Mastercard (MA): Assessing Valuation as Analysts Spotlight Profitability and Market Expansion

Mastercard (MA) is enjoying increased attention, and investors are taking notice. Recent analyst commentary placed Mastercard among the most profitable stock picks for 2025, highlighting its strong net income generation. In addition, new product launches such as the BMO Escape Credit Card indicate renewed momentum in unlocking growth beyond traditional payment services, especially as travel and digital spending rebound.

Shares of Mastercard have climbed nearly 29% over the past year, outpacing the broader market and reflecting excitement around the company’s expansion strategy. The introduction of travel-focused credit products, continued digital adoption, and a steady pipeline of acquisitions have contributed to this story. Momentum has been building throughout the year, evident not only in product news but also in Mastercard’s underlying earnings and revenue growth.

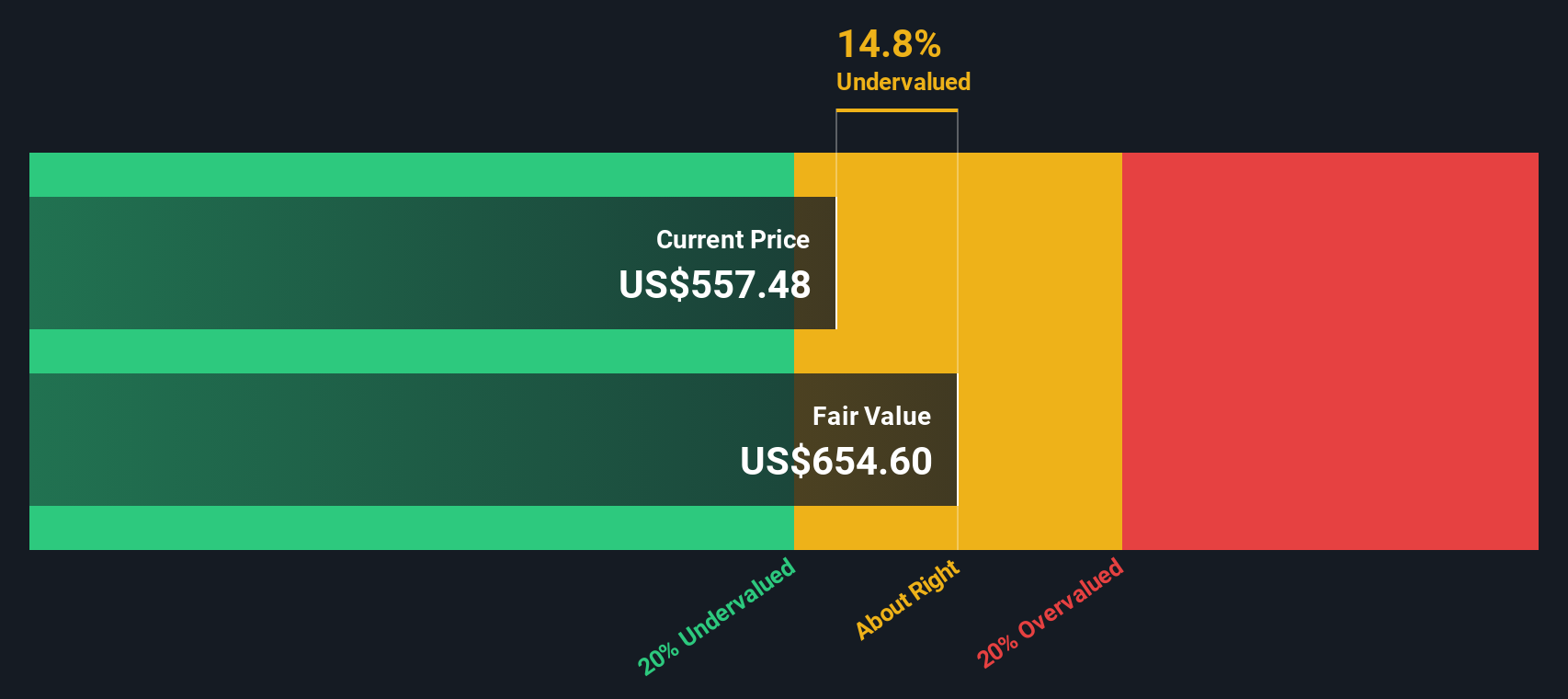

The big question now is whether Mastercard’s market price already reflects all this anticipated growth or if there is still room for upside. With the stock’s strong performance, some may wonder if this is a compelling entry point or if the market has already factored in the company’s next stage of expansion.

Most Popular Narrative: 6.8% Undervalued

According to community narrative, Mastercard is seen as undervalued by nearly 7%. Analysts project meaningful upside based on robust digital payments momentum and the company’s expanding profit margins.

Mastercard's expanded value-added services in cybersecurity, data analytics, and consulting—highlighted by the acquisition of Recorded Future and investments in AI-driven fraud solutions—support higher-margin, recurring revenue streams and net margin expansion.

Curious why so many experts still see hidden value in Mastercard after such a big run-up? The narrative reveals a daring outlook fueled by a rapid shift in payment technology, ambitious growth projections, and future profit metrics that defy traditional industry boundaries. Wondering what bold assumptions are baked into this story? Find out what’s driving analysts’ confidence in these eye-catching fair value estimates.

Result: Fair Value of $642.97 (UNDERVALUED)

--- **Rewritten Version With Corrections:**Most Popular Narrative: 6.8% Undervalued

According to the community narrative, Mastercard is seen as undervalued by nearly 7%. Analysts project meaningful upside based on robust digital payments momentum and the company’s expanding profit margins.

Mastercard has expanded value-added services in cybersecurity, data analytics, and consulting, which are highlighted by the acquisition of Recorded Future and investments in AI-driven fraud solutions. These initiatives support higher-margin, recurring revenue streams and net margin expansion.

Many experts continue to see hidden value in Mastercard even after a significant price increase. This perspective is fueled by a rapid shift in payment technology, ambitious growth projections, and future profit metrics that move beyond traditional industry boundaries. The narrative invites readers to explore what assumptions are driving analysts’ confidence in these notable fair value estimates.

Result: Fair Value of $642.97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifting market dynamics, including growing competition from real-time payment systems and increasing regulatory scrutiny, could challenge Mastercard’s ongoing growth story.

Find out about the key risks to this Mastercard narrative.Another View

Looking through our DCF model, a fresh perspective emerges. This approach focuses on projected cash flows rather than current earnings. It currently also suggests the shares are undervalued. Could this method shed extra light on future value?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Mastercard Narrative

Keep in mind, if the current outlook doesn't resonate with you or you'd rather form your own perspective, you have the tools to craft your take quickly. do it your way.

A great starting point for your Mastercard research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More High-Potential Investment Ideas?

Your next winning move could be just a click away. Skip the guesswork and check out expertly curated stock ideas that could fit your goals. Don’t let opportunity pass you by while you’re focused on just one name. Here are three exciting options to fuel your research:

- Uncover potential in innovative healthcare by checking out companies leveraging healthcare AI stocks to transform medicine, diagnostics, and patient outcomes.

- Find stocks offering strong, stable income by reviewing dividend stocks with yields > 3% that deliver attractive yields above 3%. These can be a solid choice for building a resilient portfolio.

- Tap into the explosive universe of digital currencies with cryptocurrency and blockchain stocks and see which businesses are powering advancements in blockchain and decentralized finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal