Does First Solar's 28% Surge Signal More Upside After Record Revenue Growth?

Thinking of what to do with First Solar stock right now? You are not alone. Over the past few months, First Solar has grabbed attention not just for its technological edge in solar panels, but also because its stock price has been on quite a ride. In the last 90 days, shares have surged by nearly 28%, capping a month where the stock climbed over 12%. On a five-year timeline, the total return clocks in at more than 150%. Those are eye-catching numbers, and for anyone tracking the clean energy industry, it is hard not to wonder if there is even more upside left, or if a good chunk of optimism is already reflected in today’s share price.

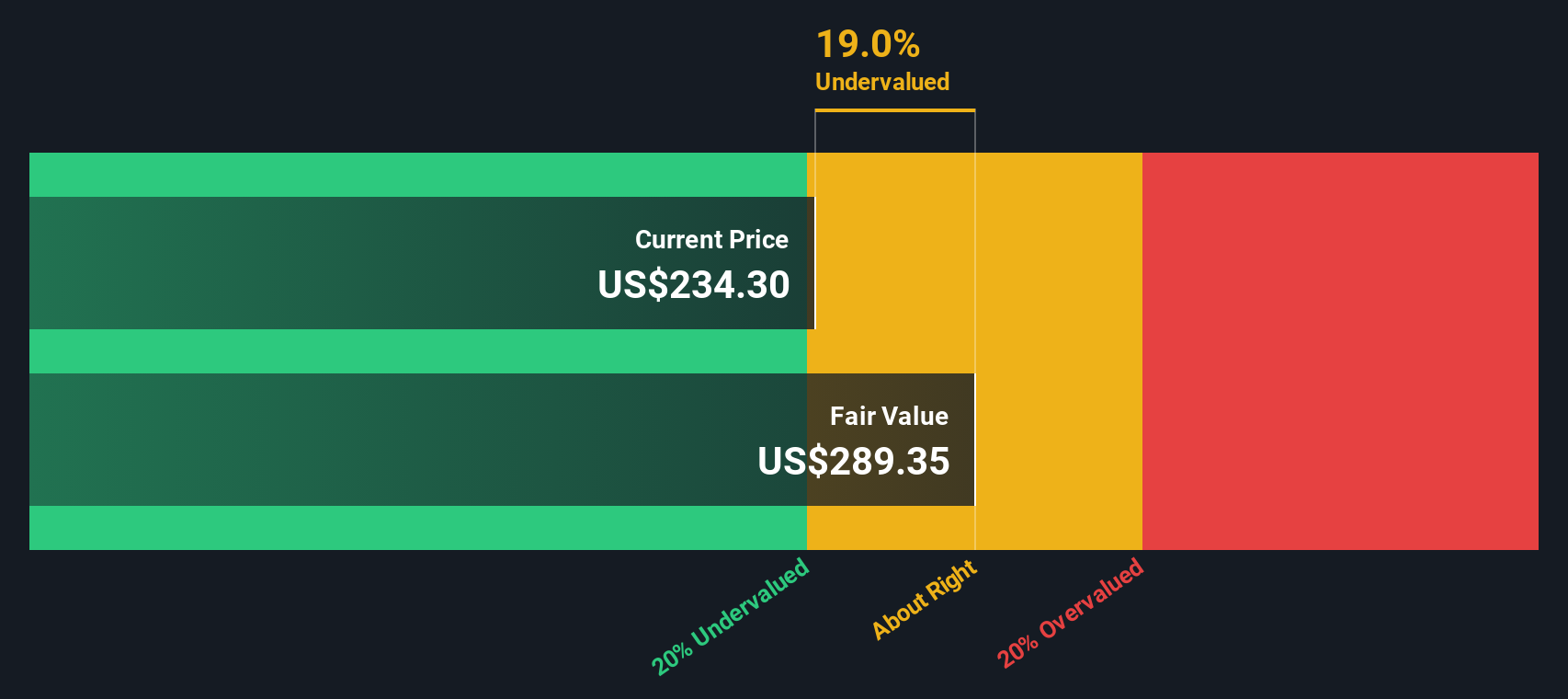

Why the upward momentum? Investors are responding to a mix of stronger earnings, rapid revenue and net income growth, and a positive outlook for solar adoption. First Solar’s recent annual numbers point to double-digit growth in both revenue and profits, with analysts steadily raising their price targets. That said, if you are looking at valuation, a key question for anyone considering buying, holding, or selling, the real story gets even more interesting. Based on six major checks for undervaluation, First Solar passes five, giving it a strong value score of 5 out of 6.

So, how are these valuation scores actually determined, and which methods should you trust when evaluating whether First Solar stock is still a bargain at current levels? Let us break down the standard approaches. Then, stick around for a perspective on valuation that investors often overlook, but may make all the difference.

First Solar delivered -12.5% returns over the last year. See how this stacks up to the rest of the Semiconductor industry.Approach 1: First Solar Cash Flows

The Discounted Cash Flow (DCF) model is a standard tool for valuing companies. It works by projecting future cash flows and then discounting them back to today’s value, providing an estimate of what the business is intrinsically worth at present.

First Solar’s most recent free cash flow (FCF) shows a deficit of about $1.25 billion. However, projections from analysts are optimistic. They forecast that FCF will rebound strongly, reaching more than $2.8 billion by 2029. Over the next ten years, these estimates suggest FCF will increase steadily each year, with cash generation surpassing $2.8 billion in 2035.

Based on these forward-looking cash flow projections and a two-stage model, the DCF calculation estimates First Solar’s intrinsic value at $287.73 per share. This is approximately 29.7% higher than the current market price, suggesting the stock is 29.7% undervalued according to this approach.

Result: UNDERVALUED

Approach 2: First Solar Price vs Earnings

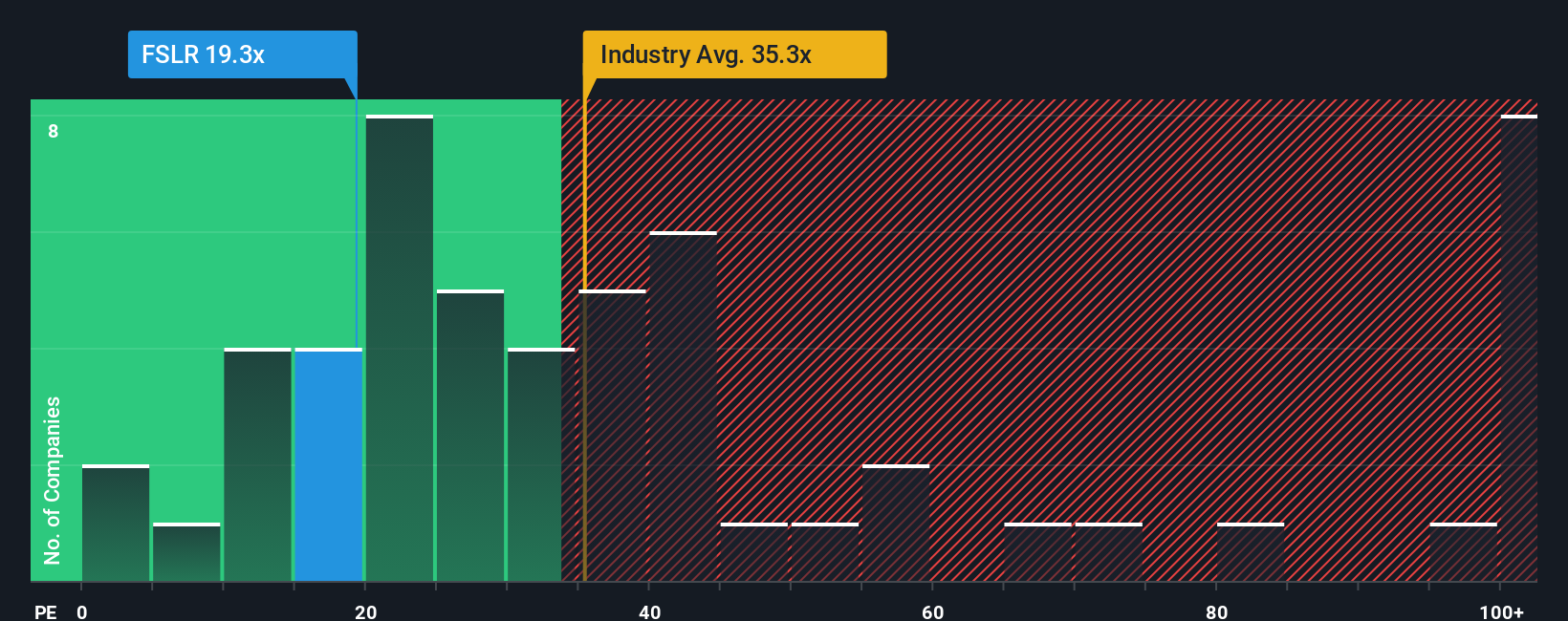

The price-to-earnings (PE) ratio is a widely used valuation metric, especially for companies like First Solar that are consistently profitable. It helps investors gauge how much they are paying for each dollar of earnings and is particularly useful when comparing with other firms in the same industry or sector.

Generally, growth expectations and risk strongly affect what counts as a reasonable or “fair” PE ratio. Higher anticipated earnings growth, better margins, and a more stable outlook usually justify higher PE ratios. In contrast, cyclical risk or uncertainty about future profits can pull this multiple down.

First Solar currently trades at a PE ratio of 17.3x. This is significantly lower than the semiconductor industry average of 30.1x and the average across its closest peers at 32.7x. Simply Wall St’s proprietary Fair Ratio suggests that, considering First Solar’s growth, profitability, and risks, a multiple of around 39.5x would be appropriate. This gap suggests the market may not fully appreciate the underlying strengths and outlook for First Solar relative to its industry peers and growth profile.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your First Solar Narrative

A Narrative is your story for what a company is worth and why, framing your beliefs about its future revenue, profits, and margins in one clear and actionable forecast.

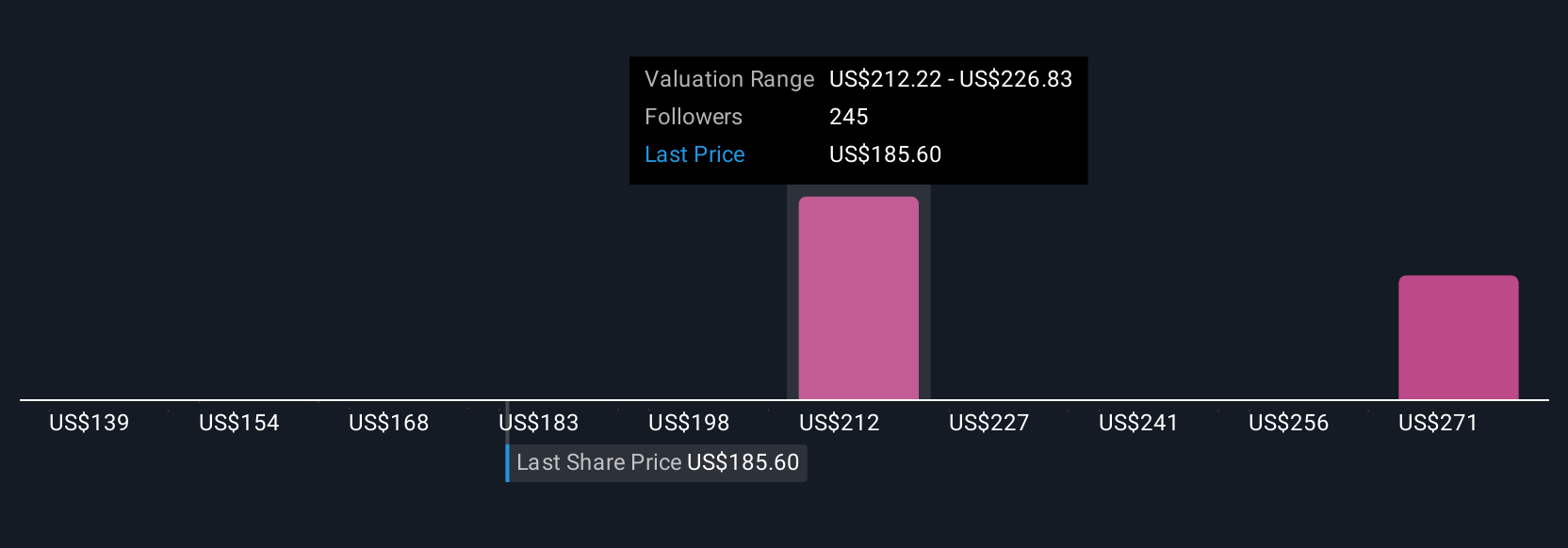

Rather than just crunching numbers, Narratives link what you believe is happening at First Solar, such as new technology, manufacturing expansions, or shifting policies, directly to a financial outlook and a fair value. This makes it easy to update and share your perspective within the Simply Wall St community.

This approach helps you connect the dots. You can compare your calculated Fair Value with today’s share price and decide quickly whether to buy, hold, or sell, especially because Narratives update instantly when new earnings or breaking news shifts your view.

With millions of investors creating and evolving their Narratives on Simply Wall St, you get a dynamic outlook tailored to what matters to you. For example, one Narrative expects First Solar to reach $3.9 billion in earnings by 2028 and sees a fair value as high as $283 per share. Another Narrative sees increased risks and forecasts just $2.0 billion in earnings, leading to a much lower fair value target of $100 per share.

Do you think there's more to the story for First Solar? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal