Is the burgeoning myth hard to beat “equity dilution” and fears that the “crypto vault” strategy for US stocks has failed?

The Zhitong Finance App learned that recently, there have been many companies in the US stock market that have soared due to their cryptocurrency holdings. This seems to have created a path to prosperity for small companies trying to obtain high returns: after buying cryptocurrencies in large numbers, they can enjoy soaring stock prices, then issue additional stock financing and continue to increase digital asset positions. The blueprint for the operation of this “cryptocurrency treasury strategy” seems perfect, but many investors clearly voted against the third part — particularly the potential equity dilution effect.

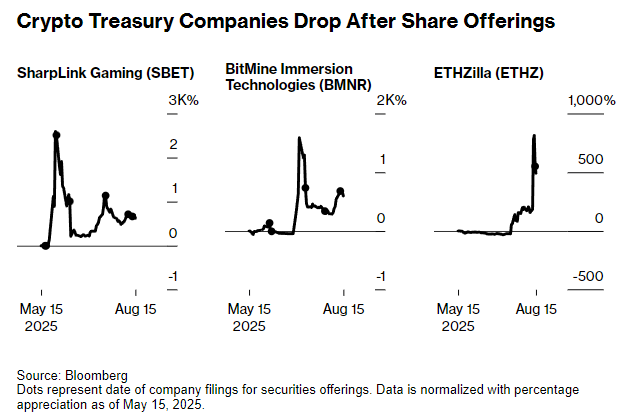

Retail investors, who account for the majority of shares in these listed companies, sell off frantically every time the company submits an additional share issuance and filing, causing the relevant individual stocks to fall rapidly from high valuations. On Thursday, after biotech company EthZilla (formerly 180 Life Sciences, ETHZ.US) announced plans to raise 500 million US dollars in stock issuance, the stock price plummeted 29% in response. Just two days ago, the company, which had transformed into an Ethereum holding platform, had just revealed its $350 million worth of Ethereum holdings, which miraculously surged 200% in a single day.

Other cryptocurrency asset holding companies are also unable to escape bad luck. After SharpLink Gaming (SBET.US) submitted a filing to the US Securities and Exchange on June 13 to allow specific investors to sell shares, the stock price plummeted 72% in a single day. In July, the filing of BitMine Immersion Technologies (BMNR.US)'s application to issue $2 billion in securities directly triggered 40% of the market value evaporated.

Retail investors see these financing filings as exit signals. They not only worried about the risk of stock dilution, but also predicted that all of the registered stocks would flow into the market (although this is not an established fact), so they chose to make a profit. What is even more unsettling is that the valuation of these companies is often several times the value of the cryptocurrency assets they actually hold — this certainly sounded a wake-up call for companies that emulate Bitcoin giant Michael Saylor's holding strategy and hoarded large amounts of digital tokens.

“When companies holding cryptocurrencies file shares, some shareholders panic sell off, believing they will face a flood of stock supply,” said Daniel Forman, partner at Lowenstein Sandler LLP. “But in many cases, this is not the case. And at that point in time, investors couldn't even sell shares because the filing hasn't taken effect yet.”

Joe Lubin, co-founder of Ethereum and chairman of SharpLink, tried to calm the market when the company's stock price fell in June due to the filing. The head of the company, which holds more than 3 billion US dollars in Ethereum and a market capitalization of about 3.5 billion US dollars, emphasized on social platform X: “This is just a standard process for post-private placement financing (PIPE) in the traditional financial sector; it does not represent an actual sell-off.” He specifically stated that neither the main investor, Consensys, nor he himself reduced their holdings. Despite this, the company's stock price plummeted by more than two-thirds the next day, and has yet to recover lost ground.

Faced with the recent stock price correction, Ethzilla Chairman McAndrew Rudisill seemed calm and uneasy. He believes this is a reasonable return to the value of corporate Ethereum holdings after experiencing a sharp rise in stock prices. “We are currently in this band with a net market ratio of 2-3 times or a reasonable valuation range,” Rudisill said in an interview.

Despite sharp fluctuations, cryptocurrency asset holding strategies have brought excessive profits to some companies. EthZilla has accumulated a cumulative increase of 136% since announcing the transformation plan at the end of July; SharpLink, which once specialized in sports betting technology, has risen 210% since the transformation in late May.

Retail anxiety

Retail investor Reza Ibrahim said he has invested in a number of cryptocurrency holding companies, but he predicts the industry is about to peak. He has closed his position after SharpLink achieved a 150% return and plans to completely divest before cryptocurrency expectations fall in the fourth quarter of this year. “This field is in urgent need of deep adjustments,” the 26-year-old investor confessed.

56-year-old Juan Plasencia chose a partial profit settlement — he only cut his SharpLink holdings by half due to lower valuations compared to his peers. However, after BitMine submitted a filing for the issuance of an additional 80.2 million shares, he immediately emptied all of his holdings. “Private investors are unlikely to maintain overvalued positions for a long time,” Plasencia said. Even after experiencing a sharp decline, BitMine's market capitalization is still close to $10 billion, which is about a 45% premium over its net cryptocurrency asset value.

“The day the lockdown period ends is when the sell-off begins,” Plasencia analyzed. “Their profits are already locked in.” Although he understood that the company might not issue all of the registered shares, this uncertainty was enough to prompt him to leave the market early. “The difficulty is that it is impossible to predict the actual financing scale and circulation volume, so by default, the filing amount will be fully paid.”

Some investors make trading decisions based solely on social media discussions. Forman pointed out that the actual meaning of these filing documents is far more complicated than the headlines suggest, and “the emerging investor community is learning to understand this mechanism.”

As the racetrack became more crowded, Gregory Sichenzia, founder of Sichenzia Ross & Friedman LLP, predicted: “90% of companies will be eliminated. After the bubble bursts, stock prices collapse, and financing channels dry up, only companies with truly strong execution can survive.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal