Upwork (UPWK): Assessing Valuation in Light of Its Major Enterprise Expansion with Lifted Launch

Most Popular Narrative: 20% Undervalued

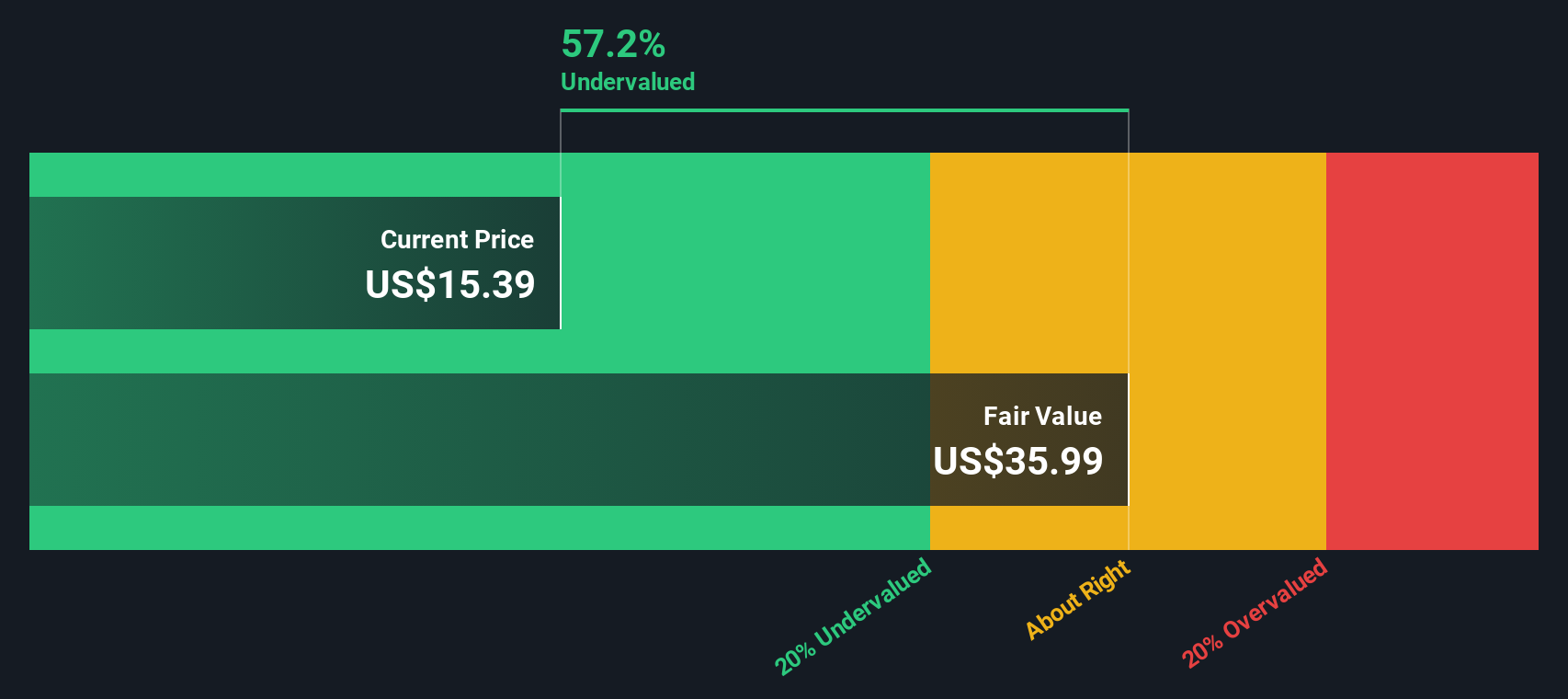

According to the community narrative, Upwork is considered significantly undervalued, with analysts projecting a fair value that is roughly a fifth higher than current trading levels. The narrative highlights a convergence of AI-powered product investment, growing enterprise penetration, and cost efficiencies as key drivers behind this positive outlook.

"Upwork's accelerated investment in AI-powered talent matching and workflow automation is already increasing average spend per contract and improving user experience for both clients and freelancers. This provides a clear path to higher revenue and improved gross margins as these enhancements scale."

What is lifting this bold price target? The narrative points to changes beneath the surface, such as smarter automation, rising stickiness with big clients, and bolder financial projections than you might expect. Are you wondering what assumptions make analysts believe future earnings will justify a premium to today's price? The details behind the projected revenue and profit trends might surprise you.

Result: Fair Value of $18.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing macroeconomic uncertainty and slow new client acquisition could limit Upwork’s growth. These factors may challenge even the most optimistic outlooks.

Find out about the key risks to this Upwork narrative.Another View: Discounted Cash Flow Perspective

To test the earlier view, the SWS DCF model takes a fresh approach by estimating Upwork’s worth based on its future cash flows. This method also sees value that the market might be missing, but can numbers alone tell the whole story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Upwork Narrative

If the narrative above does not match your perspective or you want to dig into the numbers firsthand, you can build your own view in just a few minutes and do it your way.

A great starting point for your Upwork research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Now is the perfect time to widen your horizons and spot companies leading powerful trends that other investors might miss. Use these strategies with Simply Wall Street’s Screener tools to get ahead with new insights and potential winners.

- Target larger potential payouts and strengthen your portfolio’s income by searching for stable businesses paying dividend stocks with yields > 3%.

- Take advantage of machine learning advancements and find companies transforming healthcare by screening for innovative healthcare AI stocks.

- Identify high performers in undervalued sectors and gain a head start on overlooked gems by seeking out undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal