High Insider Ownership Drives Growth In IREN And Two Other Stocks

As the U.S. stock market grapples with a tech sector slump and renewed tariff uncertainties, investors are increasingly seeking stability in companies with strong insider ownership. High insider ownership can align management's interests with those of shareholders, potentially driving growth even amid broader market volatility.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.5% | 93.2% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.6% | 74.3% |

| Hippo Holdings (HIPO) | 14.1% | 41.2% |

| Hesai Group (HSAI) | 21.3% | 41.5% |

| FTC Solar (FTCI) | 23.2% | 63% |

| Credo Technology Group Holding (CRDO) | 11.4% | 36.4% |

| Cloudflare (NET) | 10.6% | 46.1% |

| Atour Lifestyle Holdings (ATAT) | 21.9% | 23.1% |

| Astera Labs (ALAB) | 12.3% | 36.8% |

We're going to check out a few of the best picks from our screener tool.

IREN (IREN)

Simply Wall St Growth Rating: ★★★★★★

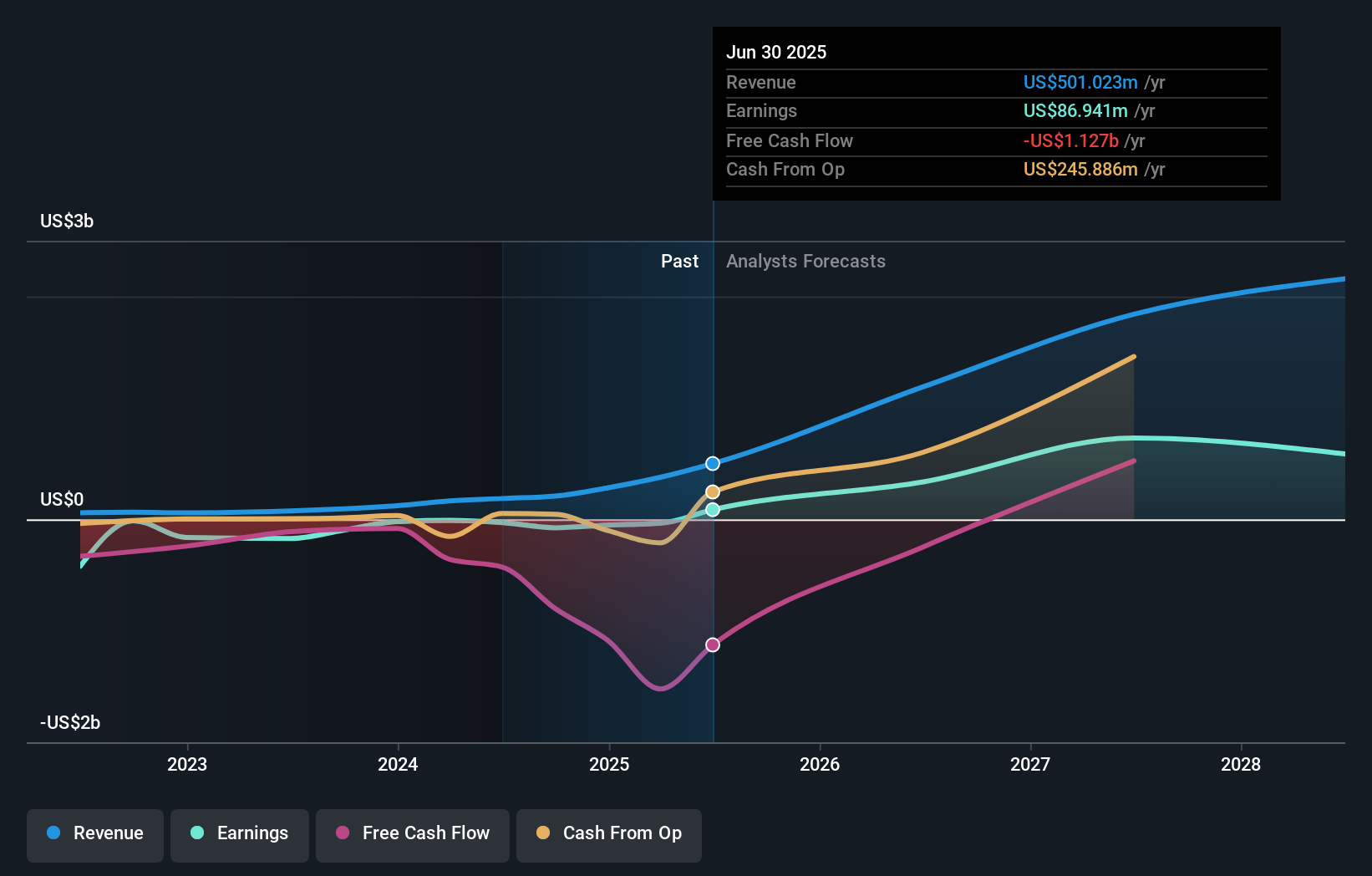

Overview: IREN Limited operates in the integrated data center business with a market cap of $7.20 billion.

Operations: The company generates revenue of $501.02 million from building and operating data center sites for Bitcoin mining.

Insider Ownership: 11.6%

Return On Equity Forecast: 22% (2028 estimate)

IREN's recent earnings report highlighted a significant turnaround, with the company achieving profitability and reporting US$86.9 million in net income for the year ending June 2025. Despite past shareholder dilution, IREN's revenue is forecast to grow at 34.7% annually, outpacing market expectations. The company's earnings are also projected to increase by 74.3% per year, indicating robust growth potential despite its highly volatile share price and lack of recent insider trading activity.

- Dive into the specifics of IREN here with our thorough growth forecast report.

- The valuation report we've compiled suggests that IREN's current price could be inflated.

Simulations Plus (SLP)

Simply Wall St Growth Rating: ★★★★☆☆

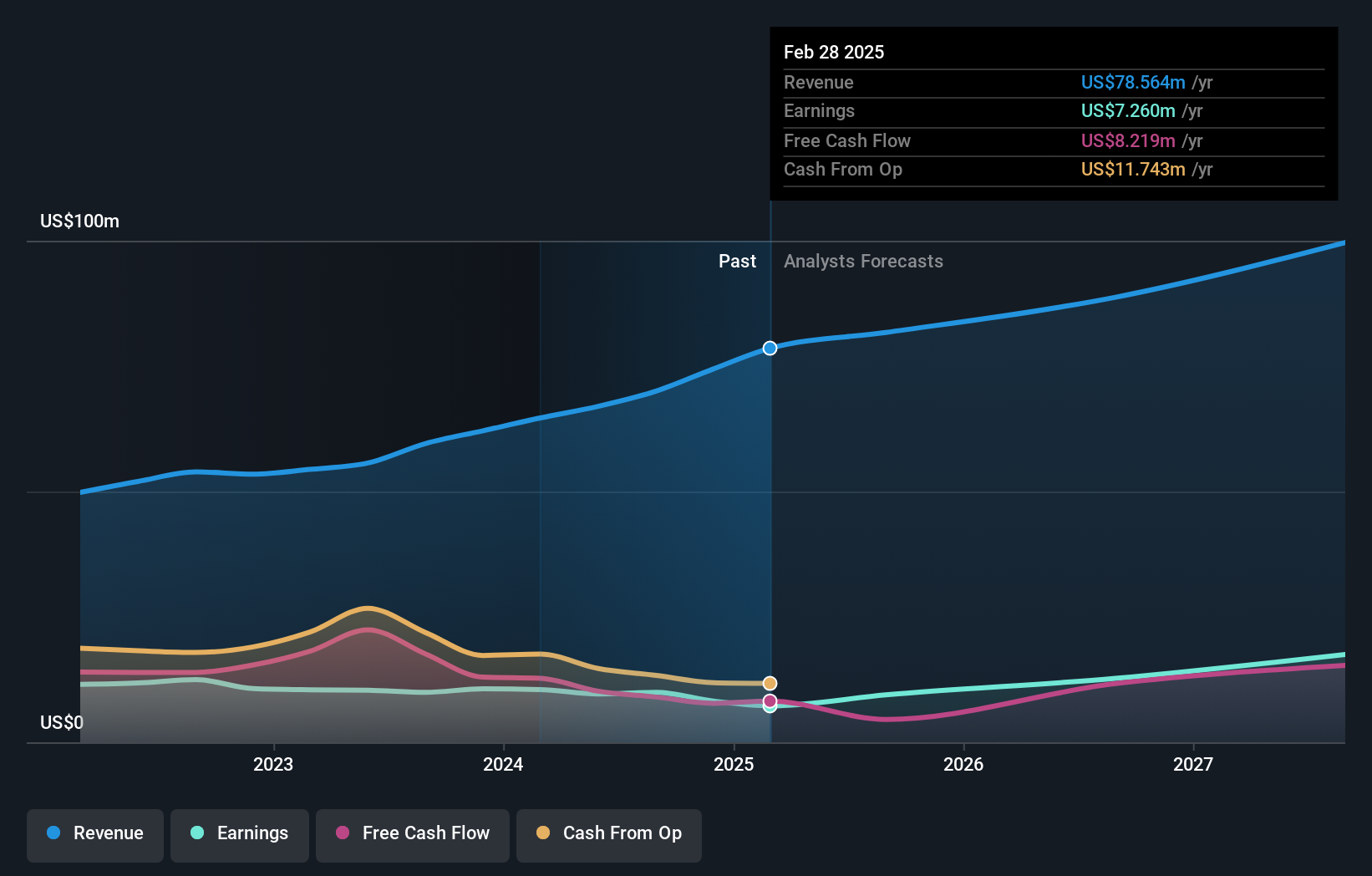

Overview: Simulations Plus, Inc. creates software for drug discovery and development that leverages artificial intelligence and machine learning to model, simulate, and predict molecular properties globally, with a market cap of $285.20 million.

Operations: The company's revenue is derived from two main segments: Services, contributing $33.66 million, and Software, accounting for $46.73 million.

Insider Ownership: 17%

Return On Equity Forecast: N/A (2028 estimate)

Simulations Plus is expected to see revenue growth of 10% annually, slightly outpacing the US market average. Despite recent volatility and a significant net loss of US$67.32 million for Q3 2025, the company is projected to become profitable within three years. While trading at a substantial discount to estimated fair value, recent AI-driven drug design collaborations and product advancements like ADMET Predictor 13 underscore its innovation potential amid high insider ownership stability.

- Click here and access our complete growth analysis report to understand the dynamics of Simulations Plus.

- Upon reviewing our latest valuation report, Simulations Plus' share price might be too optimistic.

Frontline (FRO)

Simply Wall St Growth Rating: ★★★★☆☆

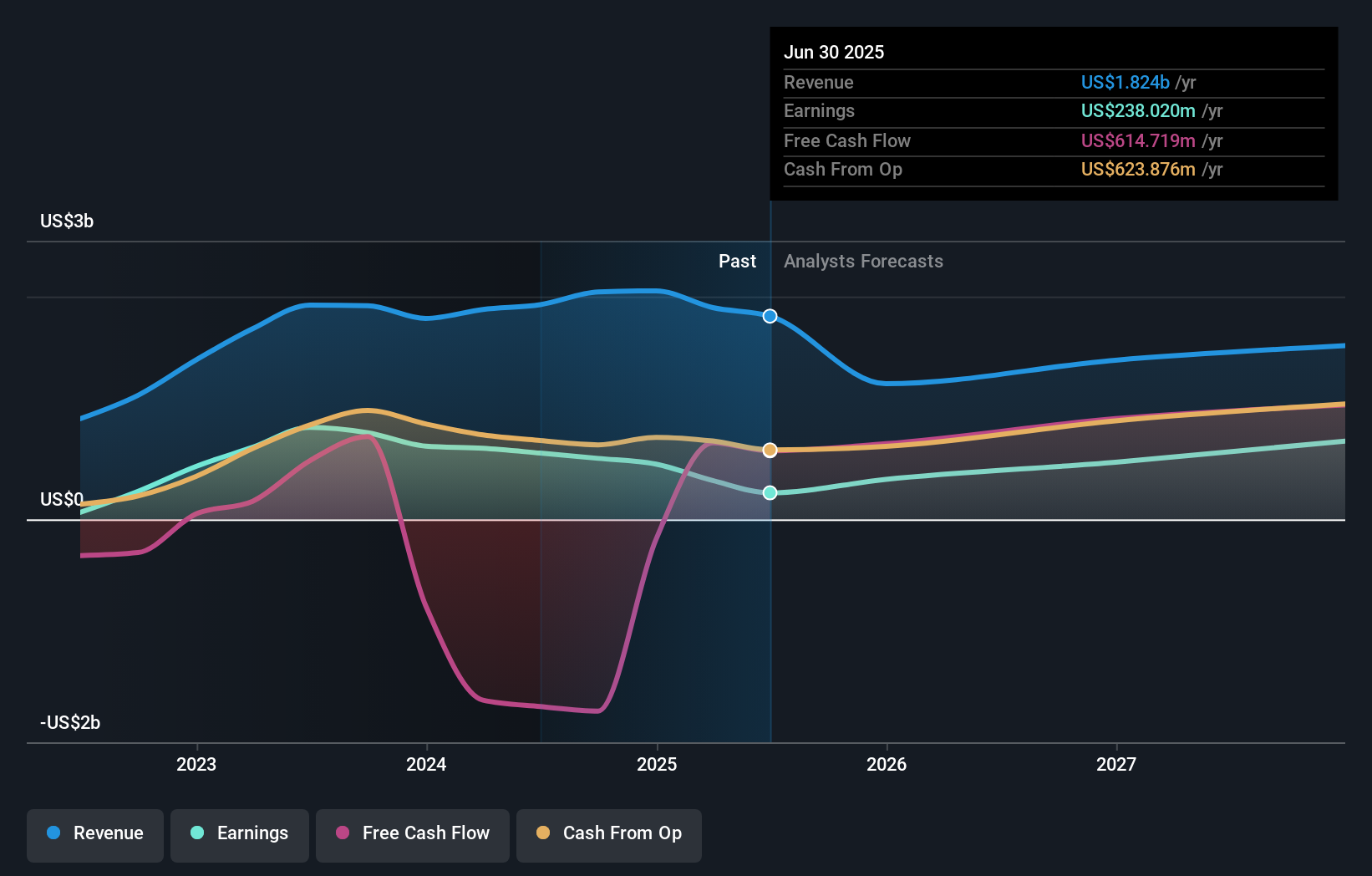

Overview: Frontline plc is a shipping company that owns and operates oil and product tankers globally, with a market cap of approximately $4.65 billion.

Operations: The company's revenue primarily comes from its tanker operations, generating approximately $1.82 billion.

Insider Ownership: 35.8%

Return On Equity Forecast: 23% (2028 estimate)

Frontline's insider ownership aligns with its growth potential, as earnings are forecasted to rise significantly, outpacing the US market. However, revenue is expected to decline by 8.1% annually over the next three years. Recent results showed a decrease in net income and profit margins compared to last year. Despite trading at a substantial discount to fair value estimates, dividend sustainability remains questionable due to insufficient earnings coverage and high interest obligations.

- Navigate through the intricacies of Frontline with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Frontline is priced lower than what may be justified by its financials.

Summing It All Up

- Dive into all 200 of the Fast Growing US Companies With High Insider Ownership we have identified here.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal