Can Essential Properties Realty Trust’s New $400M Debt Shape Its Long-Term Capital Strategy for EPRT?

- Earlier this week, Essential Properties Realty Trust announced it has priced a US$400 million offering of 5.400% senior notes due 2035, as part of its ongoing capital markets activities.

- This substantial debt financing initiative reflects Essential Properties Realty Trust’s intention to optimize its capital structure and potentially lower its cost of capital for future growth.

- With issuing US$400 million in long-term notes to manage its balance sheet, we’ll look at implications for Essential Properties Realty Trust’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Essential Properties Realty Trust Investment Narrative Recap

Essential Properties Realty Trust appeals to shareholders who believe in steady, inflation-protected rental income and ongoing growth in service-based real estate. This week's US$400 million senior notes offering strengthens balance sheet flexibility, but does not materially alter the near-term catalysts or address the most significant risk, tenant credit quality, given ongoing sector trends and exposure to middle-market tenants.

Among recent announcements, the company's Q2 2025 results stand out, with revenue and net income growth underpinning management’s commitment to increasing the annualized dividend. This positive earnings momentum is encouraging in the context of capital market activity, supporting confidence in Essential Properties’ recurring income thesis while amplifying focus on expansion-linked risks.

However, investors should not overlook the increased competition in the net lease sector and the potential for cap rate compression, as...

Read the full narrative on Essential Properties Realty Trust (it's free!)

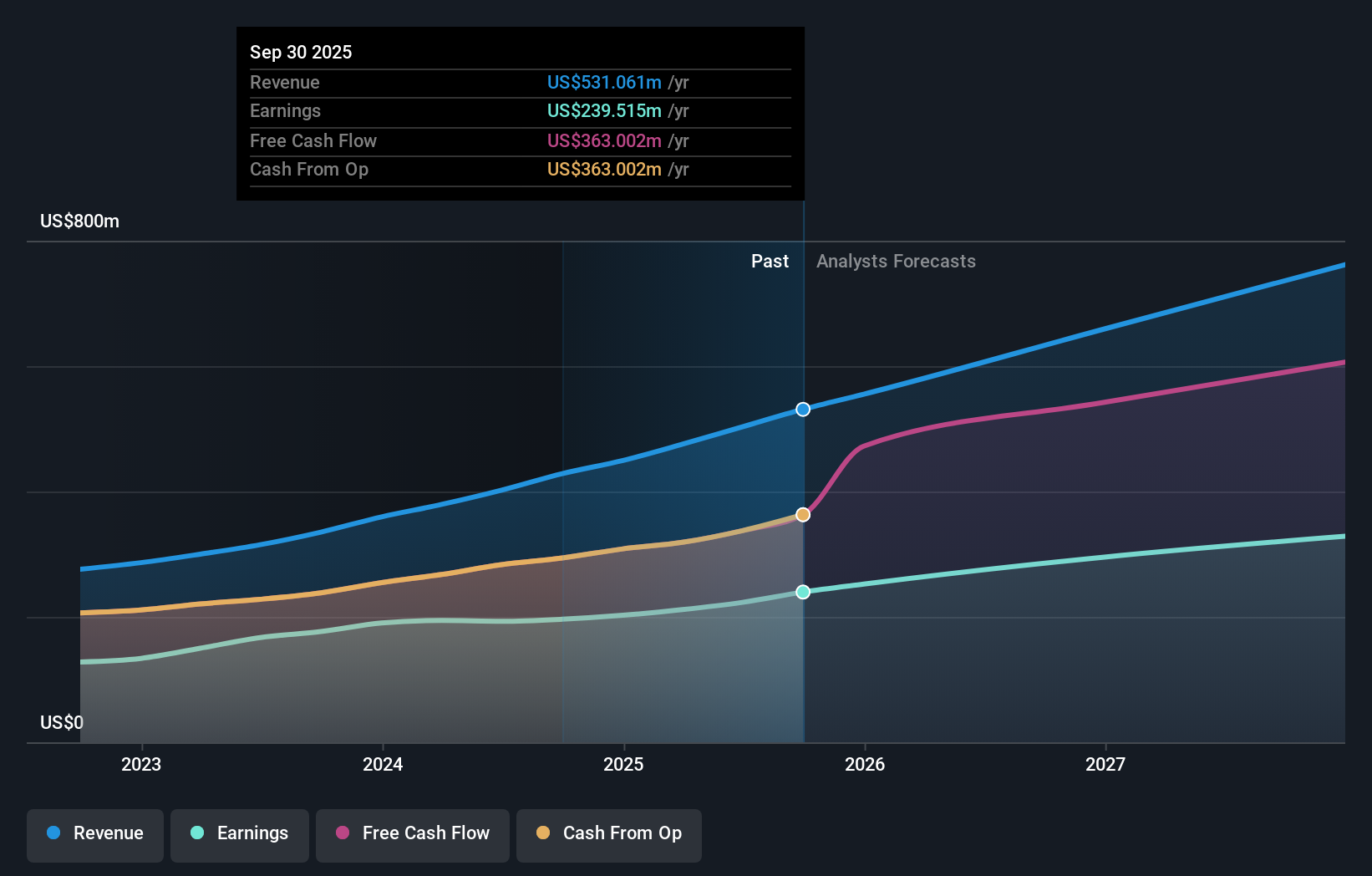

Essential Properties Realty Trust's narrative projects $787.4 million revenue and $321.1 million earnings by 2028. This requires 16.1% yearly revenue growth and a $98 million earnings increase from $223.1 million.

Uncover how Essential Properties Realty Trust's forecasts yield a $35.89 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Four fair value forecasts from the Simply Wall St Community range from US$27 to US$82.73 per share. Your outlook may shift depending on how you weigh competitive pressures threatening future investment yields.

Explore 4 other fair value estimates on Essential Properties Realty Trust - why the stock might be worth over 2x more than the current price!

Build Your Own Essential Properties Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Essential Properties Realty Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Essential Properties Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Essential Properties Realty Trust's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal