RBA August Meeting Minutes: Further interest rate cuts are expected in the coming year, and the pace of easing depends on economic data

The Zhitong Finance App learned that the minutes of the Reserve Bank of Australia's August 11-12 meeting show that policymakers expect to cut interest rates further in the next year to achieve their policy goals. The pace of interest rate cuts may depend on economic data.

The Reserve Bank of Australia cut its key interest rate to 3.6% two weeks ago, and policymakers said in the minutes of the meeting that this interest rate level “is still somewhat limited.” The Reserve Bank of Australia said in a statement two weeks ago: “Given that underlying inflation continues to fall back to the median target range of 2-3%, and the labor market loosens slightly as expected, the Board believes it is appropriate to further relax monetary policy.” The central bank added: “Given the high level of uncertainty about aggregate demand and potential supply, the Council remains cautious about the economic outlook.”

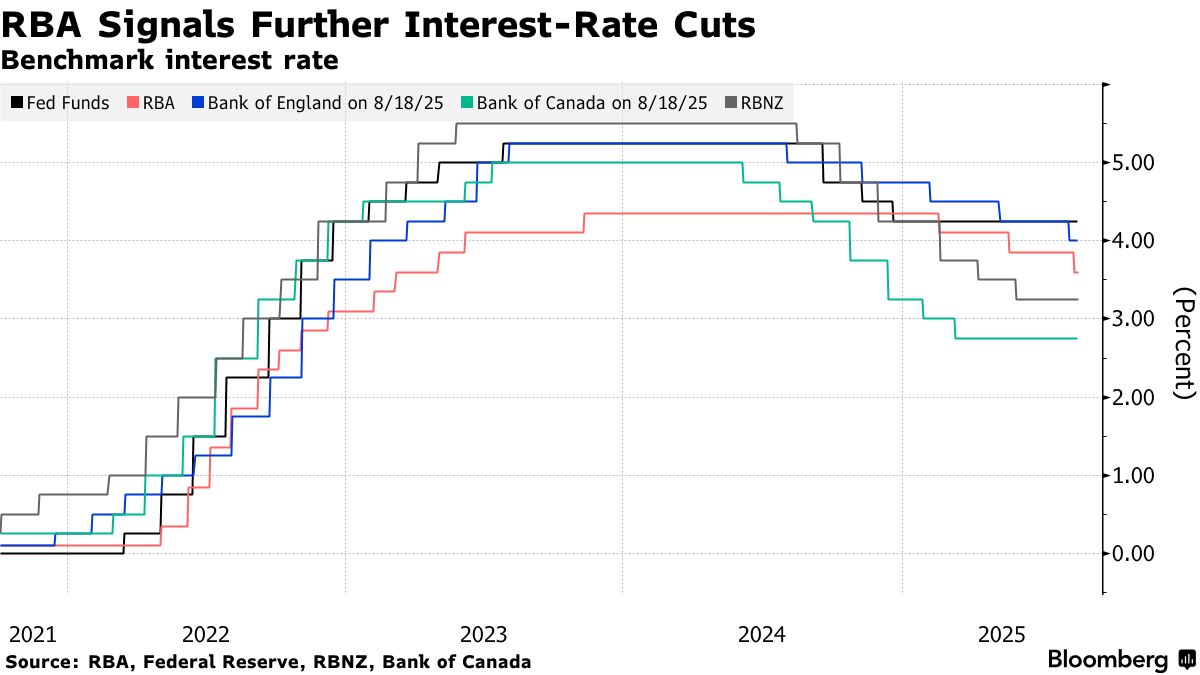

The Reserve Bank of Australia has cut interest rates by a total of 75 basis points during the current easing cycle, lowering interest rates to their lowest level since April 2023. In a context where the labor market remains tight and productivity growth is weak, its focus is shifting to the likely extent of future interest rate cuts.

The minutes of the meeting show: “Board members agreed — based on information available at the time of the meeting — that a further reduction in cash interest rates is necessary to sustainably bring inflation back to the midpoint of the target range while maintaining full employment over the next year.” “They also agreed that the pace of interest rate cuts should be determined by the data received each meeting.”

The minutes of the meeting highlight the RBA Council's careful consideration when the tight labor market and potential inflation are predicted to remain above the midpoint of the RBA's 2%-3% target range. Meanwhile, private demand is showing signs of recovery, and there is still uncertainty about “neutral interest rates.”

Meeting minutes show that considering these factors, the Reserve Bank of Australia may need to adopt a gradual easing path. Board members also discussed the need to speed up interest rate cuts when the labor market is “already balanced.” In addition, council members also discussed whether to change the pace at which the Reserve Bank of Australia reduced its holdings of government bonds. The Board consulted the newly established Governance Committee and decided to continue to reduce bond holdings after maturity, adding that the issue “no longer merits active consideration.”

As the Reserve Bank of Australia cuts interest rates, global policymakers are struggling to cope with the economic impact of the US tariff increase. The money market expects the Federal Reserve to relax monetary policy at the September meeting — it has kept interest rates unchanged this year to assess whether tariff shocks will cause continued price pressure. Meanwhile, the US labor market — the other half of the Federal Reserve's “dual mission” — is showing signs of weakening momentum. Other central banks, such as the European Central Bank, the Bank of Canada, and the Bank of England, have also implemented easing in recent months.

Economists expect that the Reserve Bank of Australia will cut interest rates twice more by March 2026, reduce cash interest rates to 3.1%, and then enter a suspension period. In this cycle, the Reserve Bank of Australia acted more cautiously. Federal Reserve Chairman Michele Bullock (Michele Bullock) has repeatedly emphasized that since policy interest rates were not pushed as high as global peers during the 2023-23 austerity cycle, the central bank may not need to cut interest rates as drastically as other central banks.

According to the data, Australia's economic growth rebounded in the three months ending June, mainly driven by household consumption and trade. The labor market also appeared tight, and the unemployment rate remained at 4.2%. The Reserve Bank of Australia slightly lowered its growth forecast for Australia's GDP in its latest forecast, while core inflation is expected to remain near the midpoint of the target range for most of the forecast period. The Reserve Bank of Australia said the Board members “emphasized the need to keep a close eye on the data and guide decisions based on its impact on the evolution of risk assessments” and “the Council will continue to focus on its mission”.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal