How Will Lam Research's (LRCX) Shelf Registration and Analyst Upgrades Shape Its Competitive Strategy?

- Lam Research Corporation recently filed an omnibus shelf registration allowing the potential issuance of various securities, including common and preferred stock, debt securities, depositary shares, warrants, rights, purchase contracts, and units.

- This move follows a period of increased analyst optimism, with several upward revisions to earnings estimates for fiscal 2026 reflecting a positive outlook for Lam’s market position in advanced semiconductor equipment.

- To assess the significance of this development, we'll explore how the recent analyst upgrades and market sentiment updates shape Lam Research's investment narrative.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

Lam Research Investment Narrative Recap

To invest in Lam Research, you need to believe in the sustained global demand for advanced semiconductor fabrication equipment, fueled by AI adoption and new chip architectures. The recent omnibus shelf registration expands Lam's financial flexibility but does not materially impact the near-term catalyst, which remains the trajectory of capital spending by major foundries and memory makers. The most significant risk continues to be potential volatility or weakness in end-market demand as wafer fabrication equipment spending remains cyclical and sensitive to broader tech investment trends.

Among Lam's recent announcements, the $10 billion share repurchase program stands out for its relevance to shareholder value alongside the new shelf registration, reflecting management's confidence in the company's cash flow and earnings profile. While product launches like the ALTUS Halo etch tool underscore Lam's leadership in next-generation manufacturing, capital allocation initiatives signal management's ongoing effort to balance growth opportunities with returns to investors.

Yet, against this backdrop, it's important to recognize that changes in large customers' capital spending...

Read the full narrative on Lam Research (it's free!)

Lam Research's narrative projects $23.5 billion in revenue and $6.7 billion in earnings by 2028. This assumes 8.4% yearly revenue growth and a $1.3 billion increase in earnings from $5.4 billion today.

Uncover how Lam Research's forecasts yield a $108.77 fair value, a 9% upside to its current price.

Exploring Other Perspectives

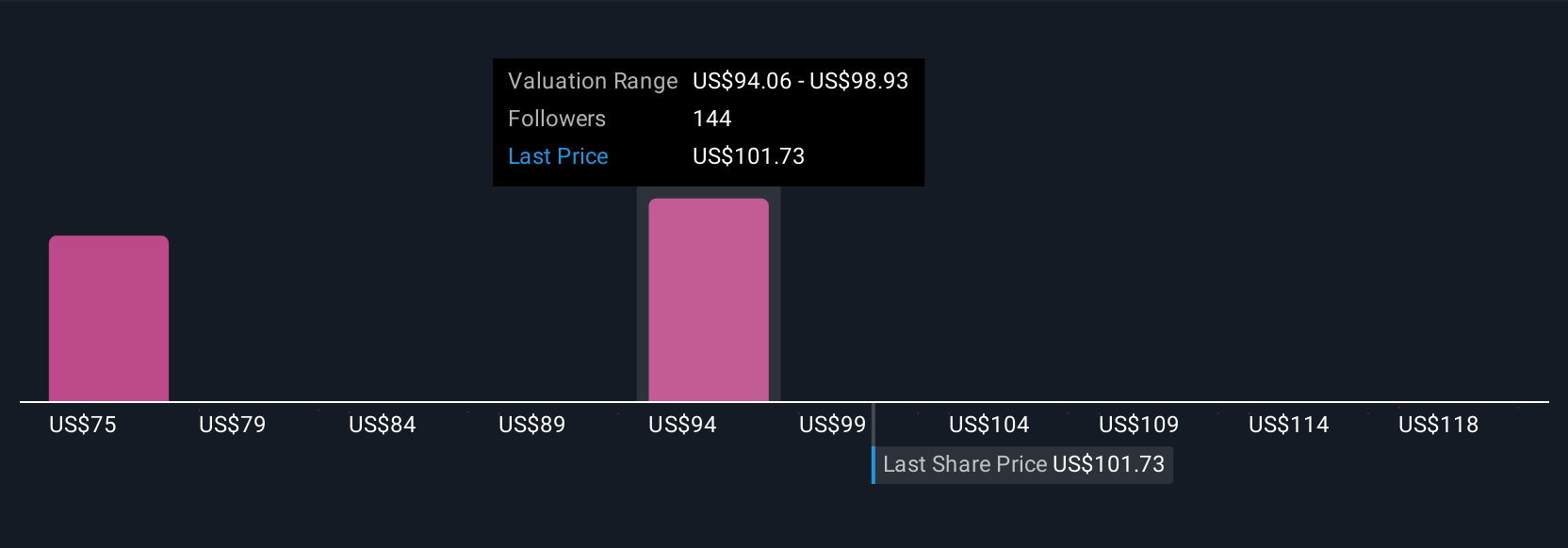

Eighteen members of the Simply Wall St Community estimate Lam's fair value between US$55 and US$135 per share. With wafer fabrication equipment demand tied closely to technology investment cycles, your outlook may differ significantly from others.

Explore 18 other fair value estimates on Lam Research - why the stock might be worth 45% less than the current price!

Build Your Own Lam Research Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lam Research research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Lam Research research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lam Research's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal