How IAC's (IAC) Earnings Turnaround and Buyback Program Could Shape Its Investment Outlook

- IAC Inc. recently reported a turnaround to US$211.45 million in net income for the second quarter of 2025, completed a US$450.96 million share buyback program, and outlined ongoing pursuit of M&A opportunities while presenting at the Oppenheimer Annual Technology, Internet & Communications Conference.

- Despite a year-over-year decrease in sales, IAC achieved positive earnings and continued to actively allocate capital and seek growth avenues through acquisitions.

- Next, we'll explore how IAC's earnings improvement and completed share buyback could influence its investment outlook and longer-term narrative.

Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

IAC Investment Narrative Recap

To be a shareholder in IAC today, you need to believe the company’s shift to digital, ongoing capital return, and active pursuit of acquisitions can deliver sustained value despite core sales declines and heavy industry competition. The recent turnaround to net income and completion of a major share buyback are positives, but neither fundamentally changes the central short-term catalysts (execution in digital growth and ad revenue diversification) or the persistent risk of revenue concentration in a handful of brands. In short, the near-term business outlook remains mostly shaped by IAC’s exposure to major tech platforms, especially Google, so the impact of this news is incremental, not transformative.

Among recent announcements, the completion of IAC’s US$450.96 million share buyback stands out as most relevant, signaling both management’s confidence and willingness to prioritize shareholder returns even in a period of revenue softness. Shareholder capital allocation, including opportunistic buybacks and steady M&A activity, continues to serve as a key catalyst, amplifying periods of outperformance but also magnifying execution risk if digital initiatives or acquisitions underdeliver.

By contrast, investors should be aware that a single algorithm change by Google could…

Read the full narrative on IAC (it's free!)

IAC's narrative projects $2.5 billion revenue and $85.5 million earnings by 2028. This requires a 12.5% yearly revenue decline and a $565.4 million increase in earnings from the current -$479.9 million.

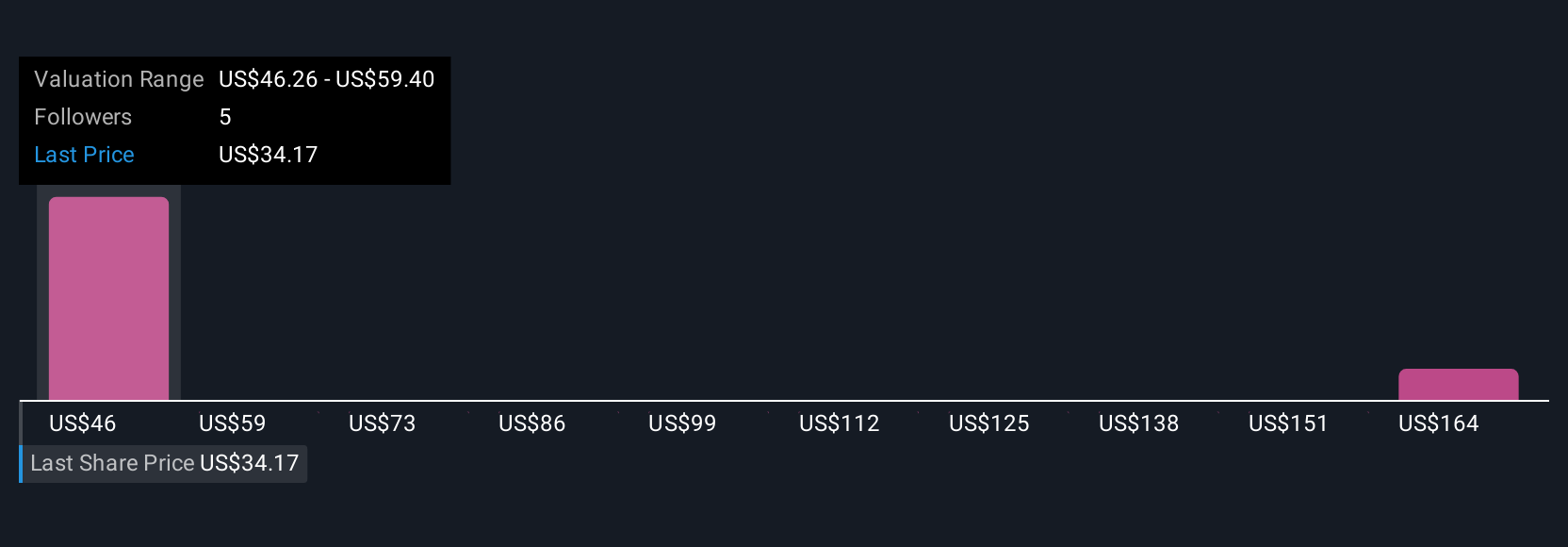

Uncover how IAC's forecasts yield a $48.69 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for IAC range widely, from US$46.26 to US$177.63, with 3 unique viewpoints considered. Despite this spread, the risk of increased reliance on digital revenue and industry giants like Google remains a central issue that could significantly affect results.

Explore 3 other fair value estimates on IAC - why the stock might be worth over 5x more than the current price!

Build Your Own IAC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IAC research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free IAC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IAC's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal