Will Expanded Patent Services Transform LegalZoom's (LZ) Trajectory in Online Legal Offerings?

- LegalZoom.com, Inc. recently expanded its intellectual property legal services, introducing attorney-assisted provisional patent application services through LZ Legal Services to offer more affordable and accessible patent filing options for businesses and inventors in the US.

- This move leverages LegalZoom's technology-enabled platform to streamline patent protection, potentially reaching inventors and startups priced out by traditional legal services.

- We'll explore how LegalZoom's entry into patent filings could reshape its long-term growth narrative in the online legal services market.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

LegalZoom.com Investment Narrative Recap

To be a LegalZoom.com shareholder today, you’ll need conviction that affordable, tech-driven online legal solutions are set to take more share as small businesses and individuals seek easier ways to protect their intellectual property, and that the company can unlock fresh revenue by streamlining complex legal filings. The expanded patent services have the potential to support the most important short-term catalyst, which is customer and subscription growth in new high-value product areas, but whether pricing and retention improve meaningfully remains unclear. The biggest risk right now continues to be intensifying price competition from generative AI tools and traditional firms going digital, which could threaten margins if sustaining differentiation gets harder.

Among recent company announcements, the compliance portfolio enhancements launched in May, using AI and attorney-monitored updates to help clients stay current with regulations, stand out. This ties directly to LegalZoom’s catalyst of higher recurring revenues from value-added services, underscoring a broadening product suite and effort to reach higher-value customers beyond basic formation services at a time when customer loyalty and product differentiation are critical.

By contrast, investors should also consider that rapid advances in AI could...

Read the full narrative on LegalZoom.com (it's free!)

LegalZoom.com's outlook projects $867.4 million in revenue and $70.5 million in earnings by 2028. This assumes a 7.1% annual revenue growth rate and an increase in earnings of $41.7 million from the current $28.8 million.

Uncover how LegalZoom.com's forecasts yield a $11.07 fair value, a 4% upside to its current price.

Exploring Other Perspectives

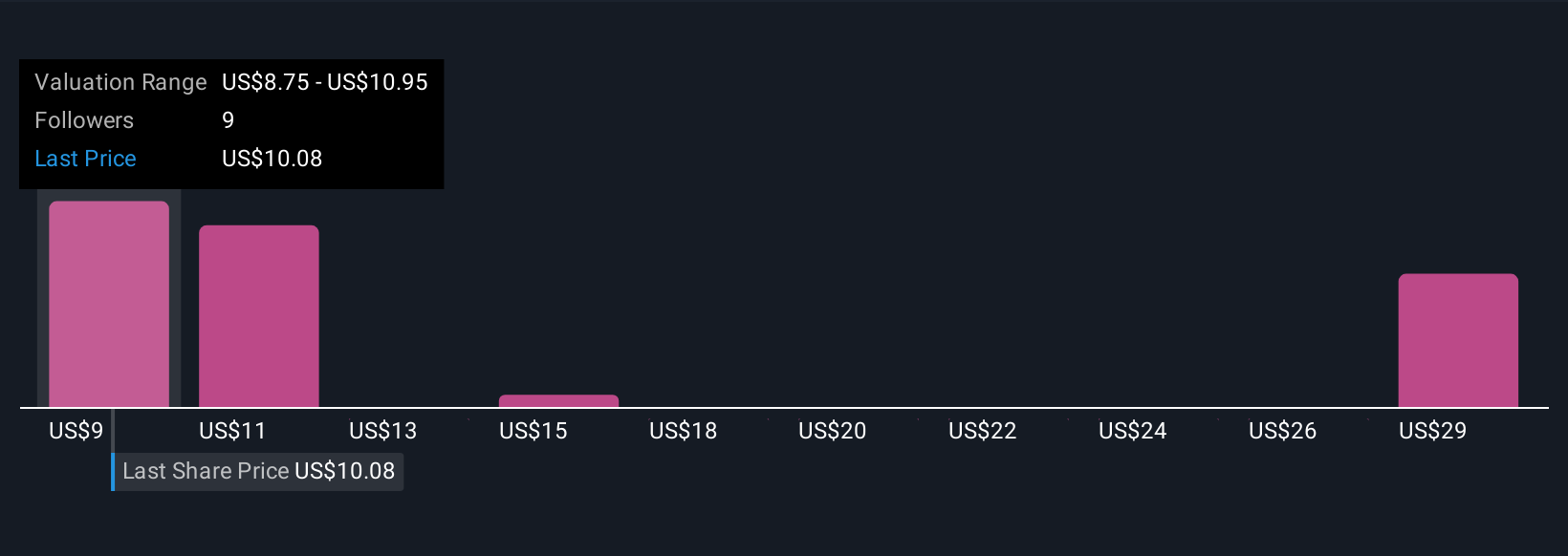

Five community-generated fair value targets for LegalZoom.com cluster between US$8.75 and US$30.71. Some participants see significant risks from low-cost digital legal service alternatives, so explore several viewpoints to sharpen your own assessment.

Explore 5 other fair value estimates on LegalZoom.com - why the stock might be worth over 2x more than the current price!

Build Your Own LegalZoom.com Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LegalZoom.com research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LegalZoom.com research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LegalZoom.com's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal