Why Sterling Infrastructure (STRL) Is Up 6.1% After Announcing CEC Facilities Group Acquisition Plans

- Sterling Infrastructure recently announced plans to acquire CEC Facilities Group to bolster its electrical and mechanical services, while intensifying its pursuit of mission-critical data center and manufacturing projects.

- This move signals Sterling's intent to diversify its revenue streams and capitalize on robust demand for complex infrastructure solutions tied to digital and advanced manufacturing sectors.

- We'll examine how Sterling's acquisition of CEC Facilities Group could shift its investment narrative toward greater diversification and project cycle efficiency.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Sterling Infrastructure Investment Narrative Recap

To be comfortable as a Sterling Infrastructure shareholder today, you need to believe the company's success depends on continued strong demand for complex E-Infrastructure projects, especially data centers and advanced manufacturing. The CEC Facilities Group acquisition appears well aligned with Sterling's efforts to diversify revenue and build project cycle efficiency, but it does not materially change the most immediate catalyst, the pace and scale of mega-project awards, or address the key risk of overreliance on these large, cyclical projects.

Among recent developments, Sterling's August earnings report stands out, highlighting another quarter of margin expansion, profit growth, and an increased 2025 outlook for revenue and net income. While rising earnings and upgraded guidance reflect robust project pipelines supporting the investment case, much of the near-term optimism still rests on capturing outsized wins in the fast-evolving data center sector, where execution risk remains elevated.

Yet, if the anticipated wave of mega-project awards were to slow...

Read the full narrative on Sterling Infrastructure (it's free!)

Sterling Infrastructure's narrative projects $2.6 billion revenue and $276.4 million earnings by 2028. This requires 6.9% yearly revenue growth and a decrease in earnings of $8.6 million from the current $285.0 million.

Uncover how Sterling Infrastructure's forecasts yield a $355.00 fair value, a 21% upside to its current price.

Exploring Other Perspectives

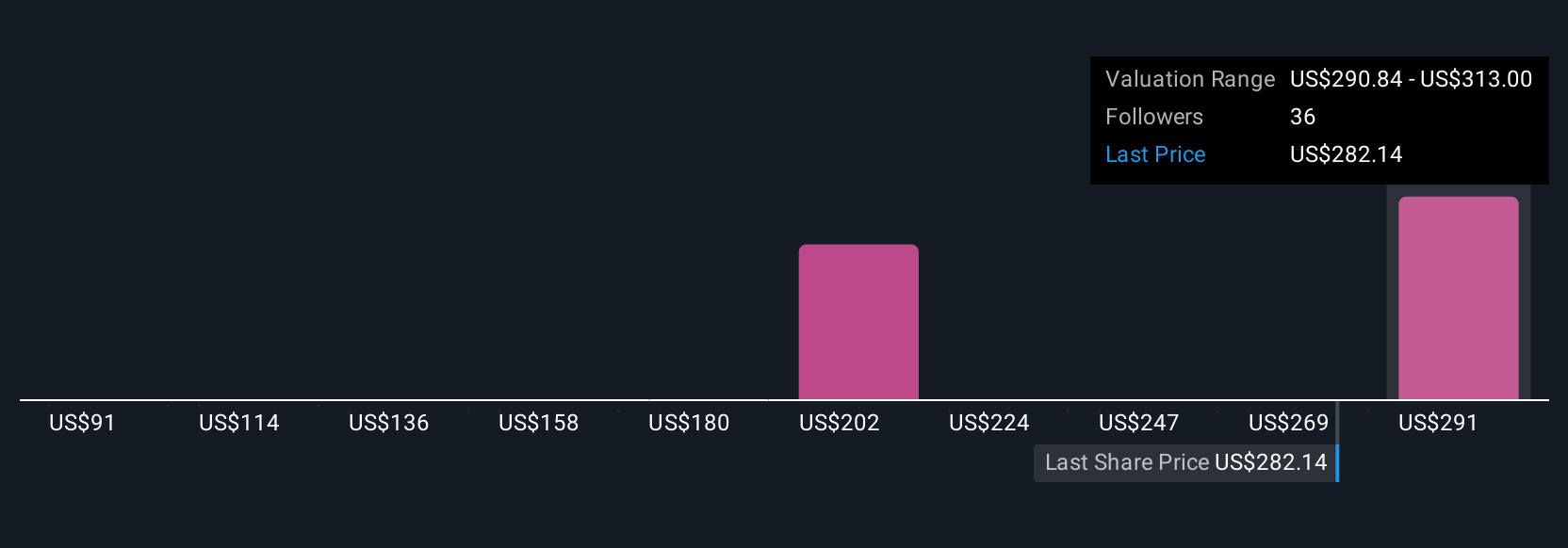

Six fair value estimates from the Simply Wall St Community range from US$91.36 to US$355, signaling broad disagreement on Sterling’s outlook. With much optimism tied to continued mega-project success, consider how swings in project pipelines can reshape the growth story.

Explore 6 other fair value estimates on Sterling Infrastructure - why the stock might be worth less than half the current price!

Build Your Own Sterling Infrastructure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sterling Infrastructure research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sterling Infrastructure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sterling Infrastructure's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal