Will Flex’s (FLEX) Crisis Response Reveal Strengths or Gaps in Its Business Continuity Strategy?

- On August 21, 2025, Flex Ltd. reported that its Mukachevo, Ukraine facility, which focuses on consumer and lifestyle products and accounts for roughly 1% of company revenue, was damaged in a missile strike, resulting in injuries to several employees and contractors.

- This facility is not involved in defense production, and Flex immediately enacted emergency protocols and business continuity measures while supporting impacted personnel and their families.

- We’ll consider how the implementation of Flex’s business continuity plan following this disruption may influence its future investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Flex Investment Narrative Recap

To be a shareholder in Flex, you need to believe in the company’s ability to deliver innovative manufacturing and supply chain solutions across sectors benefiting from demand in data center and AI infrastructure, while managing tight operating margins and customer concentration risk. The recent missile strike at Flex’s Mukachevo facility, which accounts for about 1% of revenue and is not defense-related, does not materially alter the critical catalysts or major risks facing the business in the near term.

Among recent announcements, Flex’s July 2025 launch of a new AI-oriented power shelf system stands out. This development directly supports the growth thesis around accelerated data center and AI infrastructure demand, which is considered a key catalyst for the company as it aims to drive higher-margin revenue and long-term earnings growth.

In contrast, investors should be particularly mindful of customer concentration risk within Flex’s largest business segment and how sudden changes in demand or insourcing by major clients could...

Read the full narrative on Flex (it's free!)

Flex's narrative projects $29.1 billion revenue and $1.4 billion earnings by 2028. This requires 3.7% yearly revenue growth and a $509 million earnings increase from $891.0 million.

Uncover how Flex's forecasts yield a $57.86 fair value, a 17% upside to its current price.

Exploring Other Perspectives

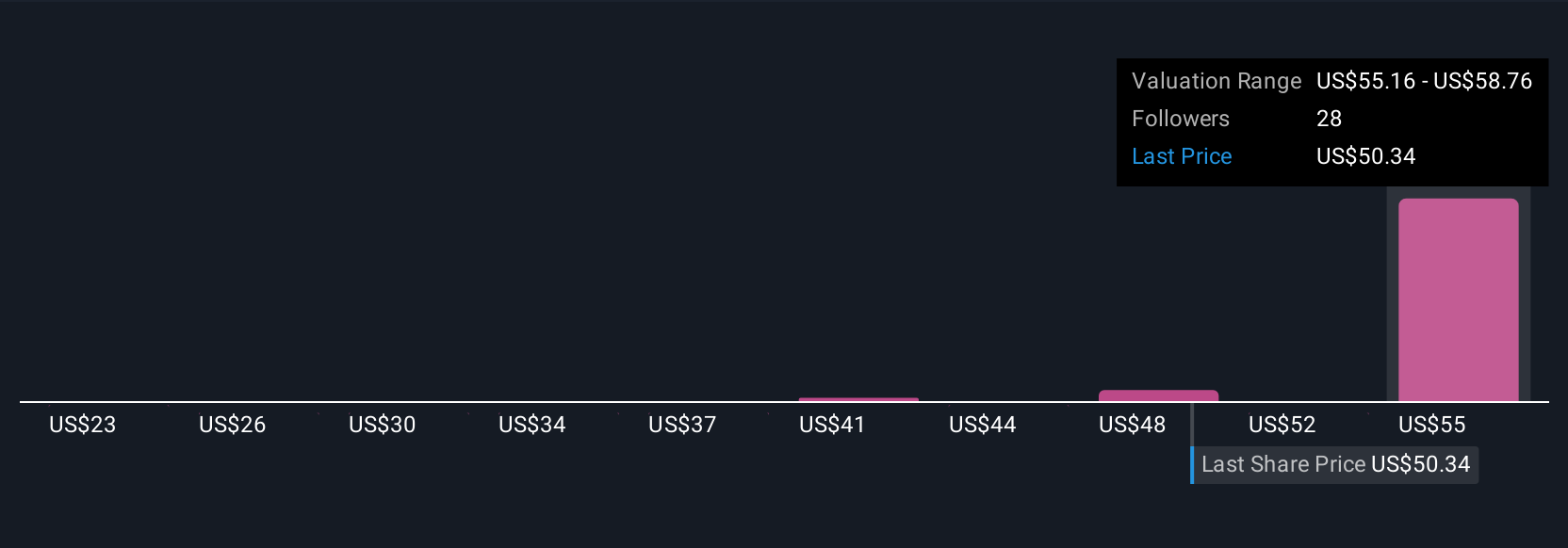

Simply Wall St Community members provided six fair value estimates for Flex ranging from US$22.73 up to US$58.92. While views on valuation differ widely, the key ongoing risk of revenue dependence on a handful of large customers remains top of mind for many investors.

Explore 6 other fair value estimates on Flex - why the stock might be worth as much as 19% more than the current price!

Build Your Own Flex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flex research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Flex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flex's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal