Will Linamar’s (TSX:LNR) Steady Payouts Outweigh Margin Pressures in a Tough Market?

- Linamar Corporation recently reported its second-quarter and first-half 2025 results, revealing year-over-year declines in both sales (CA$2.64 billion for Q2, CA$5.17 billion for H1) and net income (CA$126.91 million for Q2, CA$304.61 million for H1) compared to the prior year.

- Despite these lower earnings and sales figures, the company maintained its quarterly dividend and provided an update on share repurchases, signaling continued capital returns to shareholders amid challenging market conditions.

- With profitability under pressure, we'll examine how Linamar’s recent financial results affect the company’s investment narrative and margin outlook.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Linamar Investment Narrative Recap

To be a Linamar shareholder, you have to believe in the company’s ability to effectively manage cycle downturns and capitalize on future growth in its Mobility and Industrial divisions. The recent quarterly results, marked by declines in both sales and net income, have not materially shifted the key short term catalyst: Linamar’s new business wins and flexible manufacturing advantage. However, these numbers do highlight the ongoing risk from persistent market softness in both the automotive and agriculture segments, particularly in Europe and North America.

A particularly relevant announcement alongside earnings was Linamar’s decision to maintain its quarterly dividend at CA$0.29 per share. This demonstrates commitment to ongoing shareholder returns, even as profitability faces headwinds. Dividend stability remains important for investors looking for some cushion against volatile earnings, and its continuation during weaker financial periods could be viewed positively in the context of the company’s long-term catalysts for margin improvement.

In contrast, investors should be aware that a persistent decline in key end-markets like automotive and agriculture could further pressure...

Read the full narrative on Linamar (it's free!)

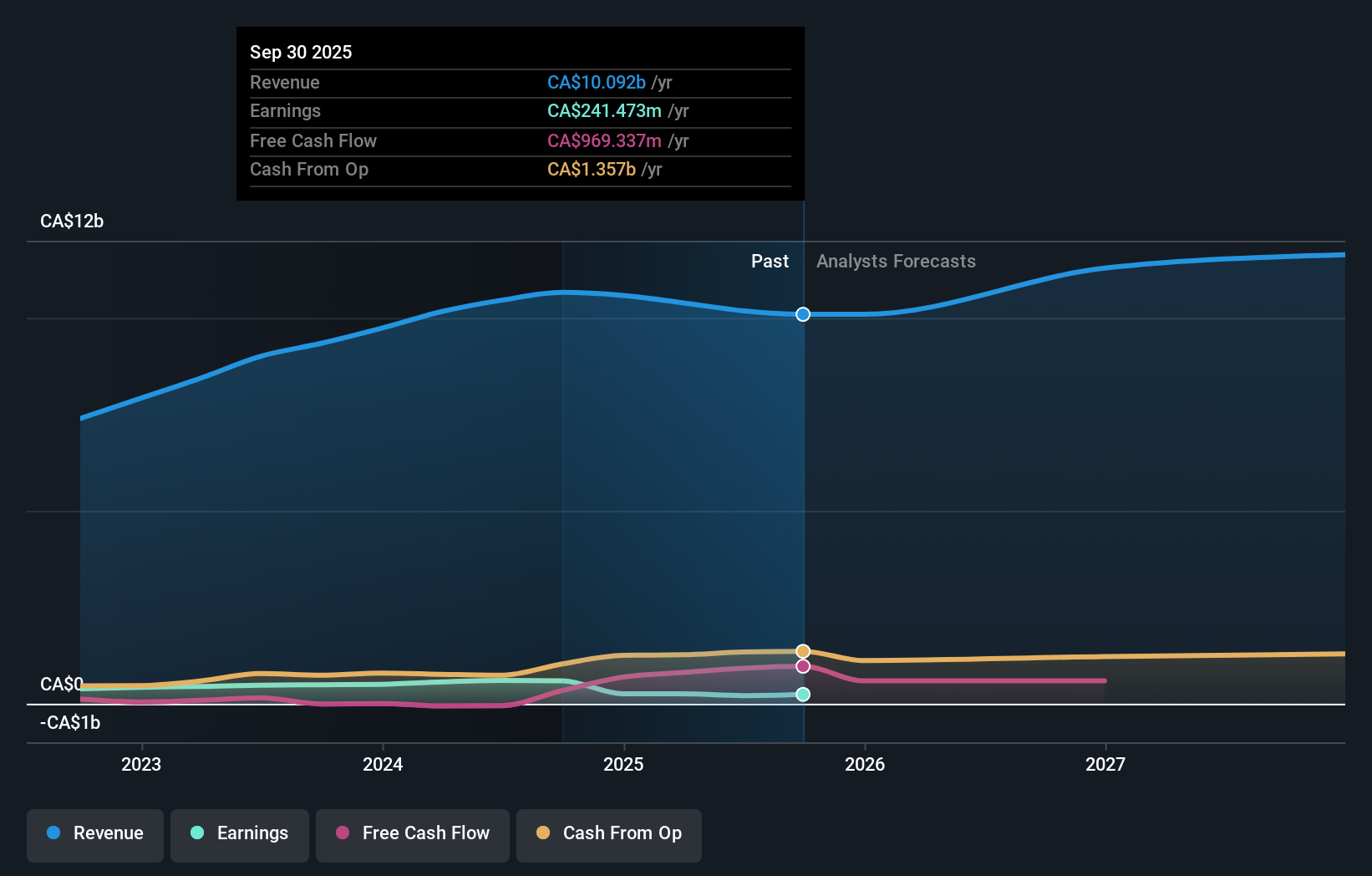

Linamar's outlook projects CA$10.5 billion in revenue and CA$811.3 million in earnings by 2028. This scenario assumes a 0.3% annual revenue decline and an increase of CA$553 million in earnings from the current CA$258.3 million.

Uncover how Linamar's forecasts yield a CA$63.67 fair value, a 13% downside to its current price.

Exploring Other Perspectives

Six recent fair value estimates from the Simply Wall St Community put Linamar’s valuation across a wide spread from CA$32.64 to CA$147.73. With earnings under pressure and margin risks in focus, your view on Linamar’s future may differ sharply from the pack.

Explore 6 other fair value estimates on Linamar - why the stock might be worth less than half the current price!

Build Your Own Linamar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Linamar research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Linamar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Linamar's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal