GitLab (GTLB): Exploring the Stock’s Valuation After Recent Modest Share Price Move

GitLab (GTLB) shares have nudged upward by just over 1% in the past day, a move that might catch the eye of investors wondering what’s next for this developer-focused software platform. While there is no headline-grabbing announcement driving the action, even modest shifts in stock price can be a signal for shareholders to revisit what is baked into the valuation. Sometimes, these small changes reflect shifting investor sentiment rather than any fundamental change in the company’s outlook.

Looking at a broader timeframe, GitLab’s stock has seen considerable swings over the past year, dipping about 4% overall and losing 7% in the past three months. The company has reported solid double-digit revenue growth, though its losses have also widened. Despite these growth numbers, the stock’s performance suggests the market remains cautious about longer-term profitability and the sustainability of its expansion in a competitive industry.

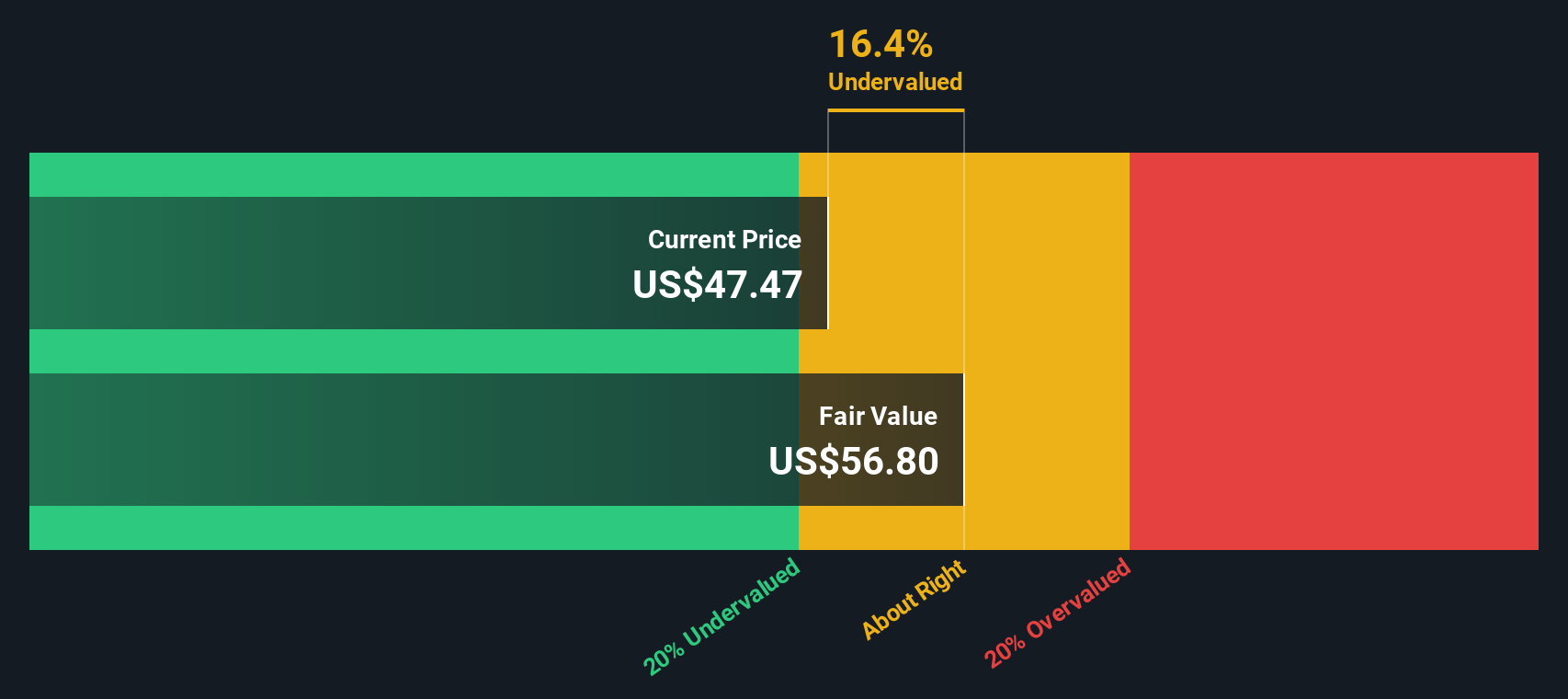

This raises the question of whether today’s price reflects lingering skepticism, or if it could provide an opportunity for investors to buy into future growth at a discount. Is GitLab undervalued, or is the market already pricing in everything it should?

Most Popular Narrative: 29.9% Undervalued

According to community narrative, GitLab is considered undervalued by nearly 30%, with its fair value estimate shaped by ambitious growth assumptions and future profitability targets.

The introduction of new product offerings like GitLab Duo and GitLab Dedicated targets increased adoption of AI in DevSecOps and offers distinct value propositions. These developments could enhance customer engagement and retention, positively affecting revenue and net margins. GitLab's emphasis on improving go-to-market operations with a newly appointed CRO and expanded customer success initiatives is intended to enhance sales efficiency and customer satisfaction, which could lead to improvements in net margins and earnings.

Curious about why this valuation is considered optimistic? There is a notable narrative here involving high double-digit growth, industry-leading profit assumptions, and a future multiple that might surprise even seasoned investors. What are the numbers driving this premium? The full details reveal the ambitious strategy and potential turning points behind this strong fair value perspective.

Result: Fair Value of $63.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, increased competition from major players and delayed revenue impact from new offerings could present challenges to GitLab’s optimistic growth narrative.

Find out about the key risks to this GitLab narrative.Another View: What If the Numbers Tell a Different Story?

Looking at GitLab through the lens of our DCF model, the picture diverges from the first approach. This method suggests GitLab remains undervalued, but is the gap as wide as some believe?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own GitLab Narrative

If you have a different perspective or want to dig into the details on your own, you can build your own view in under three minutes, or do it your way.

A great starting point for your GitLab research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Your Next Win? Uncover Fresh Investment Opportunities

Staying ahead means spotting the next big thing before everyone else. Broaden your watchlist and move confidently into tomorrow’s market by checking out these carefully curated investing angles. Take action now, or you might miss out on the smart moves others will be talking about.

- Capitalize on strong yields and secure your income stream by checking out companies offering dividend stocks with yields > 3% for a powerful boost to your portfolio.

- Catch the wave of technological disruption when you tap into industry leaders shaping healthcare’s future with healthcare AI stocks. These innovators are transforming patient care and diagnostics every day.

- Spot value-packed stocks flying under the radar and grab potential bargains that others overlook with our focused approach to undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal