How Upwork’s (UPWK) Launch of Lifted Is Shaping Its Enterprise Investment Story

- In August 2025, Upwork Inc. announced the launch of Lifted, a wholly owned subsidiary designed to provide enterprise clients with a unified platform for talent sourcing, contracting, and workforce management across all contingent workforce models.

- This initiative integrates the technology and capabilities from recent acquisitions and grants enterprises access to Upwork’s extensive global talent pool, addressing increasing demand for compliant, flexible work platforms amid the rapid expansion of AI-driven workforce solutions.

- We’ll now explore how Upwork’s enterprise-focused Lifted platform and recent technology integration reshape its investment narrative and long-term outlook.

Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

Upwork Investment Narrative Recap

To invest in Upwork, you need to believe in the company's ability to convert rising enterprise adoption and demand for flexible, AI-driven workforce management into sustained growth and improved profitability. The Lifted launch responds directly to these enterprise needs, yet the most important short-term catalyst remains clear progress in enterprise customer wins and volume ramp, a metric that could remain volatile if large clients delay adoption or cut back on contingent spending. Execution risk on recent acquisitions and the near-term financial impact from integrating Bubty and Ascen are still present, but the Lifted announcement itself does not materially alter this key risk for now.

The announcement most relevant to this development is Upwork's recent appointment of Anthony Kappus as chief operating officer. Kappus’ background in digital marketplaces and operations, combined with the new CTO’s expanded role, could bolster Upwork’s push to scale Lifted and deliver on its growth catalysts, especially as the company integrates new technology and enhances compliance for enterprise users.

But in contrast, investors should be aware that increased focus on complex enterprise deals also exposes Upwork to...

Read the full narrative on Upwork (it's free!)

Upwork's narrative projects $906.3 million revenue and $147.8 million earnings by 2028. This requires 5.5% yearly revenue growth and a $97.6 million decrease in earnings from $245.4 million today.

Uncover how Upwork's forecasts yield a $18.70 fair value, a 32% upside to its current price.

Exploring Other Perspectives

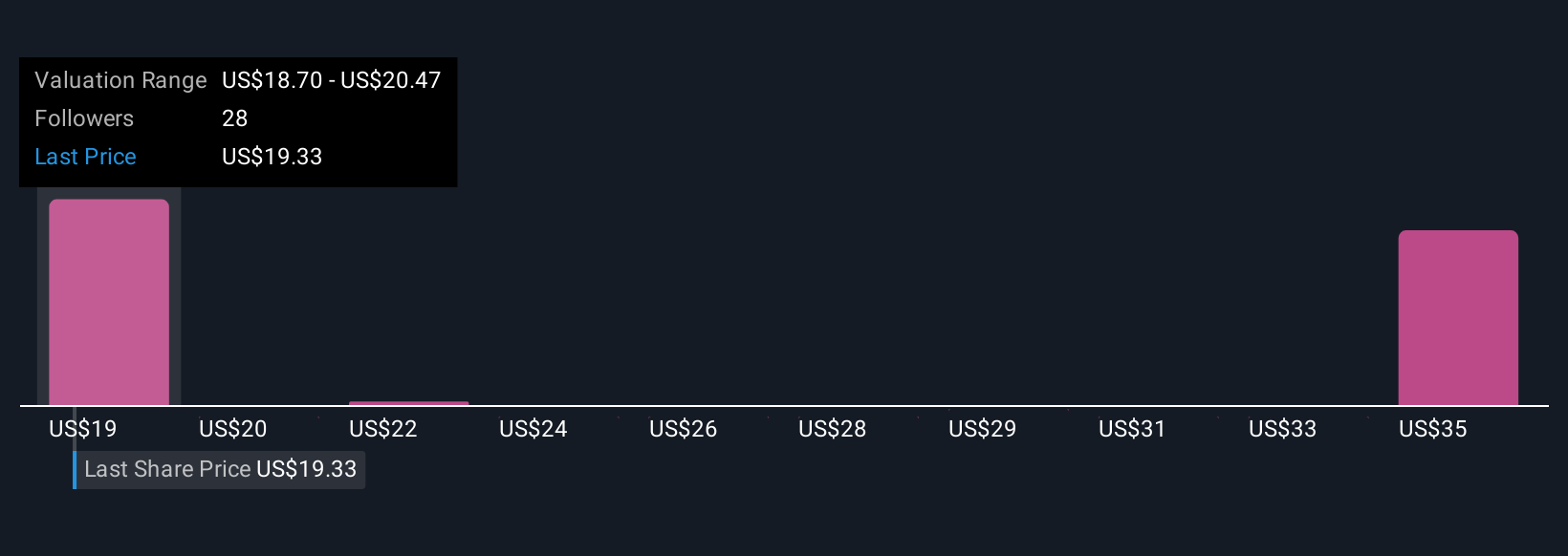

Five fair value estimates from the Simply Wall St Community range widely between US$18.70 and US$35.64 per share. While Lifted expands enterprise offerings, ongoing execution risk from integrating acquisitions remains a key watchpoint for future performance.

Explore 5 other fair value estimates on Upwork - why the stock might be worth over 2x more than the current price!

Build Your Own Upwork Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Upwork research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Upwork research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Upwork's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal