What Amgen (AMGN)'s Strong Q2 Results and Upbeat 2025 Guidance Mean For Shareholders

- Amgen Inc. recently reported second quarter financial results, showing revenue of US$9.18 billion and net income of US$1.43 billion, up from the previous year, alongside raising its full-year 2025 earnings guidance.

- These results signal both significant growth in profitability and the company's confidence in its ongoing business momentum despite a highly competitive biotechnology landscape.

- We'll examine how Amgen's strong quarterly financial performance and raised outlook add to its broader investment narrative and future outlook.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Amgen Investment Narrative Recap

Shareholders in Amgen need to believe in the company's ability to translate groundbreaking science and robust late-stage pipeline assets into sustained earnings, even as competition and pricing pressures intensify. The company's second quarter results, with strong revenue growth and increased guidance for 2025, reinforce existing catalysts like product launches in obesity and oncology, but they do not meaningfully alter the near-term risk of biosimilar competition threatening key revenue streams, especially for flagship franchises.

Among Amgen’s recent announcements, the updated full-year 2025 revenue and earnings guidance stands out. By providing a range of US$35.0 billion to US$36.0 billion in sales and highlighting improved profitability, the company is highlighting its confidence in portfolio strength and business execution. Still, the biggest short-term risk remains ongoing industry-wide pricing pressure, especially for major products like Prolia, with competitive and regulatory headwinds continuing to act as constraints.

But while the near-term outlook looks solid, there’s still the impact of intensifying biosimilar launches on Amgen’s flagship therapies that investors should be aware of...

Read the full narrative on Amgen (it's free!)

Amgen's outlook projects $37.3 billion in revenue and $8.6 billion in earnings by 2028. This reflects a 2.2% annual revenue growth rate and a $2.0 billion earnings increase from current earnings of $6.6 billion.

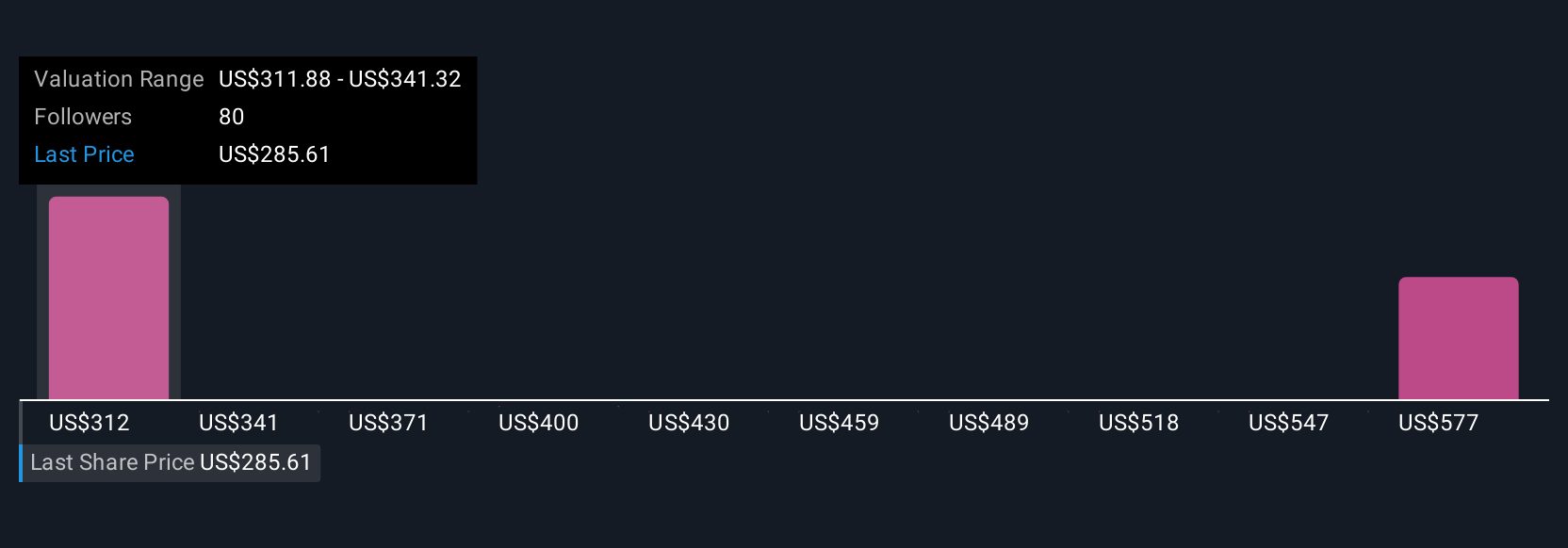

Uncover how Amgen's forecasts yield a $314.44 fair value, a 6% upside to its current price.

Exploring Other Perspectives

The most pessimistic analysts were forecasting that Amgen’s annual revenues would fall to US$34.6 billion and earnings decline to US$5.4 billion by 2028. If you believe aging products and rising competition are bigger threats than the consensus, these estimates might be more in line with your outlook. Investor opinions can differ widely, so it’s worth exploring how events like this quarter’s positive results could shift expectations in either direction.

Explore 5 other fair value estimates on Amgen - why the stock might be worth over 2x more than the current price!

Build Your Own Amgen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amgen research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Amgen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amgen's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal