Assessing Silicon Labs (SLAB) Valuation After 33% Revenue Surge and New Product Launches

Silicon Laboratories (SLAB) just delivered one of those headlines that grabs the attention of investors weighing their next move. The company’s recent quarterly report showed a robust 33% jump in revenue compared to last year and new products hitting the shelves, which usually suggests there are growth engines humming behind the scenes. Still, the upbeat news was tempered by continued operating losses and some ongoing headaches with inventory, leading to a mix of optimism and caution in the market.

Looking at the bigger picture, the stock has ridden a wave of momentum lately, rising 8% over the past month and gaining 16% in the past three months. This rally builds on a 22% total return over the past year, outpacing many industry peers but still reflecting some volatility as management contends with uneven performance across customer programs. Over five years, SLAB shareholders have seen returns above 40%, but persistent operating losses and swings in sentiment mean it remains a battleground for investors, especially with divergent analyst views and visible market reaction to margin improvements and risks.

So after a year of meaningful gains and with management holding a resolutely positive view, is Silicon Laboratories trading at a bargain, or are investors already pricing in all the future growth?

Most Popular Narrative: 3.5% Undervalued

According to community narrative, Silicon Laboratories is currently priced below its estimated fair value, with analysts highlighting accelerating earnings, stronger margins, and robust end-market growth supporting further upside from here.

"Rapid expansion of smart home, healthcare, and industrial IoT deployments—including multiple large-scale customer production ramps and a deep design win pipeline—supports robust, multi-year revenue growth as the number of connected devices in these sectors accelerates. Ongoing rollout of new, highly integrated, energy-efficient wireless platforms (Series 2 and Series 3) positions Silicon Labs to capture increased market share and supports higher ASPs, which is likely to drive top-line growth and gross margin improvement."

Hungry for the details driving this bullish stance? Discover which transformational technologies and strategic shifts lie beneath these big growth calls. The backbone of this valuation is a set of forward-looking targets that could redefine what is possible for Silicon Labs, if things fall into place. What exactly are these optimistic assumptions? Dive in and see for yourself how analysts are building this case for upside.

Result: Fair Value of $150.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition and the risk of slower IoT adoption could quickly cast doubt on the optimism priced into Silicon Labs shares.

Find out about the key risks to this Silicon Laboratories narrative.Another View

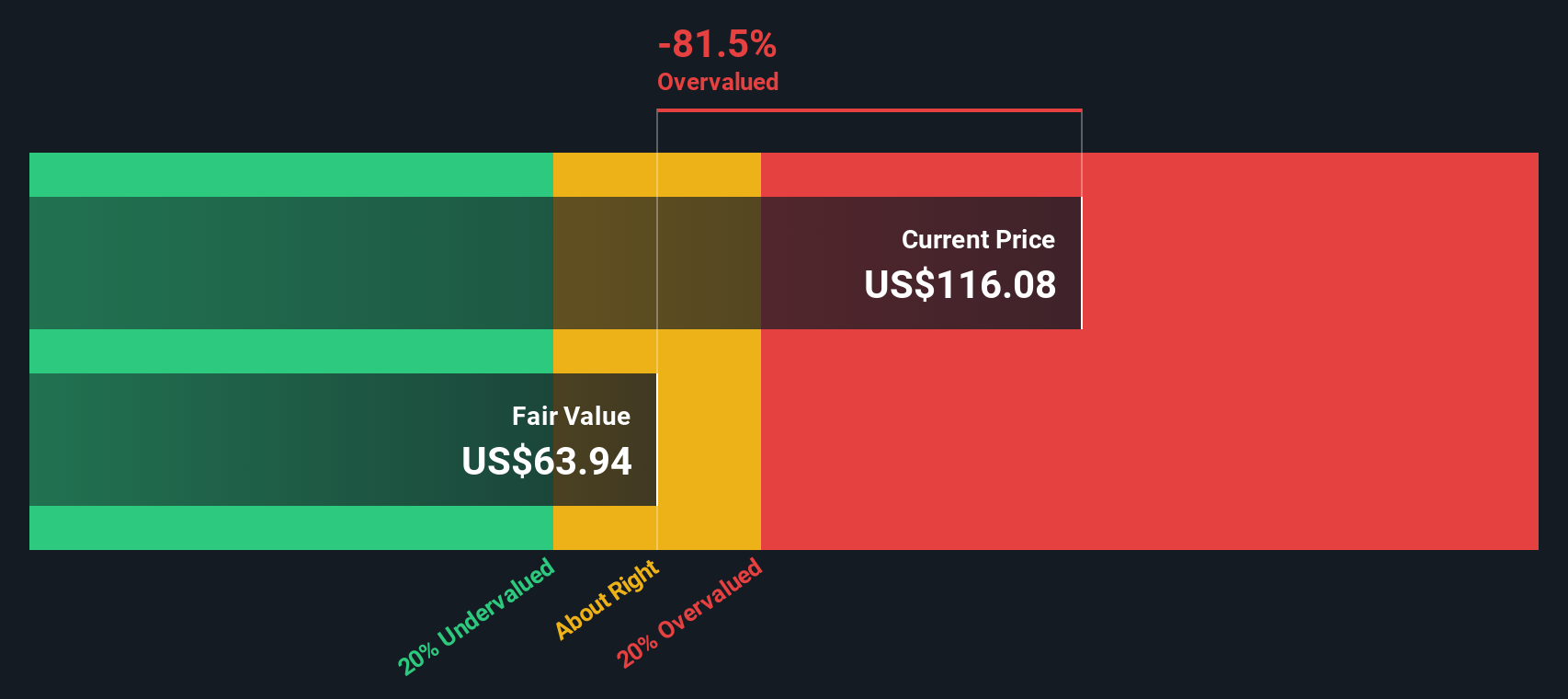

The SWS DCF model offers a challenging counterpoint, suggesting that Silicon Laboratories may actually be trading above its intrinsic value, despite optimistic growth expectations. Could market enthusiasm be running ahead of the fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Silicon Laboratories Narrative

If you see the story differently or want to chart your own path, you can build a custom narrative in just a few minutes. do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Silicon Laboratories.

Want More Winning Opportunities?

Level up your portfolio by tapping into handpicked investment themes you will not want to overlook. These tailored ideas highlight trends and sectors that could give you an edge, helping you take action as opportunities emerge.

- Start shaping your income strategy by targeting dividend stocks with yields > 3%. These choices combine stable dividends with reliable business models, setting your sights on long-term growth and attractive yields.

- Uncover the next wave of healthcare breakthroughs by focusing on healthcare AI stocks. Companies in this space are using artificial intelligence to reshape diagnostics, treatment plans, and patient care.

- Catalyze your search for fast-growing potential by zeroing in on AI penny stocks. These opportunities involve businesses transforming industries with machine learning, automation, and real-time data insights.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal