Is There Still Opportunity in Uranium Energy After 96% Share Price Surge?

If you are wondering whether Uranium Energy deserves a spot in your portfolio, you are not alone. With uranium prices grabbing global headlines and investors seeking exposure to clean energy sources, Uranium Energy’s stock has caught quite a few eyes. Over the last year alone, shares have skyrocketed by a staggering 96.2%. Even when you zoom out to the last five years, the stock has climbed an incredible 804.3%, handily outperforming many peers. Of course, no stock moves in a straight line. The last seven days saw a modest dip of 1.9%, a blip compared to the 16.7% surge over the last month, as renewed interest in nuclear energy continues to ripple through the market.

Part of this momentum stems from broader market optimism in the uranium sector, as countries revisit their energy strategies to meet climate targets and manage geopolitical uncertainties around fuel supplies. Uranium Energy’s ability to ride these macro trends is one thing, but whether the stock is still a good value at its current price of $10.4 is another question entirely. Looking at our value score, Uranium Energy gets a 2 out of 6, suggesting that while it is undervalued in some respects, the overall picture is mixed.

So how do we really know if Uranium Energy is trading at a bargain, or if the best days are already behind it? Let’s dig into some of the most telling valuation approaches. Stay tuned for a uniquely practical lens on stock valuation that you will not want to miss at the end of this article.

Uranium Energy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Uranium Energy Cash Flows

The Discounted Cash Flow (DCF) model is a widely used valuation method that estimates a company's intrinsic value by extrapolating its future cash flows and then discounting them back to today's dollars. In simple terms, it asks: if we know what Uranium Energy will earn in the years ahead, what is that worth right now?

Currently, Uranium Energy is generating a negative free cash flow of -$56.17 million, reflecting its heavy investment phase. However, analysts foresee a sharp turnaround. By 2028, projected free cash flow is set to climb significantly to $173.5 million. By 2035, projections, including estimates from Simply Wall St, reach over $790 million. This anticipated growth highlights optimism about the company's future as the uranium sector gains momentum.

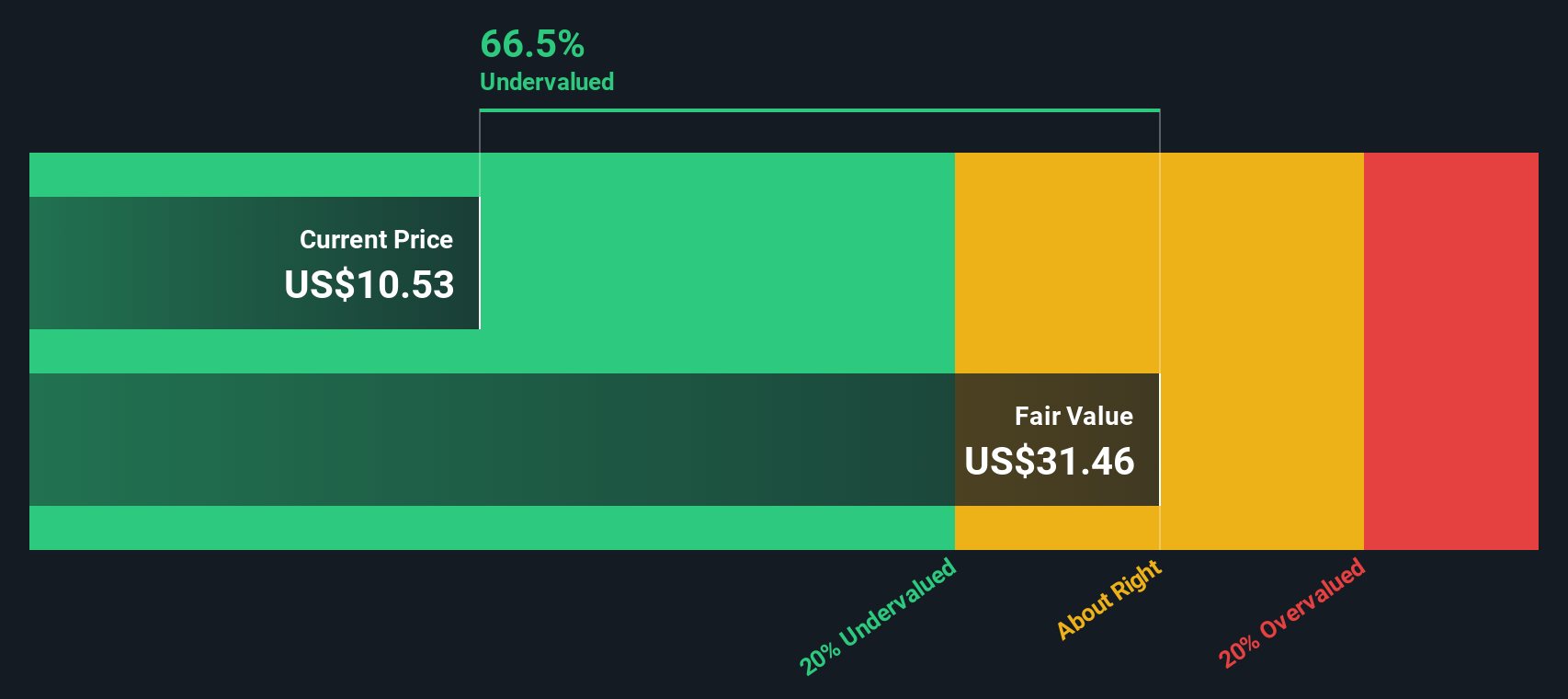

Using these projections, the DCF model calculates Uranium Energy's intrinsic value at $31.46 per share. With the stock recently trading at $10.40, this suggests it is 66.9% undervalued. In other words, the current share price offers a substantial discount compared to the company’s estimated true worth based on future cash generation.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Uranium Energy.

Approach 2: Uranium Energy Price vs Book

The price-to-book (PB) ratio is a popular valuation tool, especially for companies like Uranium Energy that are not yet profitable but have significant tangible assets. This multiple is often used by investors to gauge how much they are paying for each dollar of a company’s net assets. It is a preferred choice when earnings are negative or volatile.

Not all PB ratios are equal. A ‘fair’ PB ratio is influenced by expectations for future growth, perceived company risk, and overall market sentiment toward the sector. Generally, industries with promising growth prospects or more stable balance sheets justify higher PB multiples.

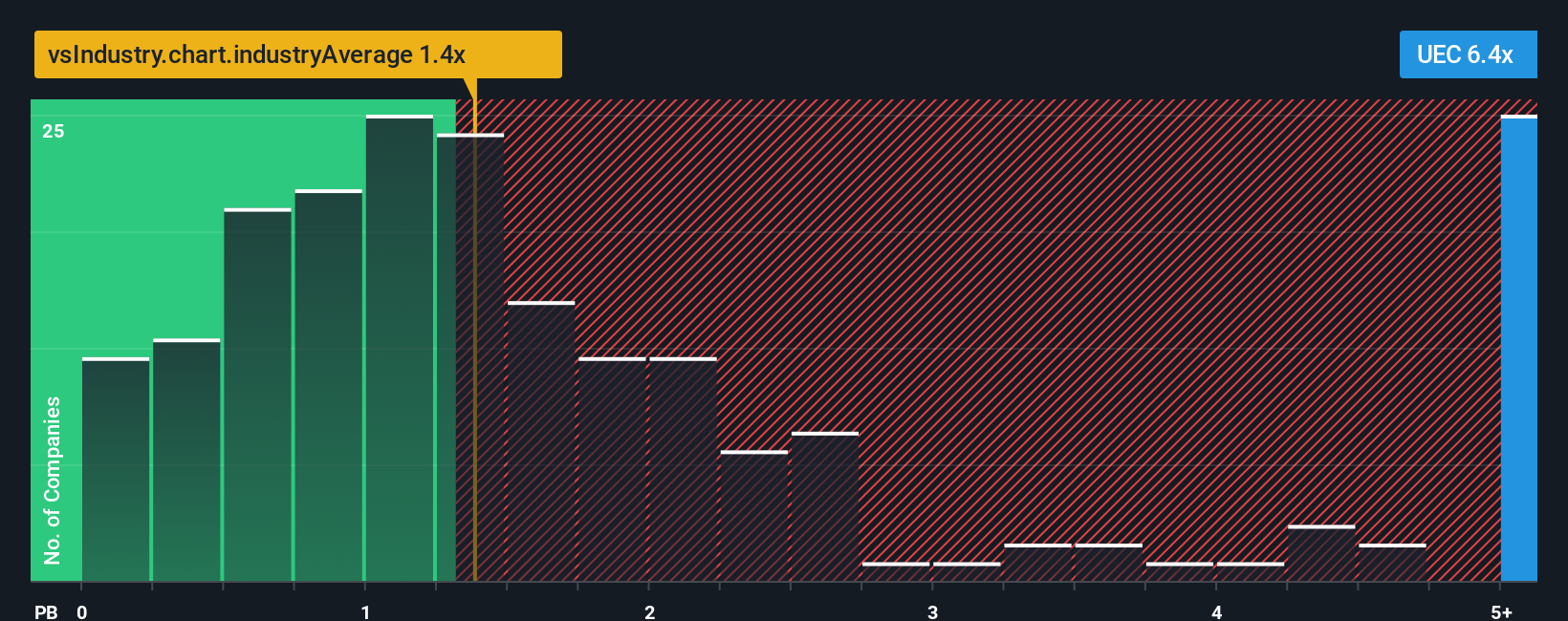

Uranium Energy’s current PB ratio stands at 5.18x. This is substantially higher than the oil and gas industry average of 1.32x and its peer group average of 3.15x. At a glance, this premium suggests that investors are pricing in robust growth or elevated optimism around the company’s asset value.

Simply Wall St’s Fair Ratio provides further analysis. Instead of a basic peer or industry comparison, the Fair Ratio adjusts for Uranium Energy’s unique earnings profile, growth potential, risk factors, and market capitalization. This proprietary measure is intended to offer a more tailored benchmark for what constitutes a 'fair' multiple for this specific stock.

Comparing Uranium Energy’s actual PB ratio to the Fair Ratio helps investors assess whether they are overpaying for the company’s assets or getting a reasonable deal. Since the difference between the Fair Ratio and current PB ratio is significant, this analysis suggests that Uranium Energy’s shares may be overvalued by this measure.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Uranium Energy Narrative

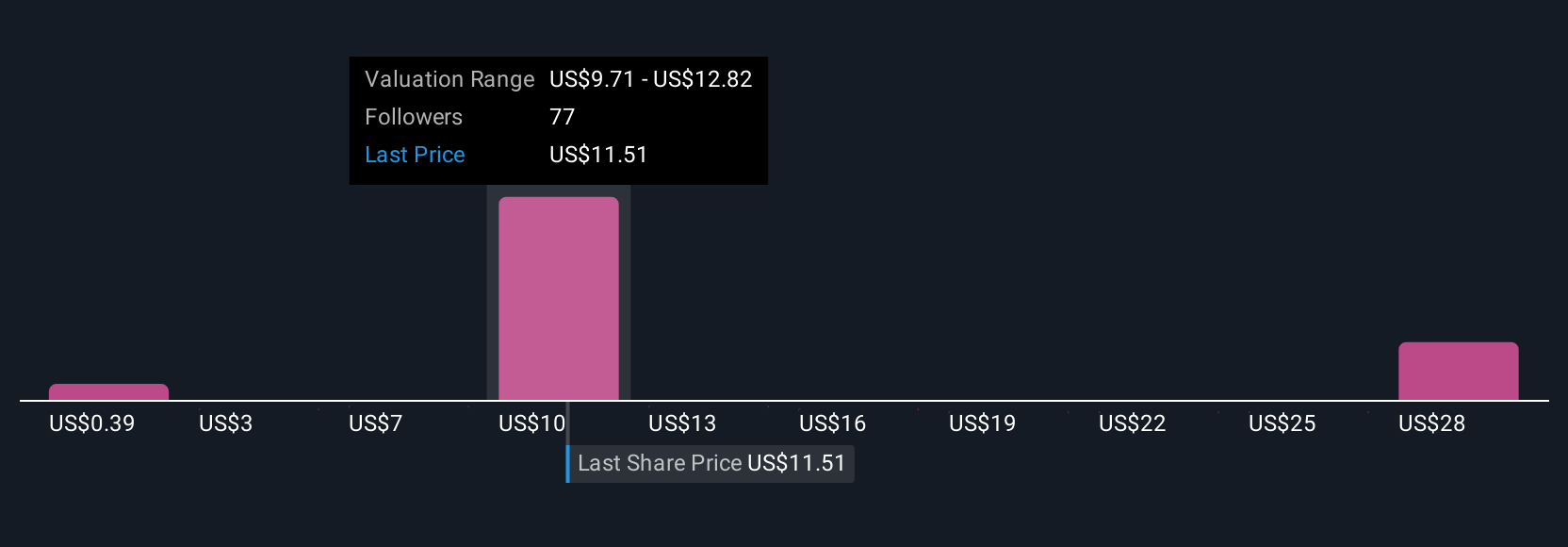

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal story behind a company. It weaves together the reasons you believe in a stock with the numbers that shape its fair value, such as future revenue, earnings, and margins. Narratives make investing easy and approachable by connecting a company's unique story to concrete financial forecasts, helping you see how today’s outlook translates into tomorrow’s fair value. Available to millions of investors on Simply Wall St’s Community page, Narratives empower you to compare your fair value with the current price and guide your investment decisions.

The power of Narratives is that they update dynamically whenever new announcements, earnings, or news affect the company, ensuring your view stays relevant. For example, some Uranium Energy investors see potential upside based on surging nuclear demand, while others are more cautious given current price levels and market risks. Whatever your perspective, Narratives give you a flexible, real-time tool to anchor your decisions with confidence and context.

Do you think there's more to the story for Uranium Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal