HPE (HPE): Assessing Valuation Following Analyst Upgrades and AI Growth Prospects

Most Popular Narrative: 3.4% Undervalued

According to the community narrative, Hewlett Packard Enterprise is considered slightly undervalued, with analysts projecting a fair value modestly above its current price. This outlook reflects optimism for future financial and operational improvements.

HPE expects to achieve synergies of at least $450 million from the Juniper Networks acquisition within three years of closing. If the deal is approved and successfully integrated, this could enhance revenue and net margins. The company's focus on AI, with a significant backlog and pipeline of AI systems orders, suggests potential for substantial revenue growth in the second half of 2025 as inventory challenges are addressed and new product generations are deployed.

Curious how HPE’s future value rests on bold growth in AI and ambitious synergy targets? The narrative’s calculation blends rising profitability with a daring forecast for margins and earnings. Want to know the exact financial leaps analysts are banking on? These projections could reshape perceptions of what HPE is truly worth.

Result: Fair Value of $23.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain. These include regulatory hurdles for the Juniper deal and fierce pricing pressure in servers, factors that could change HPE's growth trajectory.

Find out about the key risks to this Hewlett Packard Enterprise narrative.Another View: Discounted Cash Flow Analysis

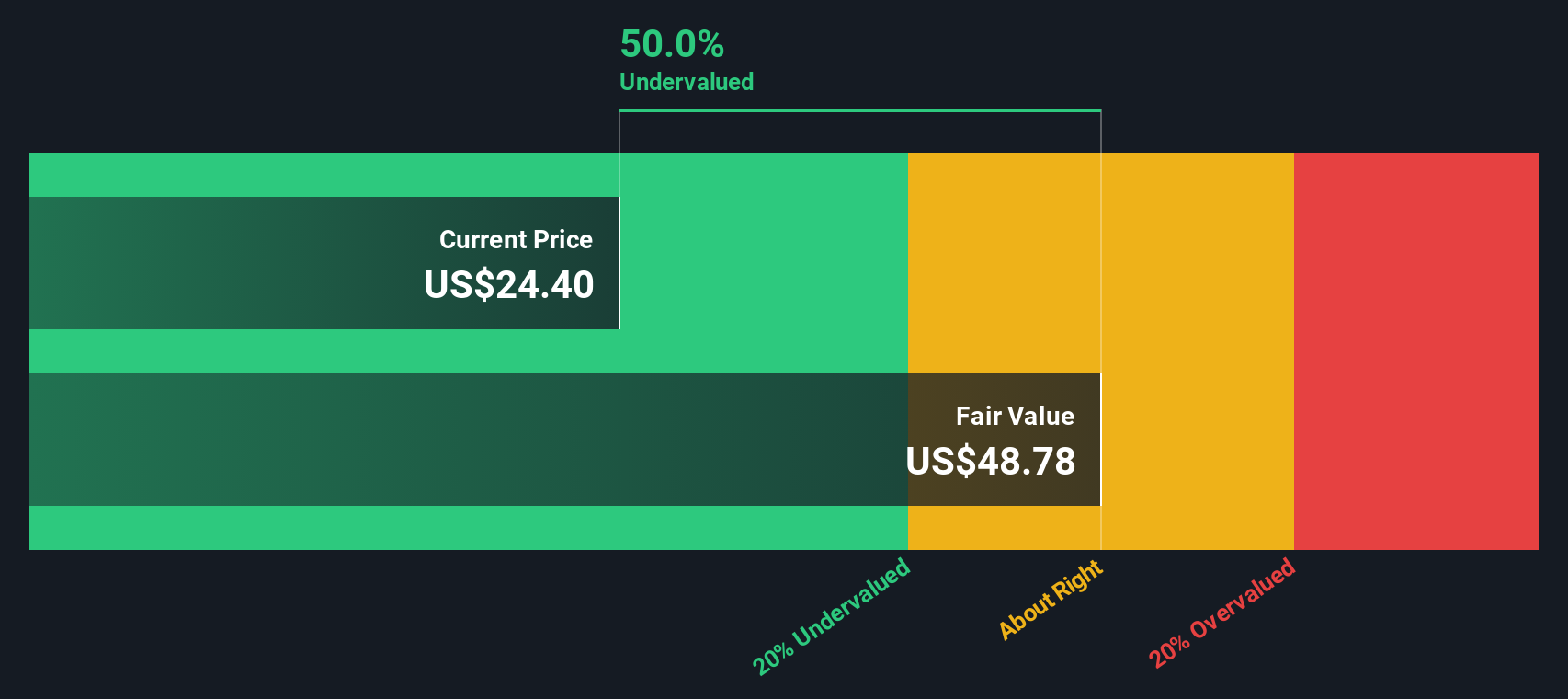

Taking another approach, the SWS DCF model also points to Hewlett Packard Enterprise being currently undervalued. This method relies on projected cash flows rather than analyst forecasts. However, there is some uncertainty as to whether future earnings will actually align with these assumptions.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hewlett Packard Enterprise Narrative

If you have a different perspective or want to dive deeper into the data, you can easily build your own narrative in just a few minutes. So why not do it your way?

A great starting point for your Hewlett Packard Enterprise research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Broaden your investing horizons and stay a step ahead by focusing on high-potential opportunities selected by the Simply Wall Street Screener. Do not miss these standout ideas because smart investors are already tracking them. Start building an even stronger portfolio today with these promising avenues:

- Discover reliable income streams by checking out dividend payers offering yields above 3%. Tap into dividend stocks with yields > 3% for more information.

- Identify trailblazers in AI-powered healthcare and see which companies are using artificial intelligence to revolutionize diagnostics and next-generation treatments with healthcare AI stocks.

- Find undervalued gems that provide attractive value based on future cash flows with undervalued stocks based on cash flows and explore opportunities for potential market-beating returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal