Did Lowering Flow Studio Prices and Expanding Free Access Just Shift Autodesk's (ADSK) Investment Narrative?

- Earlier this month, Autodesk unveiled a new, more affordable pricing model for its AI-powered Flow Studio platform, including a free tier and halving the Lite plan price from US$20 to US$10.

- This initiative not only expands access to high-end 3D animation and VFX tools, but also strengthens Autodesk's commitment to organic growth after formally integrating Wonder Dynamics' technology into its ecosystem.

- We'll now explore how making advanced AI creative tools more accessible could reshape Autodesk’s investment outlook.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Autodesk Investment Narrative Recap

As a shareholder, the most important belief is in Autodesk’s ability to drive sustainable growth by combining digital transformation with AI-powered creative tools, while managing operational risks tied to restructuring and new business models. The rollout of affordable AI features through Flow Studio could influence short-term catalysts by expanding Autodesk’s customer base, but the impact on immediate revenue and profit margins is likely immaterial given ongoing go-to-market restructuring and macroeconomic challenges.

Among recent company announcements, the decision to abandon pursuing PTC Inc. in favor of organic growth aligns closely with the recent Flow Studio launch, reinforcing Autodesk’s focus on broadening reach with more accessible solutions in priority sectors. This approach may enhance Autodesk’s long-term appeal as it seeks to improve recurring revenue streams, but the near-term benefits depend heavily on execution through the ongoing restructuring phase.

In contrast, investors should keep a close eye on operational disruptions that could emerge from headcount reductions and go-to-market changes, especially as...

Read the full narrative on Autodesk (it's free!)

Autodesk's outlook forecasts $8.8 billion in revenue and $1.8 billion in earnings by 2028. This reflects an annual revenue growth rate of 11.4% and an $0.8 billion increase in earnings from the current $1.0 billion.

Uncover how Autodesk's forecasts yield a $341.72 fair value, a 19% upside to its current price.

Exploring Other Perspectives

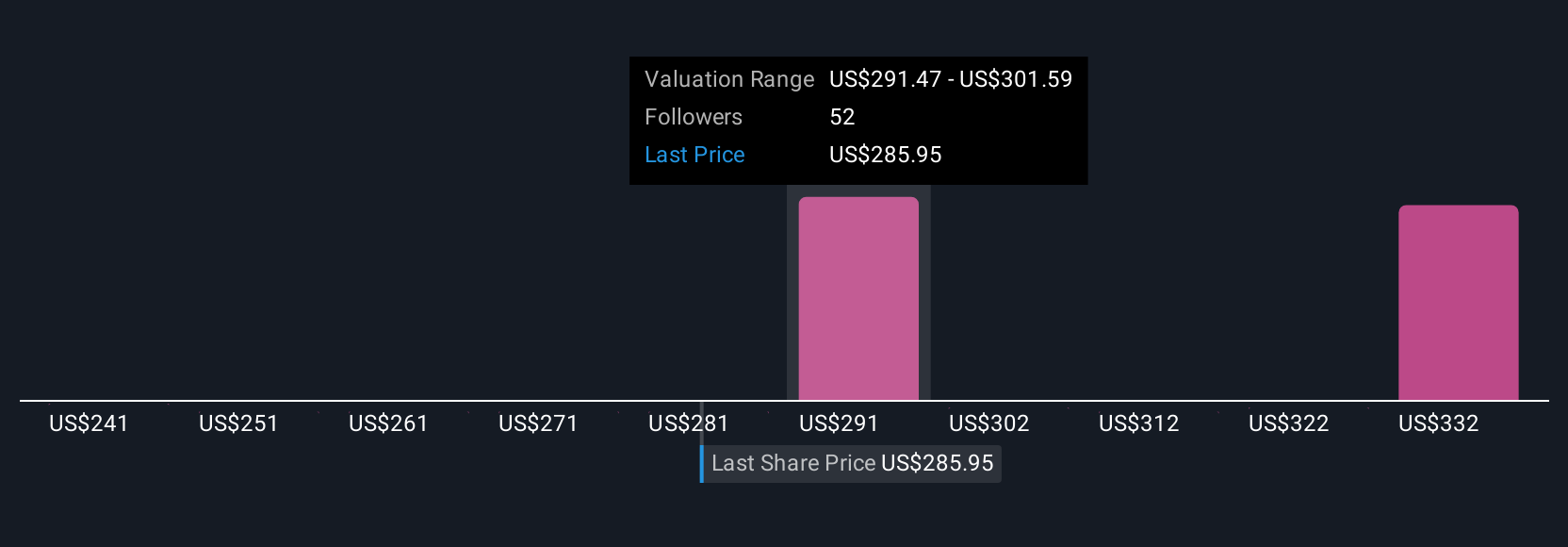

Six individual fair value estimates from the Simply Wall St Community for Autodesk range from US$240.87 to US$341.72, highlighting significant opinion gaps. Broader potential hinges on successful expansion of Autodesk’s customer base, as recent product changes show, making it valuable to explore alternative perspectives on growth and risk.

Explore 6 other fair value estimates on Autodesk - why the stock might be worth 16% less than the current price!

Build Your Own Autodesk Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Autodesk research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Autodesk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Autodesk's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal