case unless it foreshadows actual news. The coming months remain high stakes for aTyr’s trajectory, both in opportunity and in risk.

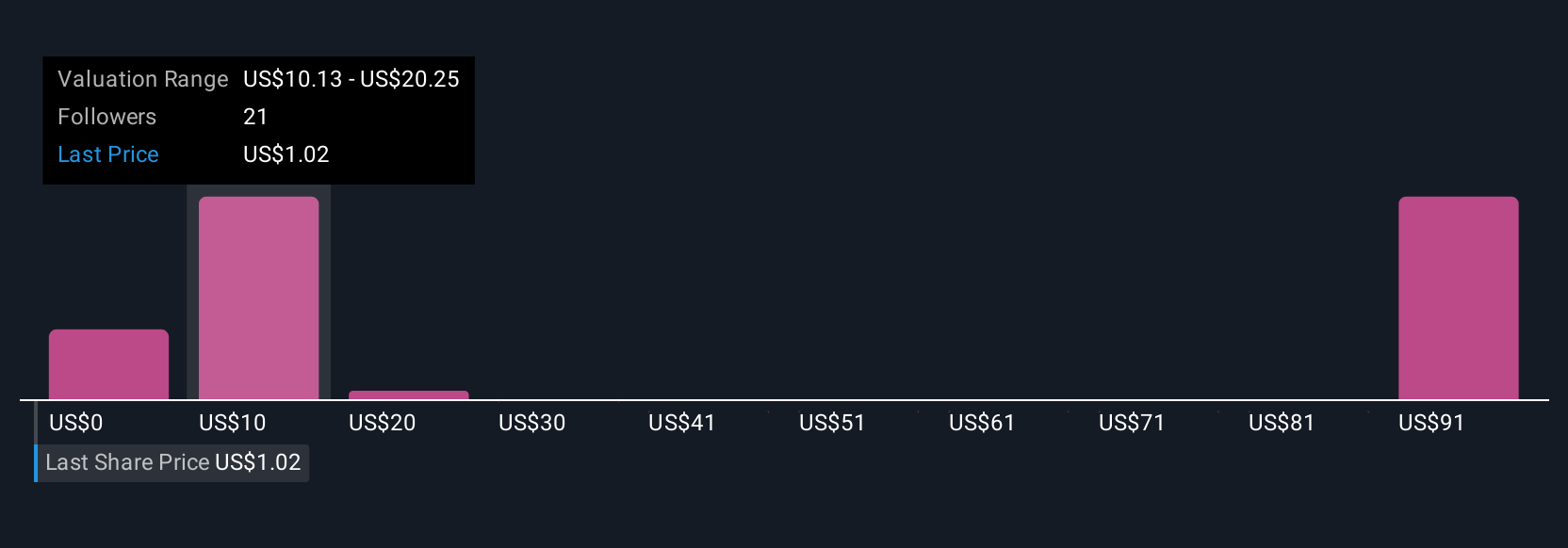

But on the other hand, funding needs remain an issue that investors should not overlook. aTyr Pharma's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 10 other fair value estimates on aTyr Pharma - why the stock might be a potential multi-bagger!

Build Your Own aTyr Pharma Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your aTyr Pharma research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free aTyr Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate aTyr Pharma's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal