There's Reason For Concern Over Beauty Farm Medical and Health Industry Inc.'s (HKG:2373) Massive 29% Price Jump

Beauty Farm Medical and Health Industry Inc. (HKG:2373) shares have continued their recent momentum with a 29% gain in the last month alone. The last month tops off a massive increase of 121% in the last year.

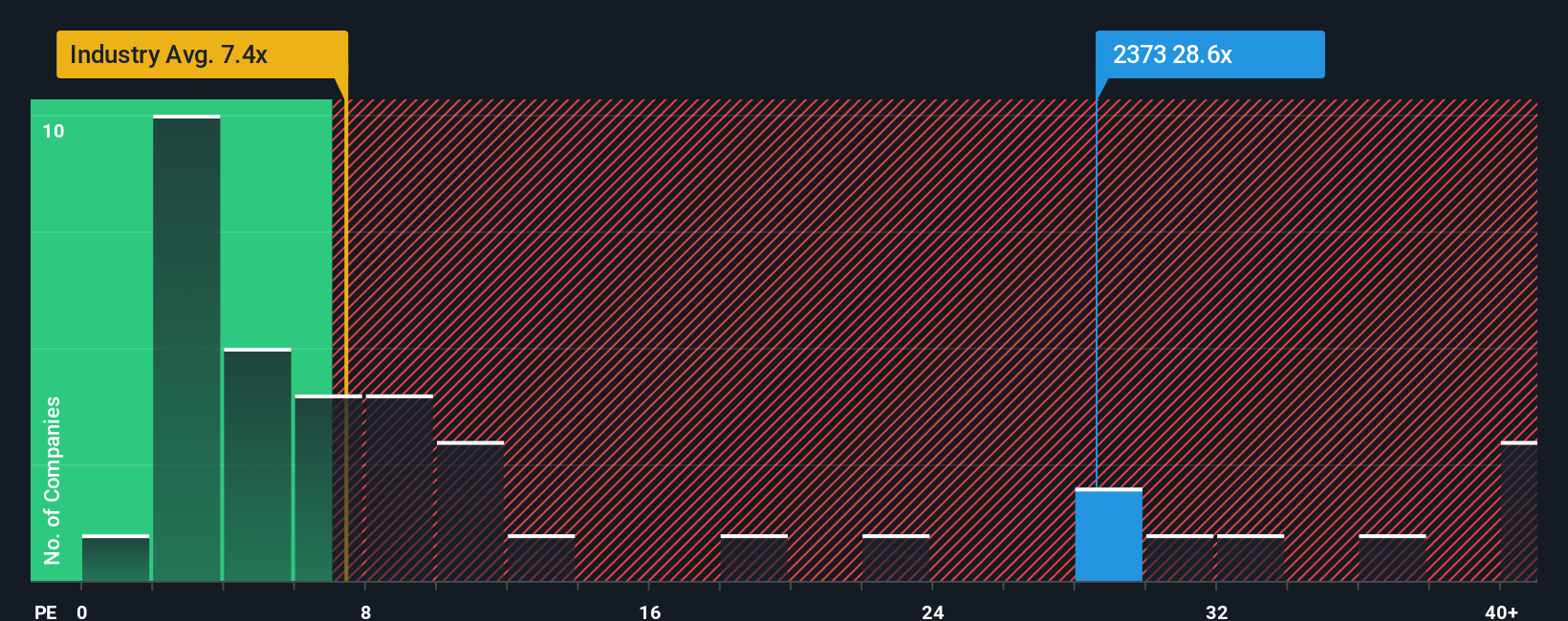

Since its price has surged higher, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 12x, you may consider Beauty Farm Medical and Health Industry as a stock to avoid entirely with its 28.6x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Beauty Farm Medical and Health Industry has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Beauty Farm Medical and Health Industry

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Beauty Farm Medical and Health Industry's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 23%. Pleasingly, EPS has also lifted 104% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 14% each year over the next three years. Meanwhile, the rest of the market is forecast to expand by 15% per annum, which is not materially different.

In light of this, it's curious that Beauty Farm Medical and Health Industry's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Beauty Farm Medical and Health Industry's P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Beauty Farm Medical and Health Industry currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 1 warning sign for Beauty Farm Medical and Health Industry that we have uncovered.

If you're unsure about the strength of Beauty Farm Medical and Health Industry's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal