Insider Action In European Undervalued Small Caps For September 2025

The European market has faced a challenging environment recently, with the pan-European STOXX Europe 600 Index declining amid concerns about U.S. Federal Reserve independence, renewed tariff uncertainties, and political instability in France. Despite these headwinds, small-cap stocks can offer unique opportunities for investors willing to navigate volatility, especially when insider activity suggests potential value not yet recognized by the broader market.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Foxtons Group | 10.6x | 1.0x | 40.32% | ★★★★★☆ |

| Bytes Technology Group | 18.2x | 4.6x | 8.36% | ★★★★☆☆ |

| Hoist Finance | 10.2x | 2.0x | 18.02% | ★★★★☆☆ |

| Sabre Insurance Group | 8.9x | 1.6x | -8.19% | ★★★★☆☆ |

| Renold | 10.6x | 0.7x | 2.93% | ★★★★☆☆ |

| Oxford Biomedica | NA | 5.3x | 48.16% | ★★★★☆☆ |

| Nyab | 23.1x | 1.0x | 32.34% | ★★★☆☆☆ |

| Oxford Instruments | 39.9x | 2.1x | 18.85% | ★★★☆☆☆ |

| A.G. BARR | 19.2x | 1.8x | 46.79% | ★★★☆☆☆ |

| CVS Group | 44.6x | 1.3x | 38.78% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Sabre Insurance Group (LSE:SBRE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sabre Insurance Group is a UK-based company specializing in underwriting motor insurance, primarily focusing on niche markets such as taxis and motorcycles, with a market cap of £0.25 billion.

Operations: The company generates revenue primarily through its Taxi and Motorcycle segments, with a significant adjustment contributing to the overall figures. Over recent periods, the net profit margin has shown variability, reaching as high as 25.43% in 2018 before experiencing fluctuations in subsequent years. Operating expenses and non-operating expenses have been notable factors impacting profitability.

PE: 8.9x

Sabre Insurance Group, a small player in the European insurance market, recently reported a half-year net income of £18.92 million, up from £15.11 million last year. Basic earnings per share rose to £0.0764 from £0.0608 over the same period. Insider confidence is evident as board members have been purchasing shares since July 2025, signaling potential value recognition within the company despite its reliance on external borrowing for funding. The firm announced an interim dividend of 3.4 pence per share and commenced a share repurchase program authorized to buy back up to 25 million shares by June 2026, reflecting strategic capital management efforts amidst evolving industry dynamics.

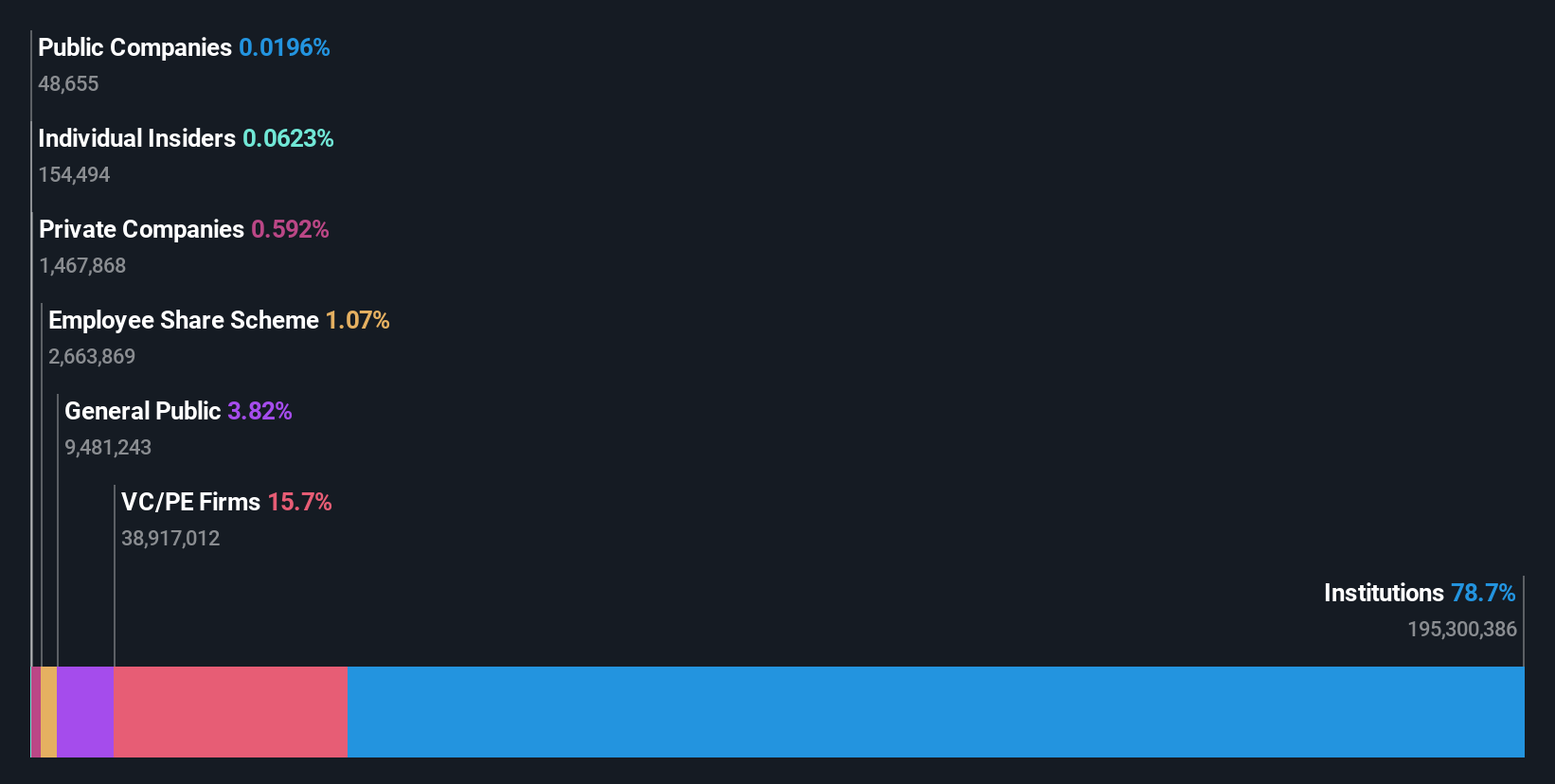

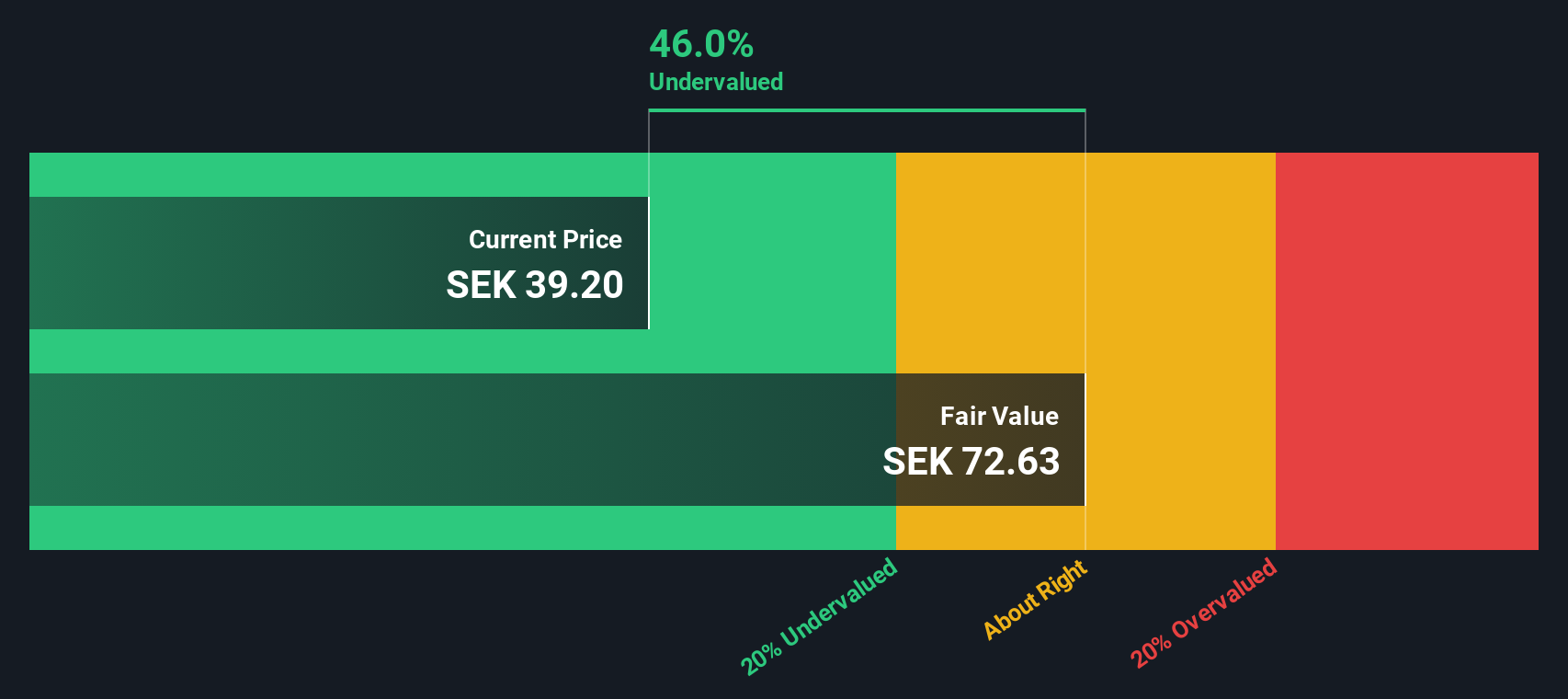

Fagerhult Group (OM:FAG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Fagerhult Group is a company that specializes in providing lighting solutions across various segments, with a market capitalization of SEK 9.84 billion.

Operations: The company's revenue streams are primarily derived from five segments: Premium, Collection, Professional, Infrastructure, and Smart Solutions. Over recent periods, the gross profit margin has shown an upward trend reaching 39.92% in June 2025. Operating expenses have been primarily driven by sales and marketing costs followed by general and administrative expenses.

PE: 31.1x

Fagerhult Group's recent performance highlights its potential as an undervalued investment opportunity, despite some financial challenges. Sales for Q2 2025 were SEK 1,848 million compared to SEK 2,167 million the previous year, with net income dropping to SEK 46 million from SEK 109 million. Insider confidence is evident with Bodil Gallon's purchase of 8,000 shares valued at approximately SEK 308,400 in June. The company anticipates earnings growth at a rate of nearly 35% annually.

- Click here to discover the nuances of Fagerhult Group with our detailed analytical valuation report.

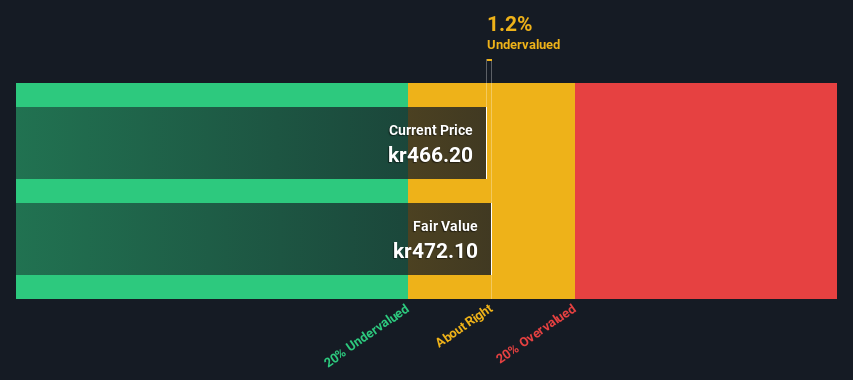

Vitec Software Group (OM:VIT B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Vitec Software Group is a Swedish company specializing in software and programming solutions, with a market capitalization of SEK 14.11 billion.

Operations: Vitec Software Group generates revenue primarily from its Software & Programming segment, amounting to SEK 3.53 billion. The company's cost of goods sold (COGS) is SEK 1.86 billion, resulting in a gross profit of SEK 1.67 billion and a gross profit margin of 47.25%. Operating expenses are reported at SEK 992.60 million, with general and administrative expenses comprising a significant portion at SEK 382.48 million.

PE: 37.0x

Vitec Software Group, a European tech firm, is navigating the market as an undervalued player with insider confidence evident from recent share purchases. Between January and June 2025, they repurchased 47,000 shares for SEK 29.8 million. Despite a dip in net income to SEK 104.91 million in Q2 compared to last year, sales rose to SEK 813.37 million. The company is actively seeking acquisitions with robust M&A plans, hinting at potential growth opportunities ahead.

- Take a closer look at Vitec Software Group's potential here in our valuation report.

Gain insights into Vitec Software Group's past trends and performance with our Past report.

Summing It All Up

- Delve into our full catalog of 44 Undervalued European Small Caps With Insider Buying here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal