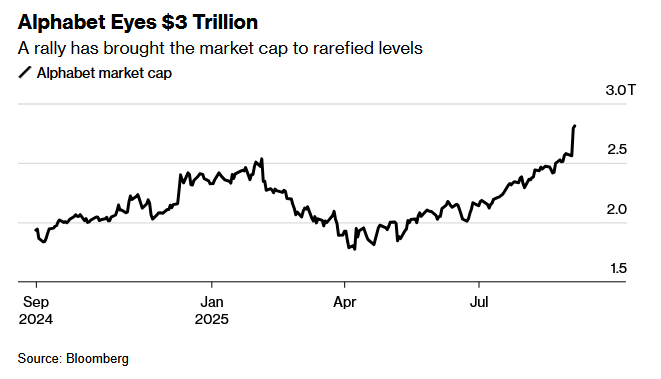

Antitrust ruling clears barriers to growth! Google (GOOGL.US) market capitalization hits $3 trillion

The Zhitong Finance App learned that the long-awaited antitrust ruling eliminated a key risk that had surrounded Google (GOOGL.US) for several months, and also “freed” the stock price.

On September 2, local time, US District Court Judge Amit Mehta ruled that Google did not need to divest its Chrome browser or split the Android operating system, while continuing to reject the relevant prosecution's demands. Google has also not been banned from paying Apple to ensure that its search remains the default option for Apple devices, but the court reserves the right to re-examine the arrangement in the future. Furthermore, Google is not prohibited from paying distribution partners to pre-install Google Search, Chrome, or their generative AI products. However, Google must share some search index data with competitors to open up competition in the online search market. At the same time, the company is no longer allowed to sign exclusive distribution contracts involving Google Search, Chrome, Google Assistant, and Gemini apps.

The market generally believes that the ruling is beneficial to Google, and that the company avoided the worst outcome, where core businesses such as Chrome and Android operating systems were split. Boosted by this news, Google closed up more than 9% on Wednesday.

Neville Javeri, senior fund manager at Allspring Global Investments, said: “This ruling clears the runway for further growth opportunities for Google.” He added that there are “incredible opportunities” for the stock.

The ruling is also expected to continue Google's gains since announcing its second-quarter earnings report. Financial reports show that demand for artificial intelligence (AI) products is boosting the company's sales, and the company's AI products continue to strengthen investors' confidence in its ability to withstand competitors such as OpenAI.

Since then, Google's stock price has risen by more than 20%, making it the best-performing top third of the Nasdaq 100 index since this year. In previous months, Google's stock price had been struggling with antitrust risks and investors' concerns that AI might encroach on its $5 billion search business.

Although the AI debate will be difficult to quell in the short term, Wall Street is increasingly confident that Google can hold its ground. The company's AI feature launched earlier this year received widespread praise, and its latest Pixel phone with built-in AI features also received good feedback. Mobile phone sales from Google and Samsung Electronics show that consumers are willing to switch to devices using Google's Android operating system.

John Blackledge, an analyst at TD Cowen, said, “We expect Google to maintain its leading position in traditional search given the new AI search capabilities and rapidly expanding Gemini apps.”

Google's current market capitalization is $2.81 trillion, which is only about 7% short of $3 trillion. So far, only Apple, Microsoft, and Nvidia have reached this level of market capitalization. Closing this gap may not be difficult. Google's current expected price-earnings ratio is around 21x, while the Nasdaq 100 Index is 26x. Meanwhile, Google's revenue is expected to increase by 14% this year, exceeding the average of the companies that make up the NASDAQ 100 Index.

However, technical indicators show that although market sentiment is improving, the momentum of Google stock may be difficult to sustain in the short term. The stock's 14-day Relative Strength Index has jumped above 83, the highest since 2017, far exceeding 70, which is considered overbought by technical traders. The stock's current trading price is at the same level as analysts' average target price, indicating that Wall Street doesn't think it has much room to rise.

Rosenblatt Securities analyst Barton Crockett said investors “can be relieved by short-term risk dissipation,” but “long-term concerns about competitive risk in the search business will limit valuation multiples.” The analyst also reiterated a “neutral” rating for the stock.

Liam McGarrity, an American investment analyst at Harris Oakmark, said, “Google's stock still looks very attractive because it has many high-quality, rapidly growing businesses.” According to reports, Harris Oakmark has Google as its biggest stock. For Liam McGarrity, the core of owning Google is believing that it can continue to stay ahead of AI competitors and maintain growth. He said, “When you consider that it is cheaper than the market but has industry-leading AI technology and significant potential in businesses such as Google Cloud and Waymo, you'll find that its transaction price is significantly discounted.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal