Caterpillar (CAT) Is Up 6.8% After Hunt Energy Partnership to Power Data Centers – Has the Digital Push Shifted the Outlook?

- On August 21, 2025, Hunt Energy Company and Caterpillar Inc. announced a long-term collaboration to deliver efficient, independent energy production for data centers, starting with a major project in Texas and aiming to deploy up to 1GW of generation capacity across North America.

- This partnership positions Caterpillar to leverage its advanced power solutions and Hunt Energy’s infrastructure experience to address the rising demand for reliable, always-on energy in the fast-growing data center sector.

- Let’s explore how Caterpillar’s entry into large-scale data center energy projects could reshape its outlook in digital infrastructure markets.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Caterpillar Investment Narrative Recap

For Caterpillar shareholders, the broad story hinges on the company’s ability to unlock growth from infrastructure and energy investments while defending margins against cost and trade risks. The recent alliance with Hunt Energy to deliver independent power for data centers reinforces Caterpillar’s strength in the fast-growing digital infrastructure segment, supporting its key near-term catalyst of robust order activity, but it doesn’t materially alter the biggest current risk, which remains potential new tariffs and margin pressure from trade policy shifts.

Among recent announcements, the August 2025 partnership with Joule Capital Partners and Wheeler Machinery stands out. This Utah data center project, combining advanced power and cooling solutions, closely aligns with Caterpillar’s expanding presence in the energy solutions market and further emphasizes how data center demand is directly supporting its growth catalysts and capacity investments.

By contrast, investors should be aware that exposure to new tariffs could still pose a significant headwind if...

Read the full narrative on Caterpillar (it's free!)

Caterpillar's outlook anticipates $75.4 billion in revenue and $13.3 billion in earnings by 2028. This scenario is based on a projected 6.1% annual revenue growth rate and a $3.9 billion increase in earnings from the current $9.4 billion level.

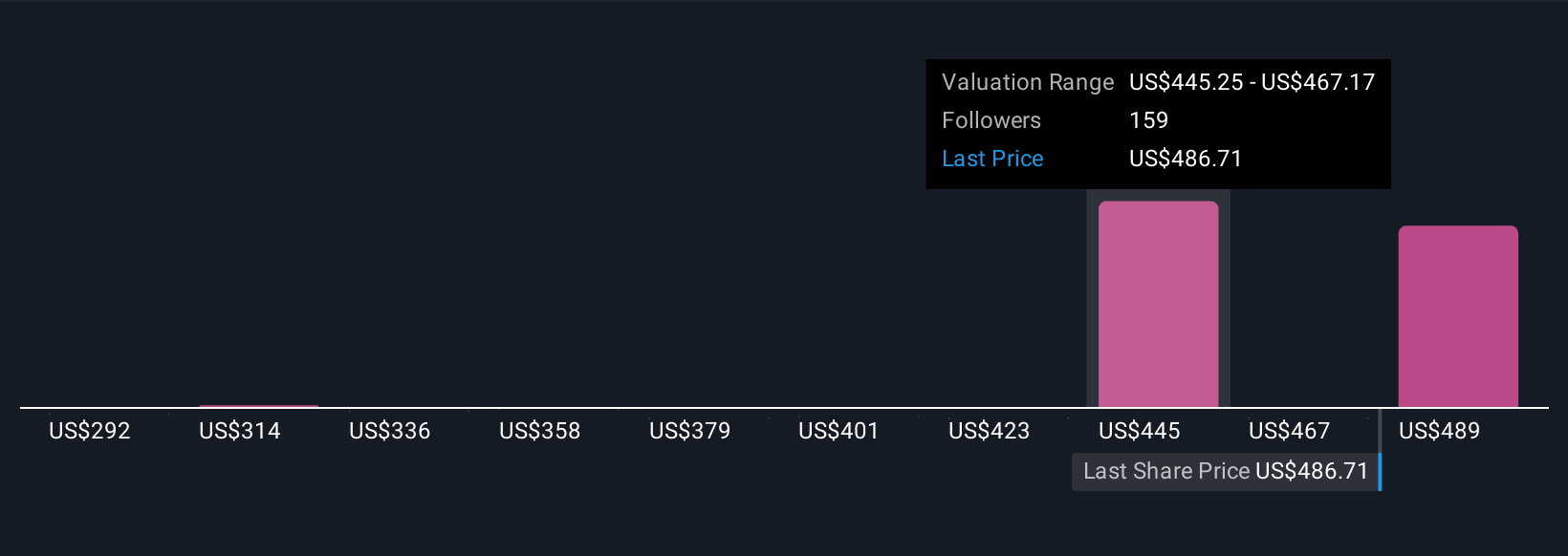

Uncover how Caterpillar's forecasts yield a $448.69 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members modeled fair values for Caterpillar ranging from US$291.79 to US$513.35 based on 21 different analyses. While many focus on data center catalysts, some warn that tariff risks could still weigh heavily on future returns, consider exploring several viewpoints to inform your outlook.

Explore 21 other fair value estimates on Caterpillar - why the stock might be worth as much as 18% more than the current price!

Build Your Own Caterpillar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Caterpillar research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Caterpillar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Caterpillar's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal