Will Raised Revenue Guidance and New Launches Shift Organon's (OGN) Growth Outlook?

- Organon & Co. recently raised its full-year 2025 revenue guidance and highlighted progress in its VTAMA cream and women’s health portfolio, driven by new product launches and biosimilar expansion.

- CEO Kevin Ali's recent purchase of company stock signals management’s commitment to Organon's ongoing recovery and business transformation initiatives.

- We'll review how the raised revenue guidance reflects management's confidence in new products and biosimilars as growth drivers.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Organon Investment Narrative Recap

To be a shareholder in Organon right now, you have to believe that new products like VTAMA cream and biosimilar launches can offset exposure to mature, off-patent brands and potential headwinds in women’s health. The raised 2025 revenue guidance is a positive signal for near-term momentum, but it does not materially change the company’s largest structural challenge: sustained price and margin pressure from generic competition and policy uncertainties in core franchises.

The most relevant recent announcement is the strong endorsement of VTAMA cream by the American Academy of Dermatology for atopic dermatitis, which supports management’s focus on new product traction as a key growth lever. However, while progress here is encouraging, the ongoing impact of loss of exclusivity in legacy products and the uncertain outlook for Nexplanon in the U.S. mean that product wins will need to be significant and sustained to meaningfully shift Organon’s revenue mix.

In contrast, investors should also be mindful of the ongoing risk from persistent pricing and funding pressure in the women’s health portfolio, especially as ...

Read the full narrative on Organon (it's free!)

Organon's outlook anticipates $6.5 billion in revenue and $990.3 million in earnings by 2028. This projection implies a 1.2% annual revenue growth rate and a $290.3 million increase in earnings from the current $700.0 million level.

Uncover how Organon's forecasts yield a $13.17 fair value, a 40% upside to its current price.

Exploring Other Perspectives

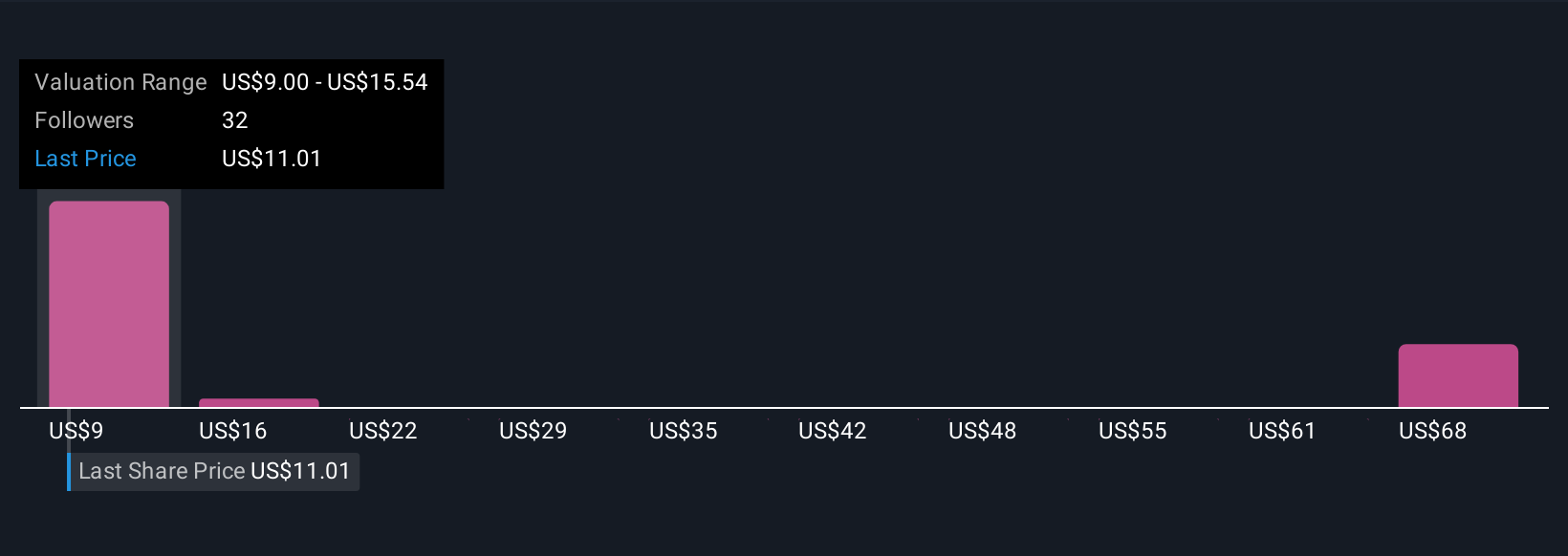

Simply Wall St Community members assigned Organon fair values ranging from US$11.25 to US$79.78, based on six different analyses. As company guidance rises, the ongoing risk from generic competition and policy headwinds remains a critical factor for future performance, explore several distinct viewpoints for a fuller picture.

Explore 6 other fair value estimates on Organon - why the stock might be worth just $11.25!

Build Your Own Organon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Organon research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Organon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Organon's overall financial health at a glance.

No Opportunity In Organon?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal