A Look at Ambarella's Valuation After Revenue Forecast Hike and Strong Quarterly Results

Ambarella (AMBA) just released a pair of positive updates, and anyone watching the stock is likely paying closer attention. The company not only raised its revenue forecast for fiscal 2026, expecting growth as high as 35%, but also delivered second-quarter results that exceeded many expectations. With sales climbing and net losses shrinking year over year, these updates are signaling that changes may be underway for the semiconductor company.

The excitement from the improved guidance and stronger earnings quickly translated into momentum for the stock. Over the past year, shares have jumped 38% and have outperformed the market in recent months. Momentum over the past quarter suggests renewed optimism among investors. This comes alongside annual revenue and net income growth, fueling debate over what is already reflected in the current price.

Following the stock’s climb and new outlook, questions are emerging about whether Ambarella presents an appealing opportunity or if the market has already priced in much of its anticipated future growth.

Most Popular Narrative: 8.4% Undervalued

According to the community narrative, Ambarella is considered undervalued by 8.4% based on analyst consensus, with fair value estimates reflecting medium-term earnings growth and margin expansion potential.

Ambarella's strategic focus on edge AI processing with more advanced reasoning models, such as DeepSeek-R1, is driving an increase in average selling prices (ASP). This presents opportunities to leverage AI at the edge for new applications, which may positively influence revenue growth.

Curious about what is driving this bullish price target? The narrative is built on breakthrough growth rates, future profitability projections, and anticipated margin improvements. The key question is how these expectations compare to Ambarella’s existing fundamentals. Explore the methods, forecasts, and factors contributing to this valuation.

Result: Fair Value of $90.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, operational risks such as reliance on a single logistics provider and shifting government policies could quickly dampen Ambarella’s upward outlook.

Find out about the key risks to this Ambarella narrative.Another View: What Does Our DCF Model Say?

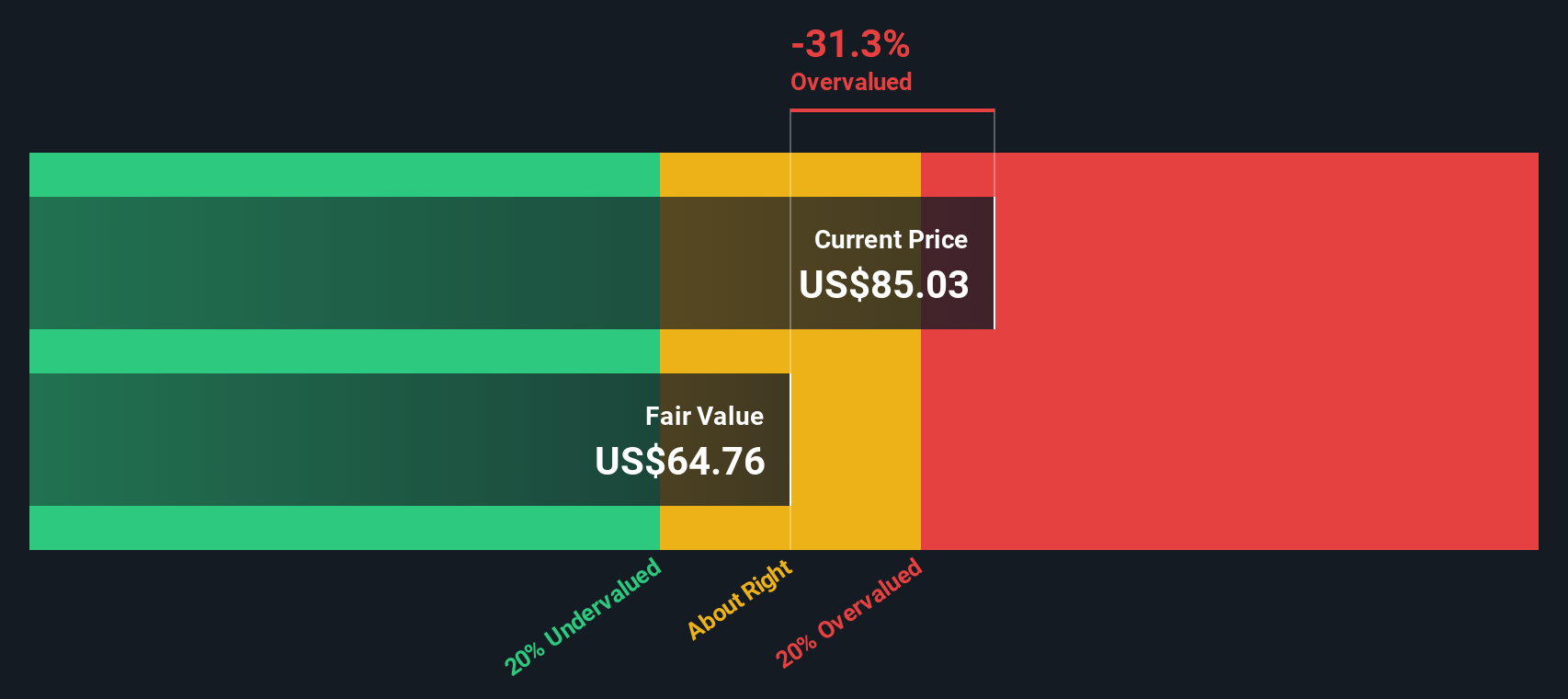

While analysts see Ambarella as undervalued based on earnings growth and potential margins, our SWS DCF model offers a different perspective. It suggests the stock might be overpriced instead. Which approach captures the true picture?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ambarella Narrative

If you have a different take or want to interpret the numbers in your own way, you can quickly generate your own assessment and perspective in just a few minutes. Do it your way

A great starting point for your Ambarella research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step ahead of the crowd by using the Simply Wall Street Screener to spot the next compelling opportunities. Make your money work smarter by uncovering niche sectors, emerging themes, or overlooked potential—all with a few clicks. If you are serious about investing, you won’t want to skip these fresh angles.

- Capture untapped growth from companies harnessing artificial intelligence by starting with the latest picks in AI penny stocks.

- Secure your portfolio with steady returns. See which businesses boast high yields through dividend stocks with yields > 3%.

- Target tomorrow’s hidden gems in undervalued markets by seeking out opportunities with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal