How Investors Are Reacting To Molina Healthcare (MOH) Securing $500M Loan to Fund Stock Buybacks

- On August 12, 2025, Molina Healthcare announced it amended its credit agreement to secure a new US$500 million term loan, extending its existing relationship with Truist Bank to support its stock repurchase program.

- This move highlights how Molina Healthcare is using short-term debt to enhance shareholder returns, leveraging financial flexibility as it awaits subsidiary dividend payments later in the year.

- We will now explore how the company's new debt financing for buybacks could shape Molina Healthcare's investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Molina Healthcare Investment Narrative Recap

To be a Molina Healthcare shareholder, you need to believe in the company's ability to grow through Medicaid and Medicare contracts and its disciplined management of medical costs. The recent amendment to secure a US$500 million term loan for buybacks may provide near-term support to the share price, but it does not significantly shift the most important short-term catalyst (contract wins) or outweigh the greatest current risk, Medicaid funding uncertainties.

Among recent announcements, the new share repurchase program, authorized up to US$1 billion through December 2026, directly ties into the use of the new debt financing. While this move may support shareholder returns, its alignment with the timing of expected subsidiary dividends suggests that broader fundamentals will remain driven by membership growth and contract execution.

Yet, investors should also be mindful that, unlike capital allocation decisions, the risk of Medicaid funding cuts is something that...

Read the full narrative on Molina Healthcare (it's free!)

Molina Healthcare's narrative projects $50.9 billion in revenue and $1.5 billion in earnings by 2028. This requires 6.9% yearly revenue growth and a $0.4 billion earnings increase from $1.1 billion today.

Uncover how Molina Healthcare's forecasts yield a $201.36 fair value, a 15% upside to its current price.

Exploring Other Perspectives

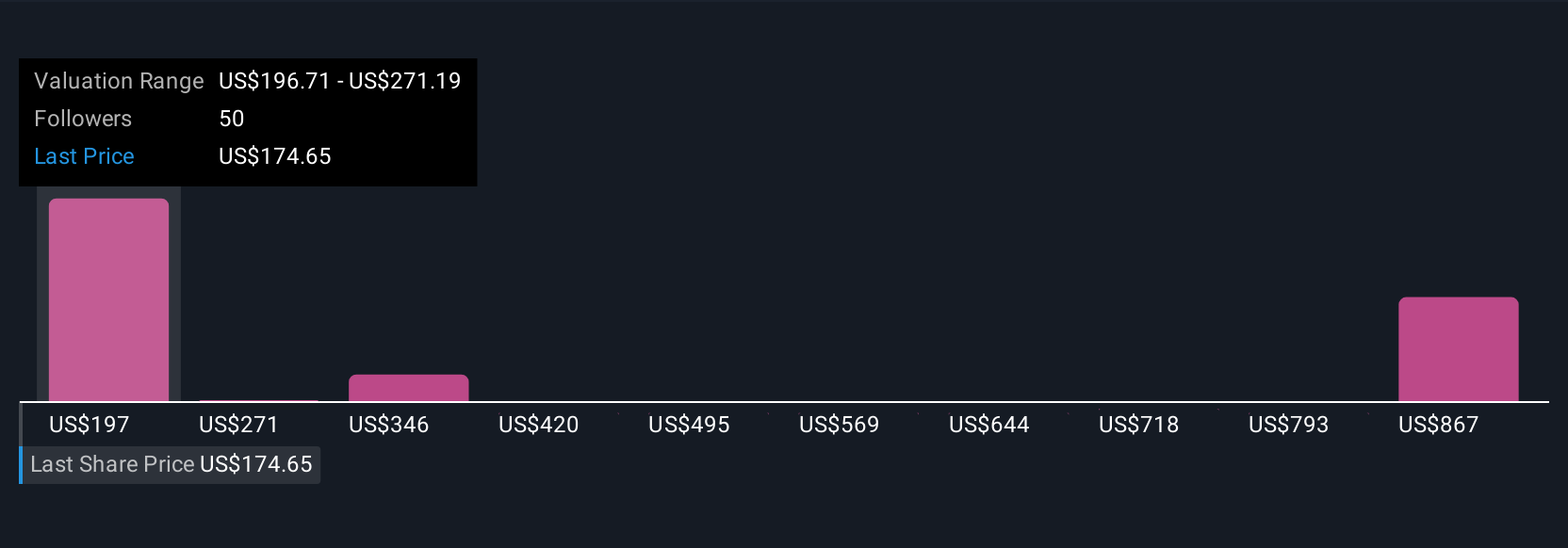

Simply Wall St Community members provided 11 fair value estimates for Molina Healthcare, spanning a wide US$201 to US$965 per share. While contract growth remains a key catalyst, your own perspective on Medicaid program risks may shape how you interpret the company’s prospects.

Explore 11 other fair value estimates on Molina Healthcare - why the stock might be worth just $201.36!

Build Your Own Molina Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Molina Healthcare research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Molina Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Molina Healthcare's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 28 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal