How Ulta Beauty’s (ULTA) Target Exit and Board Appointments Are Shaping Its Investment Story

- Ulta Beauty and Target announced in August 2025 that they will not renew their shop-in-shop partnership, concluding the collaboration by August 2026 with Ulta maintaining in-store presence until that date.

- Ulta Beauty also appointed Martin Brok and Stephenie Landry to its board, emphasizing deep retail, consumer technology expertise, and board diversity with women comprising 67% of directors.

- We'll examine how Ulta’s addition of experienced board members could influence its investment narrative and broader transformation plans.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Ulta Beauty Investment Narrative Recap

Investors in Ulta Beauty are betting on continued growth through new brand launches, digital expansion, and exclusive offerings, even as the company pivots away from the Target partnership. The news of the partnership’s end is not expected to be a material short-term catalyst or risk, since Ulta’s core drivers remain steady, but it will be crucial to watch for any unexpected competitive traction losses. At the same time, increased competition in the beauty space remains the primary near-term risk, with market share pressures potentially affecting revenue and margins.

Among recent announcements, Ulta’s board appointments of Martin Brok and Stephenie Landry stand out for bringing deep retail and consumer technology backgrounds that could support their customer experience and digital engagement goals. For investors focused on catalysts, these additions connect directly with Ulta’s ambitions to boost loyalty and launch new digital initiatives, two areas critical for fending off intensified competition and driving the next phase of core growth.

Yet in contrast, it's important for investors to keep an eye on the ongoing risk of market share loss amid...

Read the full narrative on Ulta Beauty (it's free!)

Ulta Beauty is projected to reach $13.1 billion in revenue and $1.2 billion in earnings by 2028. This scenario assumes annual revenue growth of 4.7% and essentially no change in earnings from the current level of $1.2 billion.

Uncover how Ulta Beauty's forecasts yield a $518.41 fair value, in line with its current price.

Exploring Other Perspectives

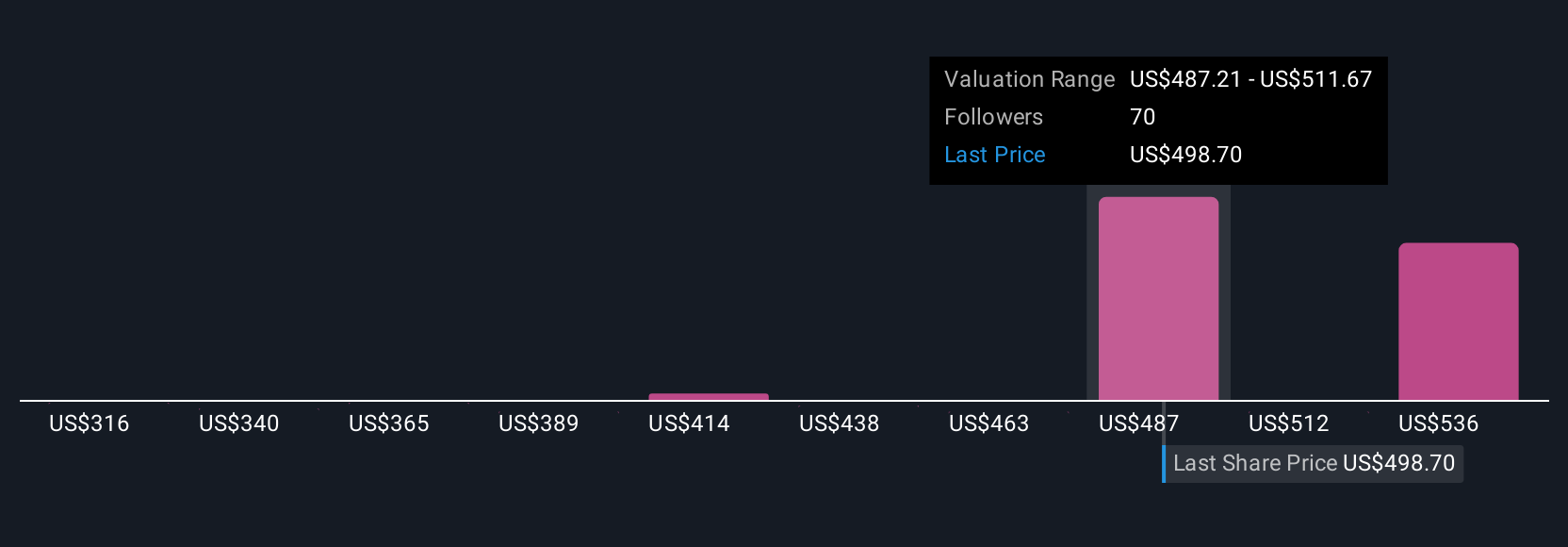

Sixteen Simply Wall St Community members estimate Ulta Beauty’s fair value from US$316 to US$564, with views spanning cautious to optimistic. While ambitious product launches may excite some, fierce beauty sector competition prompts others to reassess future earnings potential, explore diverse opinions for a fuller picture.

Explore 16 other fair value estimates on Ulta Beauty - why the stock might be worth as much as 7% more than the current price!

Build Your Own Ulta Beauty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ulta Beauty research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Ulta Beauty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ulta Beauty's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal