Could Tilray (TLRY) Leverage New 10mg THC Drinks to Strengthen Its U.S. Wellness Strategy?

- Earlier this month, Tilray Brands expanded its hemp-derived Delta-9 THC beverage portfolio by launching new 10mg format drinks under the Fizzy Jane's and Happy Flower brands, now available online and across retail markets in 10 states.

- This development marks a significant step for Tilray Brands into higher-dosage beverage offerings, broadening consumer choice and expanding distribution reach in the U.S. hemp beverage category.

- We'll explore how the entry into the 10mg THC beverage segment could reshape Tilray's long-term prospects in the consumer wellness market.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Tilray Brands Investment Narrative Recap

Shareholders in Tilray Brands are typically betting on the company's ability to lead and scale within the tightly regulated U.S. cannabis and hemp wellness market, despite challenging legalization timelines and persistent unprofitability. The launch of 10mg Delta-9 THC beverages across multiple states extends Tilray’s reach and consumer appeal, but it is unlikely to materially alter the company’s most important short-term catalyst: U.S. regulatory progress. The high cash burn and net losses also remain the key operational risk, with no immediate solution from this product launch.

Among recent Tilray announcements, the June 2025 release of a new Summer Cannabis Collection, featuring additional THC beverages and innovative formats, underscores management’s push to diversify the product mix. This aligns with the catalyst of driving higher-margin revenue streams, complementing the expanded beverage portfolio and positioning Tilray to appeal to wellness-focused consumers even as broader regulatory changes remain uncertain.

But while product innovation is encouraging, investors should be aware that persistent net losses and negative cash flow raise ongoing concerns over...

Read the full narrative on Tilray Brands (it's free!)

Tilray Brands' narrative projects $940.4 million revenue and $193.4 million earnings by 2028. This requires 4.6% yearly revenue growth and a $2.4 billion earnings increase from current earnings of -$2.2 billion.

Uncover how Tilray Brands' forecasts yield a $0.928 fair value, a 16% downside to its current price.

Exploring Other Perspectives

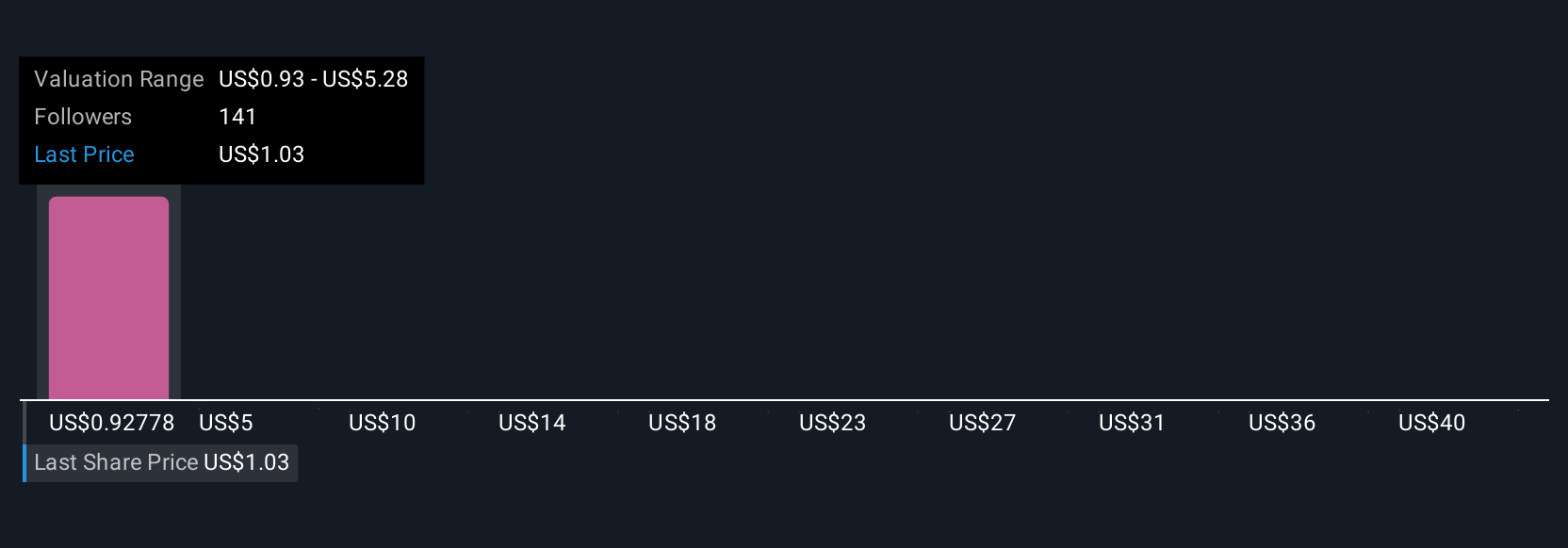

Sixteen members of the Simply Wall St Community estimate Tilray’s fair value from US$0.93 to US$44.45 per share, reflecting a wide spread of expectations. With persistent unprofitability and cash flow challenges, the company’s next steps could have broad implications for long-term holders, see how other investors are assessing the outlook.

Explore 16 other fair value estimates on Tilray Brands - why the stock might be a potential multi-bagger!

Build Your Own Tilray Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tilray Brands research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Tilray Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tilray Brands' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal