Edison International (EIX): Evaluating Valuation as Debt Concerns Intensify Despite Ongoing Dividend Payouts

Most Popular Narrative: 15.2% Undervalued

According to community narrative, Edison International is viewed as undervalued by analysts, based on forward-looking growth and risks. They estimate a fair value that sits substantially higher than the current share price, implying meaningful upside potential.

Significant state and federal investment, along with policy momentum for decarbonization, is expected to support large-scale grid modernization and renewable energy integration projects. This could provide Edison International with stable, above-inflation capital expenditure opportunities and expand its regulated rate base, which would support earnings and rate base-driven revenue growth.

The story behind this valuation may surprise you. Want to uncover the assumptions that produced such a bullish price target? The analysts behind this narrative used key financial projections and factored in transformative industry shifts to inform their estimate. See what is driving their analysis and take a closer look at the fundamental drivers of this undervaluation.

Result: Fair Value of $66.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts. However, escalating wildfire liabilities or regulatory setbacks could reshape the outlook. These factors pose real threats to earnings and dividend security in the coming years. Find out about the key risks to this Edison International narrative.Another View: Discounted Cash Flow Raises Doubts

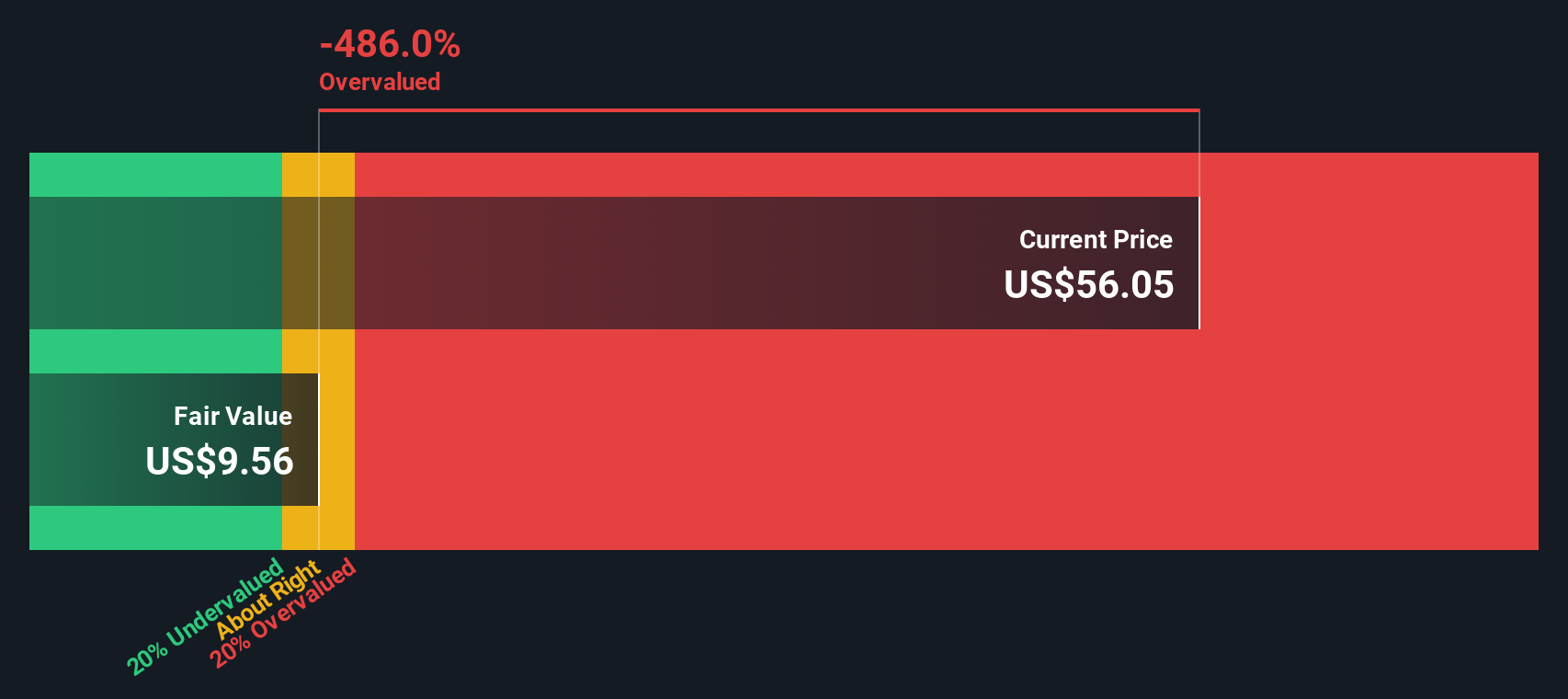

While the analyst consensus sees Edison International as undervalued, our DCF model paints a different picture. This approach suggests the stock may be trading above its fair value, which calls the bullish case into question. Which narrative stands up to scrutiny?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Edison International Narrative

If you see things differently or want to reach your own conclusions, you can dive into the numbers and craft your own perspective in just minutes. Do it your way.

A great starting point for your Edison International research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for More Stock Opportunities?

Broaden your investment perspective and get ahead of the curve by using our powerful screening tools. Don’t miss your chance to spot tomorrow’s standouts before the crowd. Take action now to shape your portfolio with some of the most compelling trends in the market:

- Spot high-yielding companies that could boost your income stream with dividend stocks with yields > 3% in your portfolio.

- Target promising undervalued businesses with strong fundamentals and tap into hidden gems using undervalued stocks based on cash flows.

- Uncover the latest breakthroughs at the intersection of medicine and artificial intelligence through healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal