Amer Sports (AS) Posts Strong Q2 With US$1,236 Million Sales

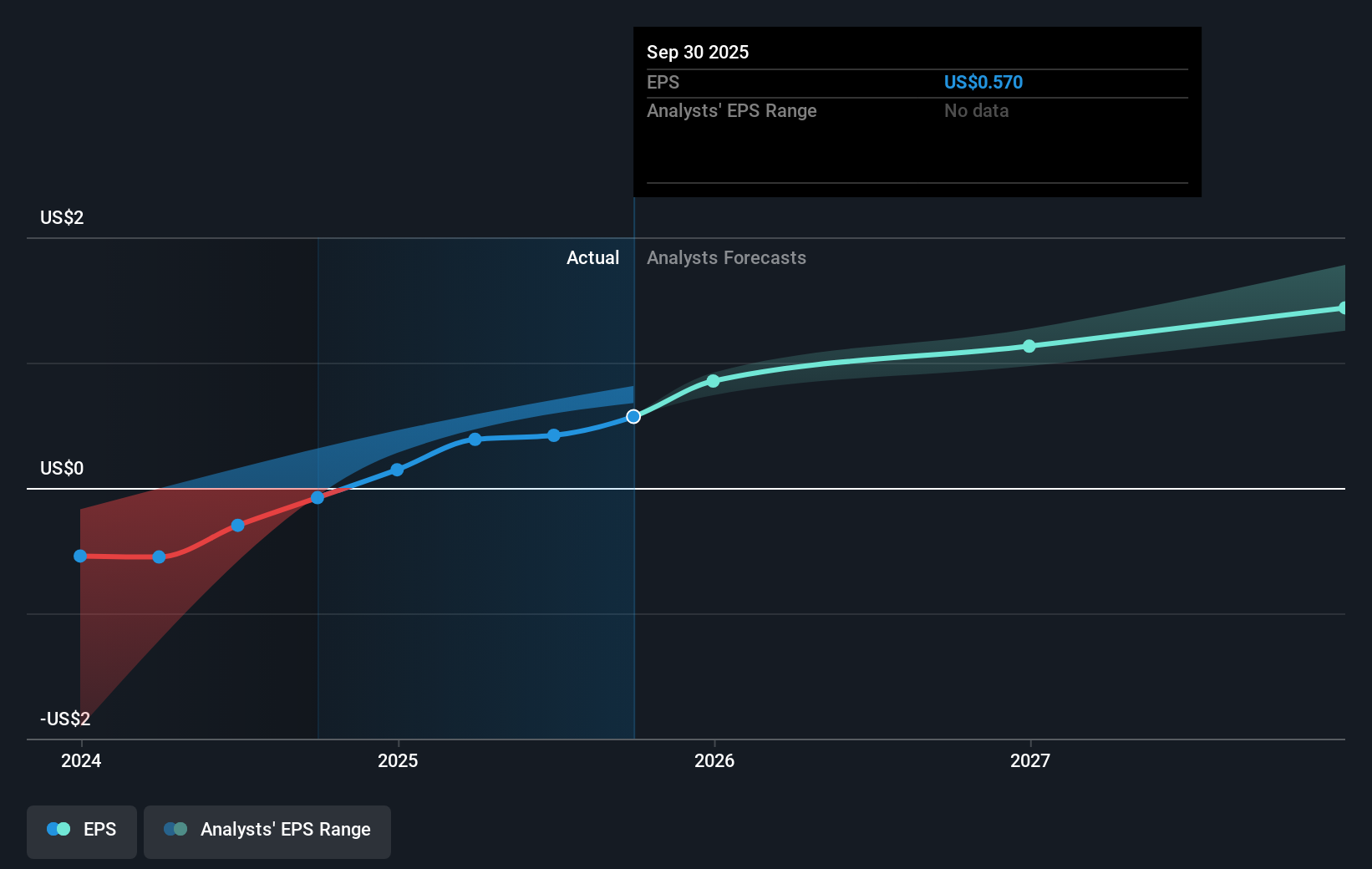

Amer Sports (AS) recently announced strong second-quarter results, with sales reaching $1,236 million, a significant improvement from the prior year, and net income showing a marked turnaround from a loss to a $18 million profit. Alongside this, the company's upwardly revised guidance for both the third quarter and the full year, estimating substantial revenue growth, may have bolstered investor confidence. These positive earnings announcements and promising future projections contributed to the 13.91% increase in AS's stock price last week, aligning with the general upward trajectory in the market, although the overall market rose by a modest 1.3%.

Buy, Hold or Sell Amer Sports? View our complete analysis and fair value estimate and you decide.

The recent earnings announcement and upward revision of guidance from Amer Sports has notably influenced both investor sentiment and the broader narrative. As the company reports US$1.24 billion in sales and a US$18 million profit turnaround, the positive momentum has already resulted in a 13.91% surge in the company's stock price over the past week. Looking at a longer-term perspective, the company's total shareholder return was 187.09% over the last year, showcasing its considerable growth trajectory in comparison to the market, which only gained 15.5% in the same period.

Amer Sports's stock performance has surpassed both the US Luxury industry and market averages over the past year, indicating resilience and strong investor interest despite potential risks. The recent strong quarterly results and optimistic guidance could further influence future revenue and earnings projections, potentially justifying analysts' forecasts of 14.6% annual revenue growth over the next three years. Currently trading at US$40.71, Amer Sports's share price remains below the consensus analyst price target of approximately US$43.58, suggesting there is still room for growth as per analyst expectations. The focus remains on key growth areas like Asia-Pacific expansion, premium product strategies, and direct-to-consumer channels, which may drive sustainable margin improvements and bolster investor confidence.

Our valuation report unveils the possibility Amer Sports' shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal