A Look at Duolingo (DUOL)’s Valuation Following Recent Share Price Volatility

If you have been following Duolingo (DUOL) lately, the stock’s swing is probably catching your eye. Over the past week, shares are up 5%, but that follows a 3% drop in the last month and a much steeper slide over the past 3 months. These moves do not stem from any single headline-grabbing announcement. However, they raise the ever-present question for investors: is this just noise, or could it indicate a shift in sentiment around Duolingo’s long-term growth?

Looking at a broader time frame, Duolingo’s performance so far this year paints an interesting picture. Despite the short-term volatility, the stock has returned 66% over the past year and is up 6% year-to-date. Strong annual growth rates in both revenue and net income are fueling optimism among some investors, while the sharp pullback in the past quarter suggests the market may be recognizing higher risks, adjusting expectations, or engaging in some profit-taking after a strong run.

With shares still far from their highs and annual gains outpacing many peers, investors are left debating a classic question: is Duolingo undervalued after the pullback, or are current prices already factoring in robust growth ahead?

Most Popular Narrative: 29.5% Undervalued

According to the community narrative, Duolingo is considered heavily undervalued, reflecting high confidence in its long-term growth prospects and transformative expansion plans.

“Rapid adoption and engagement growth in emerging international markets, notably China and broader Asia, fueled by partnerships and the ongoing rise in demand for multilingual skills as global social and economic mobility increases, support sustained expansion of Duolingo's total addressable market. This positively impacts revenue and long-term earnings potential. Continued investment in and expansion of adjacent educational categories such as Math, Music, and Chess leverage Duolingo's gamification infrastructure and strong brand. These new subjects broaden the platform's appeal, attract additional user segments, and are expected to drive higher ARPU and incremental revenue streams over the next several years.”

Want to know what is powering this bullish outlook? This narrative leans on bold projections for growth, profitability, and how Duolingo’s future multiple compares to leaders in digital learning. Curious which expectations push the fair value far above the current share price? See the key numbers analysts are betting on to justify this high target.

Result: Fair Value of $489.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slowing growth in Duolingo’s core markets and tougher regulatory hurdles abroad could quickly challenge even the most optimistic long-term outlook.

Find out about the key risks to this Duolingo narrative.Another View: Are the Numbers Too Optimistic?

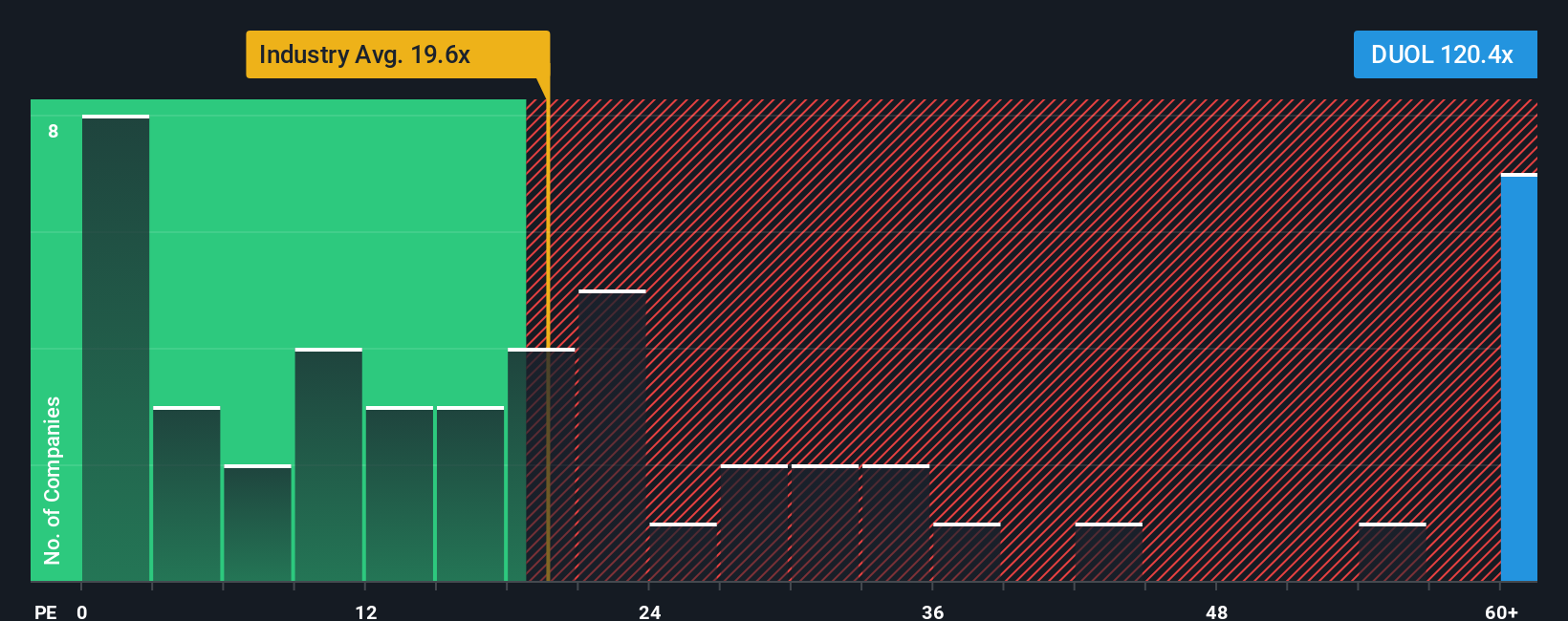

While long-term models forecast Duolingo as undervalued, a look at its current price to earnings ratio tells a very different story. In this case, the stock appears expensive compared to the industry. Which outlook deserves more weight?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Duolingo Narrative

If you see things differently, or want to dig into the numbers to craft your own story, it is easy to get started and do it your way.

A great starting point for your Duolingo research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Your Next Great Investment?

Why stop with Duolingo when exceptional opportunities are waiting? If you are eager for new avenues to grow your portfolio, the Simply Wall Street Screener makes it simple to uncover standout stocks that align with your goals. Choosing the right investments now could set you ahead of the market crowd. Do not miss your chance to take action today.

- Secure steady returns and peace of mind when you dividend stocks with yields > 3%. This feature highlights companies offering attractive yields and strong dividend histories.

- Tap into rapid innovation as you AI penny stocks. Here, emerging AI pioneers are reshaping industries and pushing the boundaries of what technology can achieve.

- Position yourself ahead of the curve by undervalued stocks based on cash flows. Find stocks that may be poised for long-term growth and are trading at compelling prices based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal