Warby Parker (WRBY) Jumps After Strong Q2, Higher Guidance and CFO Transition—Is Growth Back on Track?

- Warby Parker recently announced second-quarter 2025 earnings, reporting US$214.48 million in sales and a significant reduction in net loss compared to the previous year, alongside an increase in full-year revenue guidance and plans for 45 new store openings, including Target shop-in-shops.

- In addition to financial gains and positive outlook, the company is experiencing an executive transition, with Co-Founder and Co-CEO Dave Gilboa stepping in as interim principal financial officer following the CFO's departure.

- We'll explore how Warby Parker's raised full-year revenue guidance may influence its ongoing investment narrative and growth outlook.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Warby Parker Investment Narrative Recap

To own Warby Parker stock, you need to believe in the company’s ability to expand its customer base and boost revenue through both brick-and-mortar and digital channels, while managing operational risks from rapid store growth. The recent jump in full-year revenue guidance is likely the most important short-term catalyst, signalling solid demand, but also puts greater focus on whether retail expansion pressures margins or simply delivers scale, making margin management the biggest risk at this stage.

The plan to open 45 new stores, including Target shop-in-shops, stands out from recent updates. This decision is directly tied to their raised revenue guidance and may reinforce the company’s growth outlook, but it also brings the challenge of keeping per-store productivity high and costs under control as the footprint increases.

Yet, while revenue momentum is positive, investors should pay close attention to whether aggressive expansion creates...

Read the full narrative on Warby Parker (it's free!)

Warby Parker's outlook anticipates $1.2 billion in revenue and $85.4 million in earnings by 2028. This scenario implies a 14.8% annual revenue growth and a $94.6 million increase in earnings from the current level of -$9.2 million.

Uncover how Warby Parker's forecasts yield a $26.23 fair value, a 3% downside to its current price.

Exploring Other Perspectives

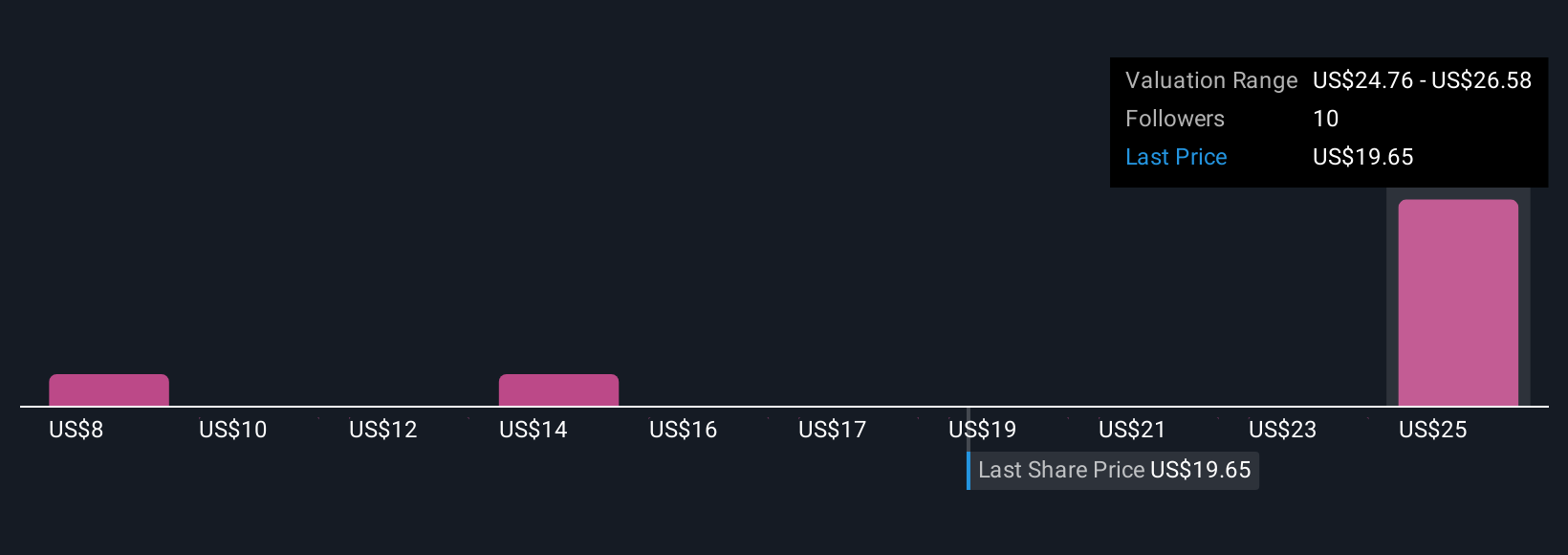

Community fair value estimates for Warby Parker (five in total) range from US$8.37 to US$26.23 per share, showing significant variation among Simply Wall St Community viewpoints. Against this backdrop, the company’s ambitious retail rollout could influence performance expectations in several key ways.

Explore 5 other fair value estimates on Warby Parker - why the stock might be worth less than half the current price!

Build Your Own Warby Parker Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Warby Parker research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Warby Parker research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Warby Parker's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal