Block (SQ) Stock: Assessing Valuation After Recent Share Price Pullback

Block (NYSE:XYZ) has recently caught investors’ attention with a dip in its share price, closing at $74.09 after shedding nearly 7% over the past month. There is no single dramatic headline driving this move, but the price action is hard to ignore, especially for investors trying to judge whether the drop is an early signal of changing sentiment or simply noise. For anyone considering adding to or trimming their position, the real question becomes whether this pullback offers genuine value or if there is something fundamental shifting in how the market views Block’s potential.

Zooming out, Block’s longer-term performance has swung between recovery and uncertainty. Although the past three months brought an encouraging 26% rally, the stock is still down nearly 15% this year. Over the past year, shares have climbed 16%, suggesting some momentum is trying to build, but it is a far cry from the levels seen several years ago. Meanwhile, revenue growth remains positive, but net income has slipped in the latest annual numbers, pointing to a business in transition as market appetite for growth is weighed against signs of volatility.

With the stock sliding recently after a decent run earlier in the year, investors are left to consider whether this is a rare buying opportunity for Block or if the market is simply pricing in all the future growth already.

Most Popular Narrative: 14.7% Undervalued

According to community narrative, Block is trading notably below its analyst-derived fair value. This suggests the share price could have more room to rise if future assumptions are realized.

The rapid acceleration in new product launches, especially around peer-to-peer features (like Cash App Pools) and integration of AI into product development, is increasing Cash App's network effects and virality. This is likely driving improved user acquisition and engagement, which supports recurring revenue expansion in future quarters.

Why do analysts consider Block’s true value potentially much higher? The narrative centers on strong growth expectations, ambitious margin forecasts, and a future profit valuation that is typically reserved for the market’s top performers. Interested in which ambitious projections support the estimated upside? Learn how Block’s fintech strategy and these notable quantitative drivers may help explain its valuation premium.

Result: Fair Value of $86.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising competition and Block’s ongoing reliance on crypto revenues could quickly challenge growth assumptions and reshape the bullish case almost overnight.

Find out about the key risks to this Block narrative.Another View: SWS DCF Model Offers a Different Perspective

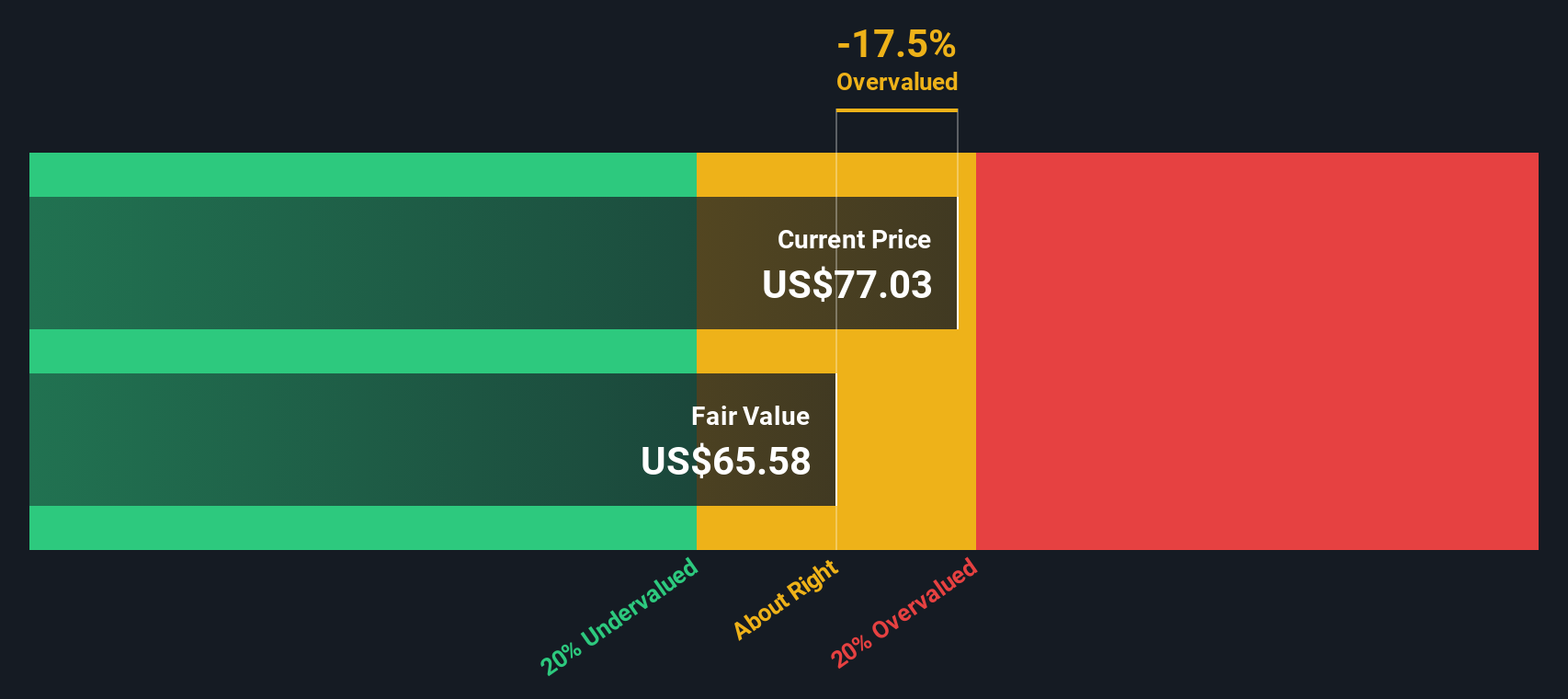

While analyst price targets point to upside, our DCF model suggests Block may actually be trading above its intrinsic value. This highlights how growth projections and risk perceptions can lead to divergent valuations. Which approach do you find more compelling?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Block Narrative

If you see the story differently or want to follow your own investment process, you can easily build a personalized Block narrative in just a few minutes. So why not do it your way?

A great starting point for your Block research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Great investors always keep their radar wide for the next big opportunity. Don’t risk missing out on companies reshaping industries and outperforming the crowd. Use these powerful screeners to put yourself next in line for market winners:

- Find up-and-coming AI innovators shaking up the tech scene with AI penny stocks. This can help you stay at the forefront of emerging technological trends.

- Target income growth with stocks offering reliable yields above 3% when you tap into our exclusive list of dividend stocks with yields > 3% that reward patient investors.

- Spot value early by identifying shares trading below their cash flow potential using our selection of undervalued stocks based on cash flows before they attract wider attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal